1. Hyundai Mobis IR: What was discussed?

Hyundai Mobis held its IR session on September 17, 2025, as part of its participation in the Korea Investment & Securities KIS Global Investors Conference. The company provided updates on recent business performance, future strategies, and addressed key investor concerns.

2. Why it matters: Growth of the Future Mobility Market

The global automotive market is rapidly transforming, centering around electrification, autonomous driving, and connectivity. Hyundai Mobis leads this transformation by developing core technologies and forming strategic partnerships within the future mobility market. This IR session provided a valuable opportunity to assess Hyundai Mobis’ competitiveness and growth potential amidst the changing market landscape.

3. How will Hyundai Mobis grow?: Analysis of Key Business Strategies

- Strong Performance: Achieved sales of KRW 30.6883 trillion (+7.6%) and operating profit of KRW 1.6467 trillion (+39.7%) in the first half of 2025.

- Increased Investment in Future Mobility: Active R&D investments in core future technologies such as electrification, autonomous driving, and IVI.

- Strengthened Global Partnerships: Expanded collaborations with global automakers such as Volkswagen and Stellantis.

- Stable Financial Structure: Maintained a low debt-to-equity ratio of 44.92%.

4. Action Plan for Investors

Key Investment Points:

- Accelerated electrification transition

- Future mobility solutions

- Global business expansion

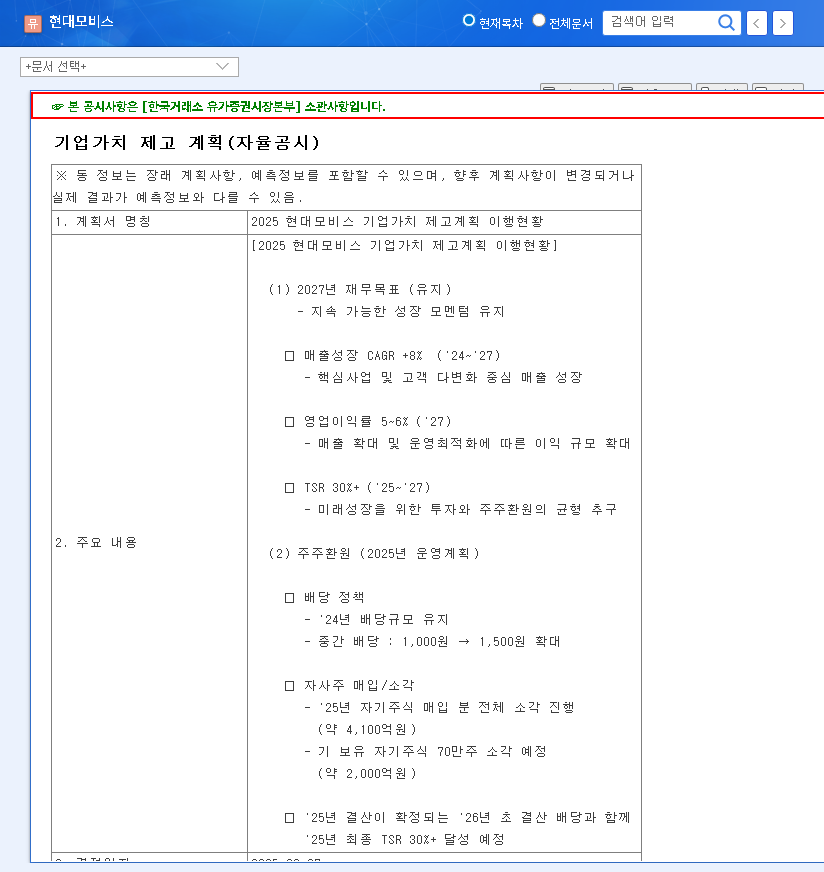

- Stable shareholder return policy

Risk Factors:

- Volatility in the global automobile and electric vehicle markets

- Fluctuations in exchange rates and raw material prices

- Geopolitical and macroeconomic uncertainties

It is crucial to continuously monitor IR outcomes, competitor analysis, and long-term growth strategies to establish effective investment strategies.

Frequently Asked Questions (FAQ)

What are Hyundai Mobis’ main businesses?

Hyundai Mobis focuses on automotive module and parts manufacturing and the A/S parts business. They are expanding investments in future mobility areas such as electrification, autonomous driving, and UAM.

What were the key takeaways from this IR session?

The company shared its recent performance and future growth strategies, particularly focusing on technological developments and business plans in electrification and autonomous driving.

What are the key investment points for Hyundai Mobis?

Key investment points include the acceleration of electrification transition, future mobility solutions, global business expansion, and a stable shareholder return policy.

What risks should investors be aware of?

Investors should consider risks such as volatility in the global automobile and electric vehicle markets, fluctuations in exchange rates and raw material prices, and geopolitical and macroeconomic uncertainties.