UNICHEM CO.,LTD (유니켐) has captured the market’s attention with its recent Investor Relations (IR) session focused on a significant financial move: a public offering of UNICHEM Bonds with Warrants (BW). This strategic decision to raise capital is a pivotal moment for the company, presenting both exciting opportunities for growth and potential risks for existing shareholders. The central question for investors is whether this BW issuance will unlock new value or simply dilute their holdings.

This comprehensive analysis dissects the key takeaways from the IR session, explains the mechanics of a BW issuance, evaluates the potential impacts on UNICHEM’s stock price, and provides a clear action plan for investors navigating this period of uncertainty.

What Exactly Are Bonds with Warrants (BW)?

Before delving into the specifics of the UNICHEM BW issuance, it’s crucial to understand the financial instrument itself. Bonds with Warrants are a hybrid security. Essentially, a company issues a bond (a loan from investors) but attaches ‘warrants’ as a sweetener. These warrants give the bondholder the right, but not the obligation, to purchase a specific number of the company’s shares at a predetermined price (the ‘exercise price’) before a certain expiration date.

For the company, this is an attractive way to raise funds, often at a lower interest rate than a standard bond. For investors, it offers the fixed income of a bond plus the potential upside of an equity investment if the stock price rises above the exercise price. For a more detailed explanation, you can review this comprehensive guide on corporate bonds.

The core dilemma of a BW issuance is the balance between raising vital capital for growth and the inevitable risk of share dilution, which can negatively impact the value of existing shares.

Decoding UNICHEM’s IR Session and BW Announcement

The Investor Relations session held on October 24, 2025, was UNICHEM’s platform to communicate the rationale behind this capital raise. The primary goal was to assure investors that the funds would be used strategically to enhance long-term corporate value. The complete details of the issuance, including the total amount, exercise price, and maturity date, are critical factors for analysis. Investors should meticulously review the Official Disclosure on DART for the definitive terms.

The Bull Case: A Catalyst for Growth

The most positive outcome is that UNICHEM effectively deploys the newly raised capital to fuel significant growth. If management presents a compelling and credible vision for using these funds—whether for expanding production capacity, entering new markets, strategic acquisitions, or investing in R&D—it could signal a new era of profitability. A successful capital raise tied to a clear growth strategy can often outweigh the short-term concerns of dilution, leading to a higher long-term stock valuation.

The Bear Case: The Burden of Share Dilution

Conversely, the primary risk associated with the UNICHEM Bonds with Warrants is share dilution. When warrant holders exercise their right to buy stock, the company issues new shares. This increases the total number of shares outstanding, which means each existing share represents a smaller percentage of ownership in the company. This can lead to a decrease in Earnings Per Share (EPS) and potentially exert downward pressure on the stock price, especially if the company fails to generate sufficient growth from the invested capital.

An Actionable Checklist for UNICHEM Investors

Given the limited public analysis and brokerage reports, diligent personal research is paramount. Here are the essential steps to take to make an informed decision:

- •Analyze the Official Disclosure: Scrutinize the DART filing for the exact terms of the BW issuance. Pay close attention to the exercise price, the total number of new shares that could be created, and the maturity date.

- •Evaluate the Use of Proceeds: Go beyond the headlines. Understand precisely how management plans to use the capital. Is it for a specific, high-ROI project or for general corporate purposes? A detailed plan inspires more confidence.

- •Review Financial Health: Dive into UNICHEM’s recent financial reports. Our guide on how to read financial statements can help you assess their current debt levels, cash flow, and profitability.

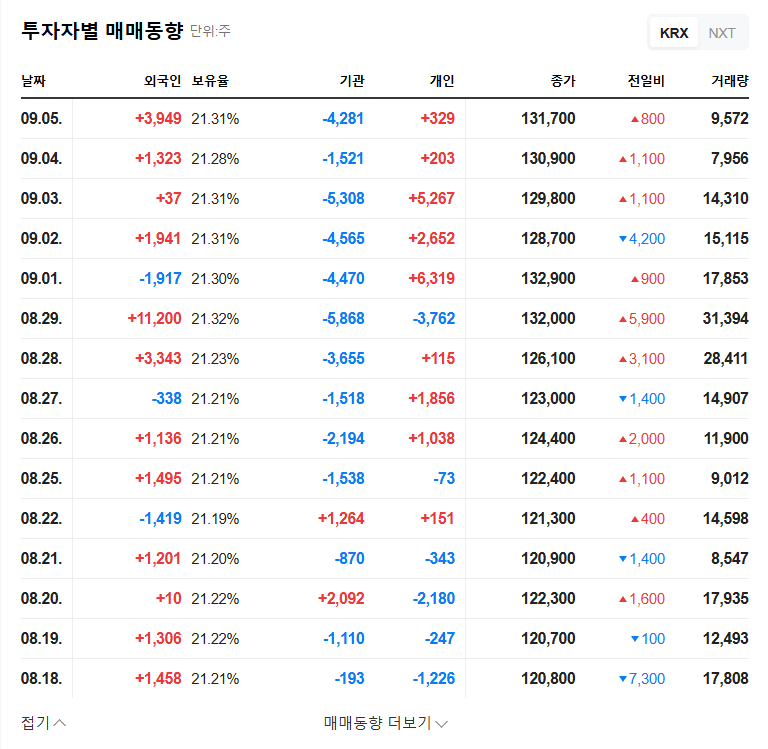

- •Monitor Market Reaction: Keep a close eye on analyst reports, media coverage, and investor forums following the IR session to gauge the overall market sentiment and professional opinions.

Conclusion: Cautious Optimism Hinges on Execution

The UNICHEM Bonds with Warrants issuance is a defining moment. It is neither inherently positive nor negative; its impact will be determined entirely by management’s execution. If the capital is used wisely to create substantial long-term value that outpaces the dilutive effect, current investors could be well rewarded. However, if the growth fails to materialize, the stock price could face significant headwinds.

Ultimately, a prudent, information-driven approach is required. The key lies in the details presented at the IR session and in the official filings. Investors should proceed with caution, armed with a thorough understanding of the terms and the company’s strategic vision before making any investment decisions.