In a significant development for the Korean tech sector, SAMSUNG SDS, a premier IT service provider, has officially secured a landmark SAMSUNG SDS ITO contract valued at a substantial ₩471.1 billion with its primary partner, Samsung Electronics. This move not only solidifies their long-standing relationship but also sends strong signals to the market about the company’s future trajectory. For investors, this isn’t just another headline; it’s a critical piece of the puzzle for any SAMSUNG SDS investment strategy.

This comprehensive analysis will dissect the multifaceted implications of this major IT outsourcing agreement. We’ll explore the immediate financial benefits, the long-term strategic advantages, and the potential challenges that investors must consider. From stable revenue streams to the ongoing balance with its logistics division, we provide the essential insights needed to navigate what comes next.

The Landmark Deal: Breaking Down the Agreement

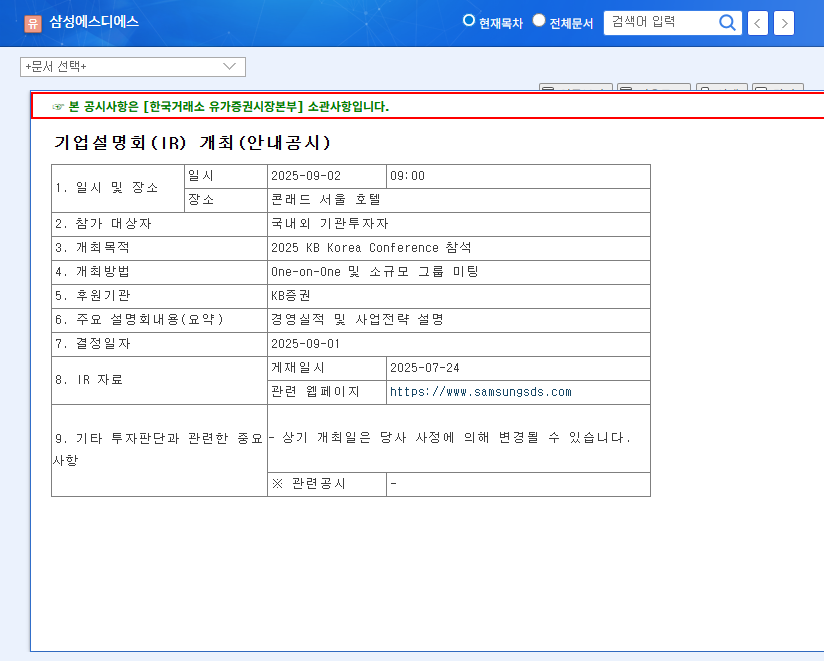

SAMSUNG SDS has formally announced the signing of an Information Technology Outsourcing (ITO) service contract with Samsung Electronics Co., Ltd. The agreement, valued at precisely ₩471.1 billion, is set for a one-year term, running from January 1, 2025, to December 31, 2025. This figure represents approximately 3.41% of the company’s projected revenue for the same year, making it a cornerstone of its financial foundation. The full details of this significant transaction have been made public, as seen in the Official Disclosure. This contract is more than just a renewal; it’s a powerful reaffirmation of the deep-seated trust and operational synergy between two titans of the Samsung ecosystem, cementing SAMSUNG SDS’s role as the technological backbone for the electronics giant.

Why This SAMSUNG SDS ITO Contract is a Game-Changer

The strategic implications of this deal extend far beyond its monetary value. It provides a stable platform for growth and reinforces market confidence. Let’s explore the core positive impacts on the company’s fundamentals.

Pillar 1: Fortified Revenue Stability

In a volatile global economy, predictability is priceless. This ₩471.1 billion contract provides a solid, predictable revenue base for the IT service division. This stability is crucial as it allows the company to confidently invest in next-generation growth engines like generative AI and cloud services, which are central to its long-term vision. This deal builds upon the existing positive momentum and creates a powerful synergy for sustained growth.

Pillar 2: Deepening the Samsung Electronics Partnership

The renewal of a long-term, high-value IT outsourcing contract with a key client like Samsung Electronics is a testament to the quality and reliability of SAMSUNG SDS’s services. This reinforces the strategic partnership and could pave the way for expanded collaboration in emerging tech fields, further intertwining their mutual success. For a detailed overview of IT service market trends, you can refer to analysis from authoritative sources like Gartner’s latest market reports.

This contract acts as an anchor, providing the financial stability needed for SAMSUNG SDS to aggressively pursue high-growth areas like cloud computing and enterprise AI solutions.

Navigating Potential Headwinds & Market Variables

While the outlook is overwhelmingly positive, a thorough SAMSUNG SDS stock analysis requires acknowledging potential challenges. The company’s diverse portfolio means it is subject to various external pressures.

The Logistics Division Balancing Act

SAMSUNG SDS operates a significant logistics business alongside its IT services. With the logistics division’s operating profit margin reportedly declining, it’s crucial for the company to balance the robust growth in IT with strategic efforts to enhance profitability in logistics. Investors should monitor how digital transformation initiatives, like those discussed in our analysis of supply chain technology, are being leveraged to improve efficiency.

Macroeconomic Factors to Watch

- •Exchange Rate Fluctuations: As a global player, an appreciating Korean Won can impact overseas revenue and profitability.

- •Interest Rate Shifts: Changes in benchmark rates can influence funding costs for new investments, though the company’s strong financial health provides a solid buffer.

- •Global Freight & Oil Prices: These variables directly affect the logistics division’s bottom line and represent a persistent source of volatility.

Investor Action Plan & Strategic Outlook

Given this major contract, investors should focus on several key areas. The positive market sentiment is likely to continue, backed by strong fundamentals in the IT service division. The challenge and opportunity lie in how effectively the company can translate this stability into broader, more diversified growth while shoring up its logistics segment.

Frequently Asked Questions (FAQ)

What is the nature of the new SAMSUNG SDS ITO contract?

SAMSUNG SDS signed a ₩471.1 billion Information Technology Outsourcing (ITO) contract with Samsung Electronics to provide comprehensive IT services for one year, from Jan 1, 2025, to Dec 31, 2025.

How significant is this contract for SAMSUNG SDS’s revenue?

The contract value of ₩471.1 billion represents approximately 3.41% of SAMSUNG SDS’s projected 2025 revenue, providing a significant and stable income stream for its IT division.

What are the main concerns for the company’s logistics business?

The primary concern is the declining operating profit margin in the logistics division. Investors are watching to see if digital transformation and other efficiency efforts can improve profitability and balance the growth from IT services.

How do macroeconomic factors impact SAMSUNG SDS?

Exchange rates can affect the value of overseas earnings, interest rates can alter investment costs, and oil/freight prices directly impact the profitability of the logistics segment. Monitoring the company’s resilience to these factors is key.

What is the overall investment outlook for SAMSUNG SDS?

The outlook is strong, thanks to this ITO contract ensuring stable IT service growth. While challenges in logistics and macro-risks require monitoring, the company’s fundamental trajectory appears positive, driven by its core tech competencies.