The recent PANGRIM asset acquisition has captured the attention of the market, signaling a pivotal moment for the company. PANGRIM CO.,LTD (003610) announced a significant investment of KRW 8.8 billion to acquire new tangible assets, a move strategically timed with the sale of its Gumi factory. This decision is far more than a simple real estate transaction; it represents a fundamental overhaul of its logistics network aimed at driving long-term efficiency and growth. This comprehensive analysis will dissect the investment’s details, explore its strategic importance, evaluate the financial implications, and provide a clear outlook for investors monitoring PANGRIM’s trajectory.

Dissecting the PANGRIM Asset Acquisition Deal

On November 12, 2025, PANGRIM CO.,LTD formally disclosed its decision to acquire land and buildings in Gongdan-dong, Gumi-si, Gyeongsangbuk-do. The total acquisition price is KRW 8.8 billion, a figure that constitutes approximately 3.82% of the company’s total assets. The transaction is scheduled to be finalized by January 30, 2026. This move is officially documented and can be verified via the official disclosure. (Source: DART). The primary driver for this substantial investment is the need to relocate its logistics warehouse following the divestment of the Gumi factory site.

This isn’t merely an asset swap; it’s a calculated strategy to re-engineer the company’s entire supply chain for enhanced operational efficiency and future scalability.

Strategic Overhaul: Boosting Logistics and Supply Chain Efficiency

The core objective of this PANGRIM asset acquisition is to build a state-of-the-art logistics hub. By centralizing and modernizing its warehousing operations, PANGRIM aims to achieve several key benefits. A new, purpose-built facility will enable more sophisticated inventory management, reduce handling times, and optimize the flow of goods from raw material import to final product distribution. This enhancement in logistics efficiency is expected to yield significant long-term operational cost reductions and a marked improvement in overall productivity, strengthening the company’s competitive edge in a volatile global market.

Financial Analysis: A Calculated Risk?

While the strategic vision is clear, any investment of this magnitude carries both opportunities and risks. A balanced view is crucial for a complete understanding.

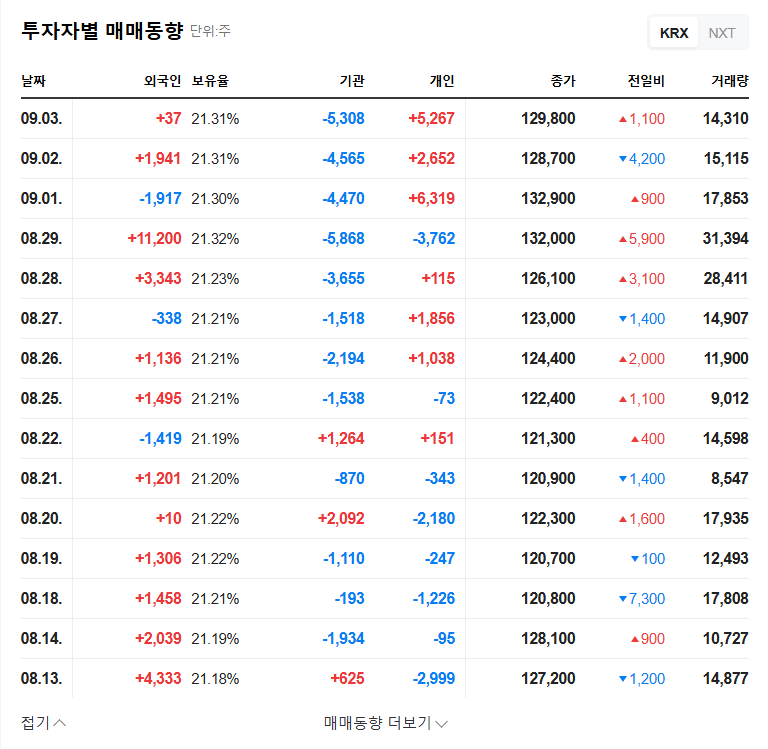

The Upside: Building on a Financial Recovery

This investment comes at a time of positive momentum for PANGRIM. After posting losses through 2023, the company successfully returned to profitability in the third quarter of 2024 (cumulative), with sales growing by 9% year-over-year. This turnaround provides a solid foundation for the KRW 8.8 billion investment, suggesting it is a move made from a position of growing strength, not desperation. The market has reacted favorably to this recovery, with the stock price showing a consistent upward trend. An efficient logistics network can further bolster the bottom line by reducing operational expenses and improving margins.

Potential Headwinds and Risks to Monitor

Despite the positive outlook, several risk factors must be considered. The success of the logistics integration is not guaranteed and could face unforeseen costs or delays. Furthermore, as a company that relies entirely on imported raw materials, PANGRIM remains exposed to external economic pressures like currency volatility and fluctuating commodity prices. Finally, the funding mechanism for the acquisition is a critical detail. If financed through significant debt, the increased interest payments could strain the company’s financial structure. Investors can learn more about analyzing corporate financial health through our internal guide.

Investor Outlook: Key Points to Watch

PANGRIM’s decision is a forward-looking move designed to strengthen its long-term competitiveness. Given the 2026 completion date, the immediate impact on stock price may be limited. However, diligent investors should keep a close watch on the following key areas:

- •Funding Source: Monitor announcements to see if the acquisition is self-funded or financed through debt, which will impact the balance sheet.

- •Project Milestones: Track the progress of the warehouse relocation and integration for any signs of delays or budget overruns.

- •Quarterly Earnings: Scrutinize future earnings reports to confirm that the financial recovery is sustained and to see the initial impact of efficiency gains.

- •Macroeconomic Indicators: Pay attention to exchange rates and raw material price trends, as these directly affect PANGRIM’s profitability. For broader market trends, sources like Reuters Business are invaluable.

In conclusion, the PANGRIM asset acquisition is a bold, strategic investment in its future. By proactively addressing the logistical challenges posed by the Gumi factory sale, the company is positioning itself for more resilient and profitable operations. While risks are present, the potential for enhanced long-term value makes this a development worth watching closely.