What Happened?

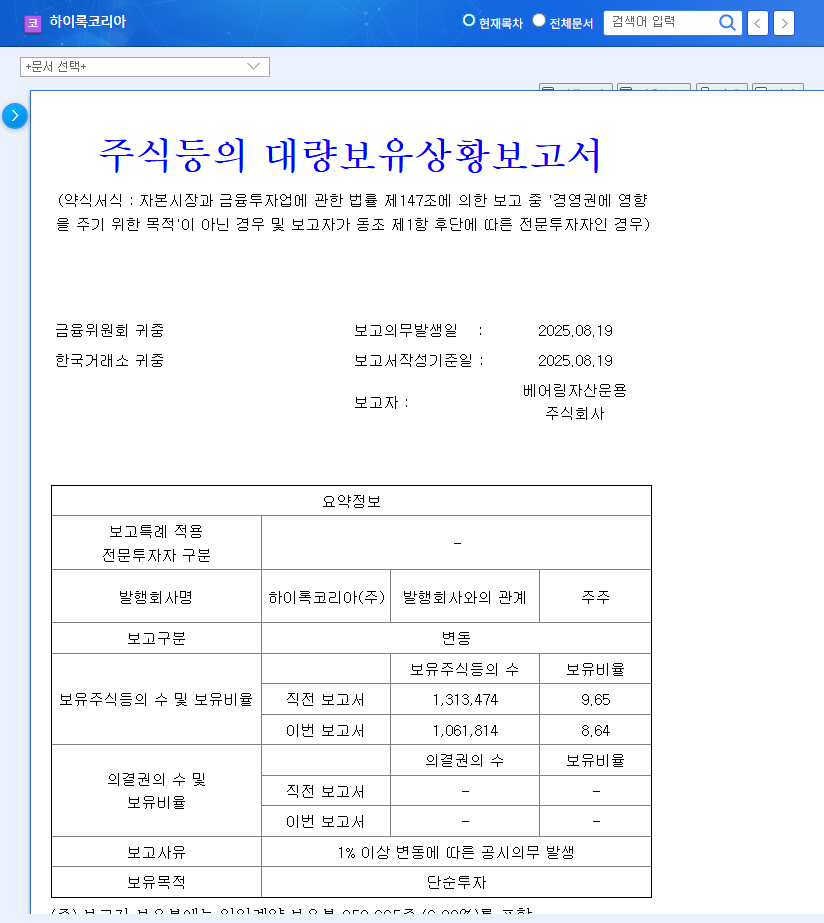

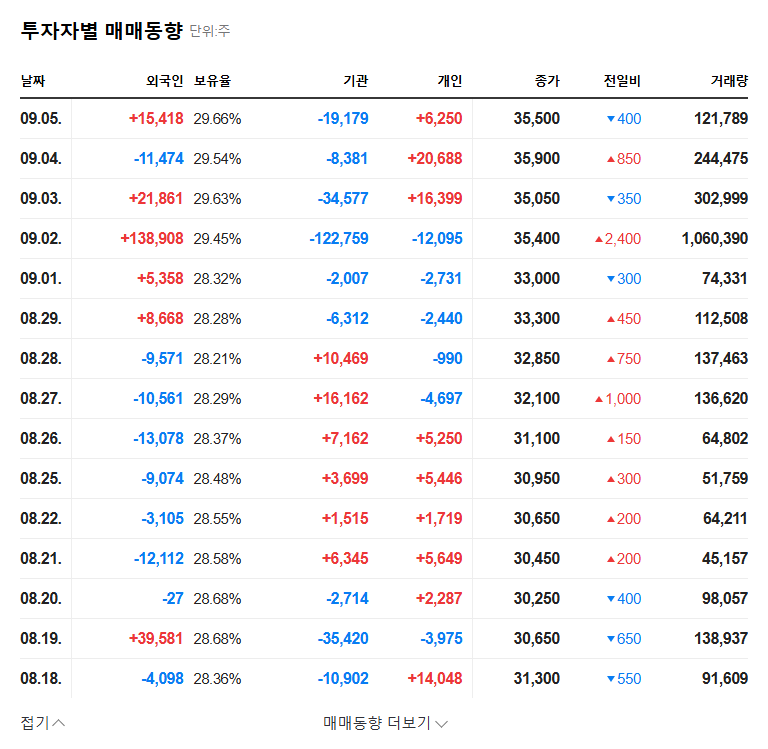

On September 8, 2025, Barings Asset Management filed a large-holding report, disclosing a reduction in its Hylok Korea stake. Through a series of trades between August 8 and 19, they decreased their holdings by approximately 1%.

Why the Reduction?

The official reason given is ‘simple investment,’ suggesting a routine portfolio adjustment. However, it’s crucial to consider this move in the context of Hylok Korea’s recent stock performance and its 2025 half-year earnings.

What’s the Impact on the Stock Price?

Short-term: Downward pressure on the stock price is anticipated due to potential selling pressure. However, a 1% decrease isn’t substantial, and considering Hylok Korea’s solid fundamentals, a dramatic drop is unlikely. Long-term: The stock price will be influenced by Hylok’s fundamentals and the macroeconomic environment. Positive factors include increased exports and growth potential in advanced industries. Negative factors include a slight decrease in operating profit, exchange rate volatility, and global economic uncertainty.

What Should Investors Do?

- Short-term investors: Consider potential buying opportunities during price dips but proceed with caution and monitor market conditions closely.

- Long-term investors: Focus on Hylok Korea’s fundamentals and growth potential, while monitoring factors like exchange rates, raw material prices, and the global economic climate. Pay close attention to Barings Asset Management’s further actions, export data, and trends in related industries.

FAQ

What does Barings Asset Management’s stake reduction signify?

It is likely a portfolio adjustment for ‘simple investment’ purposes, but it could be perceived as a negative signal by some investors.

What is the outlook for Hylok Korea’s stock price?

Short-term volatility is expected, but the long-term trajectory will depend on the company’s fundamentals and macroeconomic factors. Strong exports and growth in advanced industries are positive, while exchange rate fluctuations and global economic uncertainty pose risks.

How should investors react?

Short-term investors should be mindful of price volatility. Long-term investors should focus on the company’s fundamentals and growth potential, monitoring Barings Asset Management’s future actions, export data, and relevant industry trends.