As KUMHO PETRO CHEMICAL CO.,LTD prepares for its pivotal Q3 2025 Investor Relations (IR) conference on November 10, 2025, the investment community is watching closely. This event, which includes an earnings presentation and a Non-Deal Roadshow (NDR), is more than a quarterly update; it’s a critical moment that will shape the narrative around Kumho Petrochemical stock for months to come. Will the results validate the company’s strategy and fuel a stock price rally, or will they reveal underlying weaknesses that amplify market uncertainty?

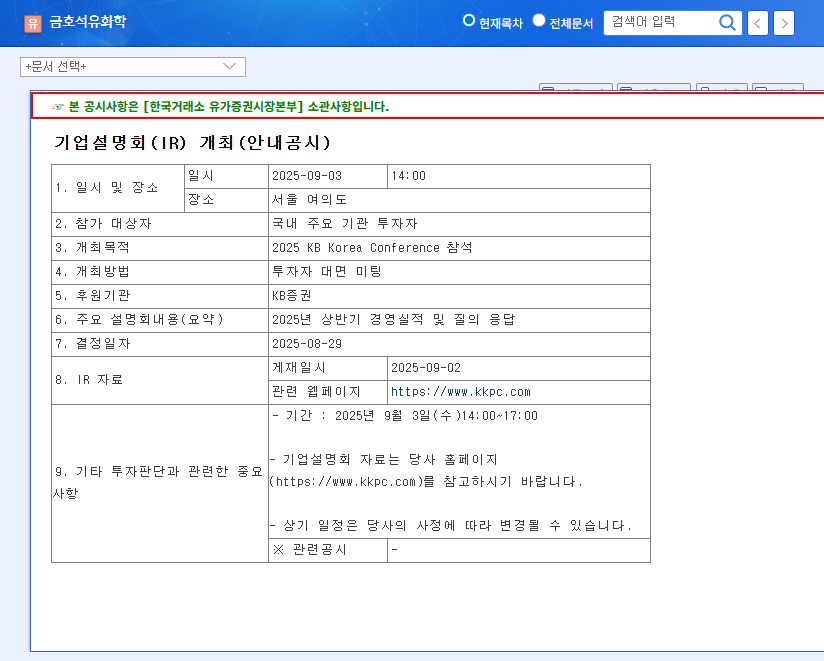

This comprehensive analysis dissects the core fundamentals, macroeconomic tailwinds and headwinds, and the potential stock implications surrounding the KUMHO PETRO CHEMICAL IR event. We will explore the company’s diverse business segments, from high-performing synthetic rubber to challenged synthetic resins, to provide a clear investment strategy for navigating the path ahead. For official details regarding the event, please see the Official Disclosure.

Core Business Fundamentals: A Tale of Two Halves

The current state of KUMHO PETRO CHEMICAL reveals a company with distinct areas of strength and challenge. Understanding this dichotomy is crucial for any potential investor. The IR will need to address how the company plans to leverage its strengths while mitigating its weaknesses.

Areas of Strength and Growth

- •Synthetic Rubber: This segment remains a bright spot, benefiting from favorable market dynamics. Falling raw material costs have improved price spreads, while a rebound in the global automotive and industrial sectors has bolstered demand. Increased latex sales further contribute to this segment’s robust performance.

- •Specialty Chemicals: A strategic focus on raw material self-sufficiency is paying dividends. This division has seen significant year-over-year growth in both sales and volume, supported by consistent and stable demand from key downstream industries.

Segments Facing Headwinds

- •Synthetic Resin: This area is the primary drag on overall profitability. An oversupply of low-priced products from China has created intense margin pressure. Compounding this is weakened domestic consumer demand due to a broader economic slowdown. A clear turnaround plan for this segment will be a key focus of the IR.

- •Carbon Nanotubes (CNT): The CNT business is facing sluggish demand. This is directly tied to the recent slowdown in global EV sales and a downturn in China’s construction sector, two key end-markets for CNT materials used in secondary batteries.

While top-line revenue has grown 4.6% to KRW 3.68 trillion, a 6.0% decrease in operating profit highlights the margin pressure from underperforming segments. The company’s commitment to share buybacks is a critical positive signal for shareholder value.

Macroeconomic Landscape and Stock Impact

No company operates in a vacuum. The performance of KUMHO PETRO CHEMICAL stock is heavily influenced by external economic factors. For more on market trends, investors often consult sources like Reuters Business for global economic updates.

- •Currency Exchange Rates: A weaker Won, particularly against the Euro, can be advantageous for an export-heavy company like Kumho, making its products more competitive abroad.

- •Oil Prices & Shipping: Stable international oil prices and declining shipping costs (as indicated by the BDI and CCFI) reduce the burden of raw material and logistics expenses, providing a potential boost to margins.

- •Interest Rates: While rate hikes have slowed, elevated borrowing costs in the US and Korea remain a consideration for capital-intensive projects and overall financial strategy.

Investment Strategy: What to Watch in the IR/NDR

The upcoming Kumho Petrochemical IR is a critical data point. Here’s what investors should focus on to formulate an effective investment strategy and gauge the future of the Kumho Petrochemical stock price.

Potential Catalysts for a Positive Outlook

- •Exceeding Expectations: If Q3 earnings beat market consensus, it would signal strong operational execution.

- •Clear Turnaround Plan: A detailed, credible strategy for the synthetic resin segment could restore investor confidence.

- •Future Growth Drivers: Highlighting progress in new ESG-linked ventures or a strategy to revive the CNT segment could excite long-term investors. To learn more, you can read our guide on evaluating chemical company growth prospects.

- •Shareholder Returns: Reaffirming commitment to share buybacks and cancellations will be seen as a major positive.

Potential Risks to Monitor

- •Earnings Miss: Q3 results falling below expectations would likely trigger a negative stock reaction.

- •Pessimistic Guidance: A downbeat outlook for Q4 or 2026, especially without a clear path to improvement, would dampen sentiment.

- •Vague Q&A Responses: An inability to convincingly address tough questions on competition or raw material risks could be a major red flag.

Conclusion: The Investor Action Plan

For investors in KUMHO PETRO CHEMICAL, this IR event is a moment of truth. The key is to listen beyond the headline numbers and focus on the qualitative narrative. Pay close attention to management’s tone, their strategic priorities, and the transparency of their answers during the Q&A session. A successful IR will build on the momentum from its strong segments and present a clear, actionable plan to fix the underperforming ones. By thoroughly analyzing the presentation and the market’s reaction, investors can make well-informed decisions regarding their position in Kumho Petrochemical stock.