A recent disclosure from INVENI Co., Ltd. (015360) regarding a change in shareholdings has captured the market’s attention. While any shift in ownership can raise questions, it’s crucial for investors to look beyond the headlines. Is this a minor adjustment, or does it signal a more profound change within the company? This deep-dive analysis will unpack the details of the report, explore the fundamental shifts in INVENI’s business strategy, and provide a clear outlook to help you make informed investment decisions. We will focus on the company’s evolving identity as a premier investment specialist and what that means for its long-term value.

The core of this analysis moves past the minor stake fluctuation to focus on what truly drives value for INVENI Co., Ltd. (015360): its successful pivot to an investment firm and its underlying financial performance.

Unpacking the Disclosure: What Exactly Happened?

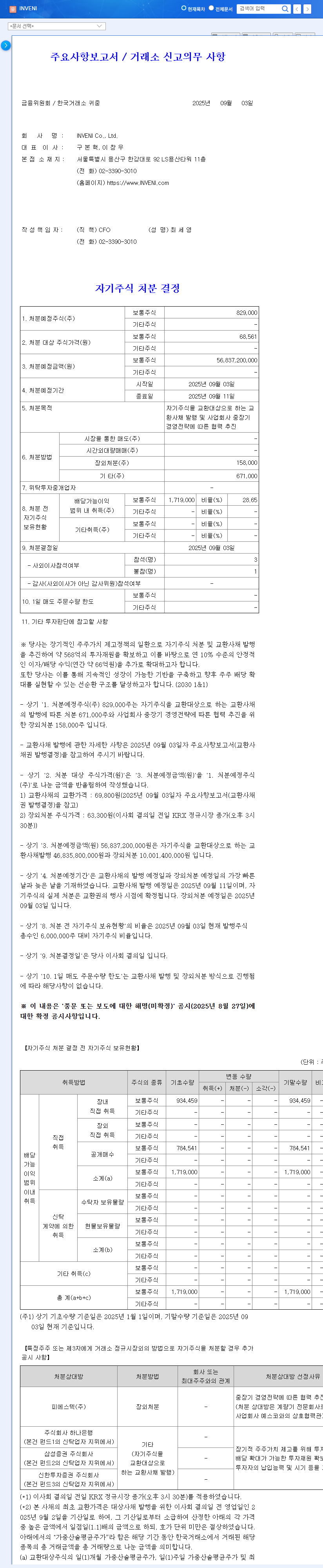

On November 14, 2025, INVENI Co., Ltd. filed a ‘Report on Major Shareholdings’ that detailed a minor change. An affiliated person, Koo Jae-hee, sold 7,074 shares on the open market over several days. This resulted in a negligible 0.14 percentage point decrease in the total stake held by the reporting representative, CEO Koo Ja-eun, and affiliated parties, moving from 42.53% to 42.39%. While transparently disclosed, the scale of this sale is minimal and is best understood as a routine portfolio adjustment rather than a strategic move. For full transparency, you can view the Official Disclosure on DART.

The Bigger Picture: INVENI’s Dual-Engine Growth Strategy

The real story for investors lies in the company’s strategic transformation. INVENI has rebranded and repositioned itself to solidify its identity as an ‘investment specialist firm.’ It now operates on a powerful dual-pillar model, combining the stable, cash-generating city gas segment (through its subsidiary YESCO Co., Ltd.) with a dynamic, high-growth investment and holding segment. This structure provides a unique blend of stability and upside potential.

Analyzing the Financial Health of INVENI Co., Ltd. (015360)

The success of this strategy is already evident in the company’s financials. As of Q3 2025, while total sales saw a slight decrease due to the city gas segment, the company’s overall profitability surged. Key highlights include:

- •Investment Segment Boom: The investment and holding segment reported a dramatic increase in operating profit, validating the company’s strategic pivot and expertise.

- •Rising Asset Value: The investment Net Asset Value (NAV) on a separate financial basis grew considerably, indicating that the underlying assets in their portfolio are appreciating in value.

- •Shareholder-Friendly Actions: The company secured approximately 56.8 billion KRW in capital through treasury stock cancellation and convertible bond issuance, signaling a commitment to both funding future investments and enhancing shareholder returns. For more on this, see expert analysis from sources like Bloomberg.

Impact Analysis: Reading Between the Lines

Given the context, the impact of this disclosure should be viewed through both a short-term and long-term lens.

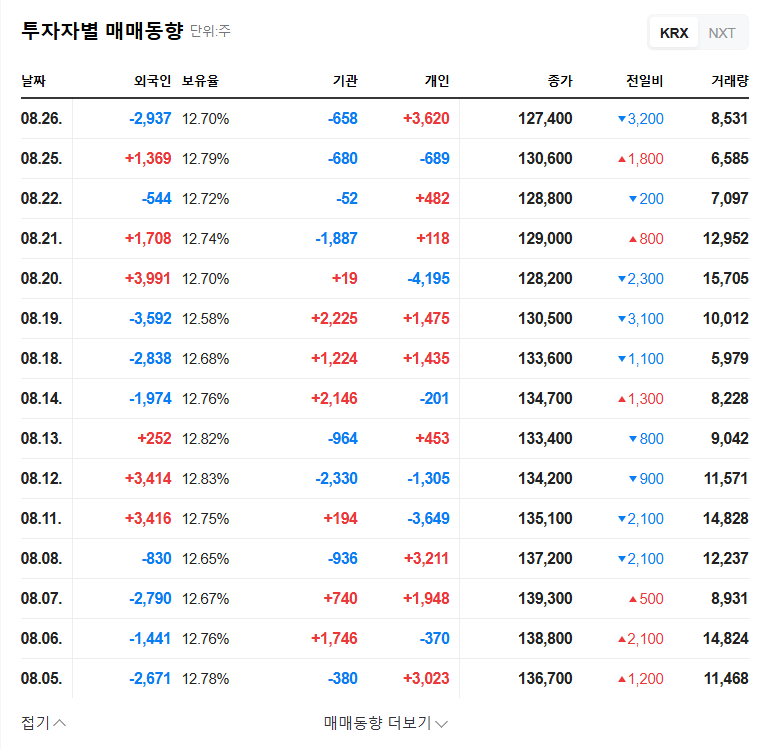

Short-Term Stock Volatility

In the short term, the direct impact on INVENI’s stock price is expected to be minimal. The number of shares sold is too small to disrupt supply and demand dynamics significantly. While market sentiment can be fickle, any price movement is more likely to be driven by broader market trends than this specific, minor event.

Long-Term Value and Management Stability

From a long-term perspective, management control remains firmly intact. The 42.39% stake held by CEO Koo Ja-eun and affiliates is substantial, mitigating any concerns about a potential management dispute. The company’s future value will not be defined by minor stake changes but by the successful execution of its INVENI investment strategy. This includes growing its assets under management, making shrewd investment choices, and continuing its active shareholder return policies. Understanding these fundamentals is key to a solid investment company analysis.

Comprehensive Outlook & Investor Strategy

Ultimately, the recent disclosure is a non-event for the company’s core thesis. Investors should instead focus on the compelling growth narrative and financial performance that INVENI Co., Ltd. (015360) is building. The mid-to-long-term appreciation of corporate value hinges on its ability to navigate the market and deliver on its ambitious goals.

Frequently Asked Questions (FAQ)

Q1: What was the recent INVENI Co., Ltd. shareholding disclosure about?

An affiliated person sold 7,074 shares, leading to a minor 0.14% decrease in the total affiliated stake, bringing it to 42.39%. This is considered a routine transaction.

Q2: Will this shareholding change negatively impact INVENI’s stock price?

The direct short-term impact on the stock price is expected to be limited due to the very small volume of shares sold. The company’s fundamentals are a much stronger price driver.

Q3: Are there any concerns about INVENI’s management control?

No. With a controlling stake of 42.39%, CEO Koo Ja-eun and affiliated parties maintain solid control over the company, and this minor sale does not pose any threat.

Q4: What are the main reasons to be optimistic about INVENI Co., Ltd. (015360)?

The key positive factors are the significant profit growth in its investment segment, a rising Net Asset Value (NAV), and a clear commitment to enhancing shareholder returns through strategic financial actions.