The maritime industry is watching closely as the HD HYUNDAI MIPO merger with its larger affiliate, HD HYUNDAI HEAVY INDUSTRIES, moves forward. A recent, crucial step—the exercise of stock purchase rights—has concluded successfully, clearing a major hurdle for the integration. This development, combined with an impressive financial turnaround in the first half of 2025, positions the company at a pivotal moment. For investors, this raises a critical question: What does this merger mean for the HD HYUNDAI MIPO stock value and its long-term growth trajectory? This analysis will provide a comprehensive look at the merger’s progress, the company’s robust fundamentals, and the strategic outlook for investors.

Merger on Track: Understanding the Stock Purchase Right Results

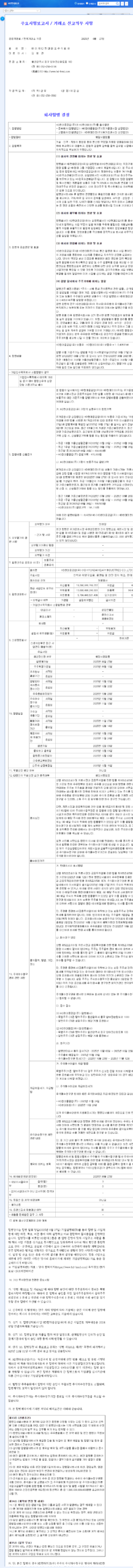

On November 13, 2025, HD HYUNDAI MIPO announced the official results of the Stock Purchase Right (SPR) exercise, a mechanism allowing dissenting shareholders to sell their shares back to the company at a pre-determined price. The outcome was overwhelmingly positive for the merger’s progression.

Key Financial Figures

- •Total SPR Exercised: The combined value of shares sold back by dissenting shareholders from both companies amounted to KRW 1.657 billion.

- •Merger Condition Met: This figure is significantly below the KRW 1.5 trillion threshold that would have jeopardized the deal.

The negligible exercise of the Stock Purchase Right indicates strong shareholder confidence in the strategic rationale behind the HD HYUNDAI MIPO merger. It suggests that the vast majority of investors believe the long-term benefits of the union outweigh any short-term concerns. The official disclosure for these results can be found on Korea’s DART system (Official Source).

Analyzing HD HYUNDAI MIPO’s Performance and Financial Health

Beyond the merger headlines, HD HYUNDAI MIPO’s performance in H1 2025 has built a powerful fundamental case for its future. The company has demonstrated a remarkable turnaround, laying a solid foundation for growth.

From Red to Black: A Successful Turnaround

- •Operating Profit: The company posted an impressive operating profit of KRW 157.9 billion, a significant recovery from the losses seen in late 2023.

- •Strategic Pricing: This was achieved by maintaining newbuilding prices approximately 30% above the 10-year average, capitalizing on strong market demand.

- •Focus on High-Value Vessels: A strategic pivot towards eco-friendly and high-value vessel orders has boosted profitability margins.

The combination of a successful merger process and a strong fundamental turnaround creates a compelling narrative for long-term value creation.

Strengthened Financials & Market Position

The company’s financial health has also shown marked improvement. The debt-to-equity ratio has decreased to a manageable 134.23%, and the interest coverage ratio has soared to 37.92, indicating a powerful ability to service its debt. This financial stability is crucial in the capital-intensive shipbuilding investment landscape. Furthermore, the global push for decarbonization, governed by regulations from bodies like the International Maritime Organization (IMO), creates a favorable tailwind. HD HYUNDAI MIPO’s specialization in medium-sized, eco-friendly vessels positions it perfectly to meet this growing demand.

The Power of Synergy: What the Merger Creates

The strategic integration of HD HYUNDAI MIPO and HD HYUNDAI HEAVY INDUSTRIES is expected to create a shipbuilding titan with unparalleled competitive advantages. This is not merely a financial transaction but a move to dominate the global market through powerful synergies.

- •Market Dominance: The combined entity will have a stronger negotiating position and a more extensive portfolio covering nearly all vessel types.

- •Operational Efficiency: Shared R&D, procurement, and sales networks will lead to significant cost reductions and streamlined operations.

- •Enhanced Innovation: Pooling technological expertise will accelerate development in key areas like LNG-powered ships, ammonia carriers, and autonomous navigation.

Investor Action Plan & Future Outlook

Given the successful clearing of the SPR hurdle and strong H1 2025 results, the outlook for the HD HYUNDAI MIPO merger is positive. However, investors should remain vigilant.

Key Considerations for Your Portfolio

Short-Term Volatility: The stock may experience temporary fluctuations around key merger dates, such as the trading suspension (Nov 27) and new share listing (Dec 15).

Long-Term Growth: The post-merger entity’s enhanced competitiveness and market position are expected to be significant drivers for long-term stock price appreciation. For more on this topic, you can read our guide on evaluating industrial sector stocks.

Macroeconomic Factors: Keep an eye on the USD/KRW exchange rate (a weaker won is generally favorable for exporters), global energy prices, and steel prices, as these will impact profitability.

Potential Risks to Monitor

- •A global economic slowdown could dampen new vessel orders.

- •Post-merger integration challenges could delay the realization of expected synergies.

- •Intensifying competition from Chinese shipyards could pressure pricing.

In conclusion, HD HYUNDAI MIPO is charting a promising course. The successful HD HYUNDAI MIPO merger is poised to unlock substantial value, while its current financial strength provides a stable platform for growth. Investors with a long-term horizon may find the current landscape to be a compelling entry point, provided they continue to monitor the key variables shaping the global shipbuilding industry.