The recent announcement of the LG Corp. Q3 2025 earnings has sent ripples through the investment community, as the numbers fell significantly short of market expectations. For current and prospective investors, this news raises critical questions: Is this a temporary stumble or a sign of deeper challenges? This comprehensive analysis provides a detailed breakdown of the financial results, the underlying causes, and a prudent action plan for navigating the path forward.

We will dissect the performance of key subsidiaries, analyze macroeconomic pressures, and offer a clear-eyed view of what this LG Corp. earnings miss means for the company’s stock and long-term valuation.

The Official Numbers: LG Corp.’s Q3 2025 Earnings Snapshot

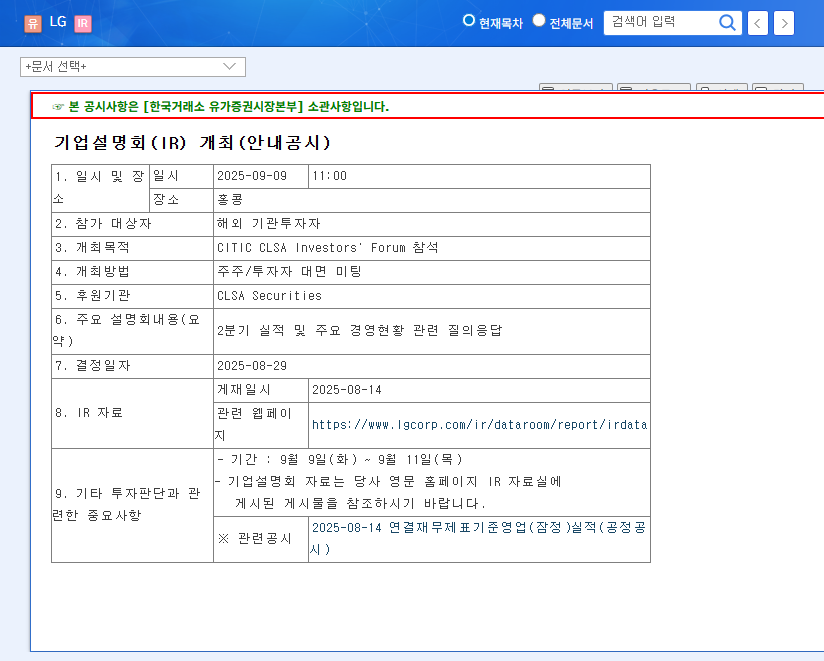

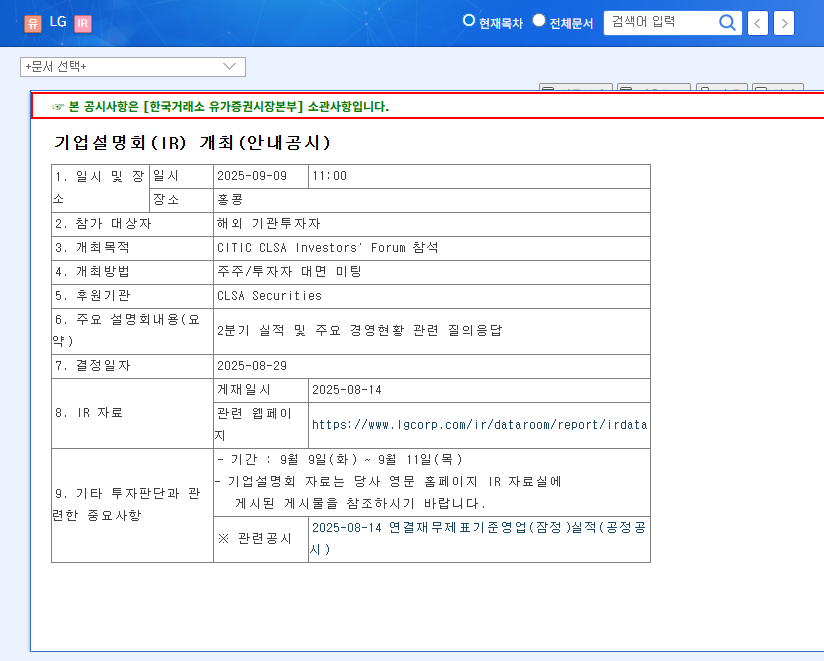

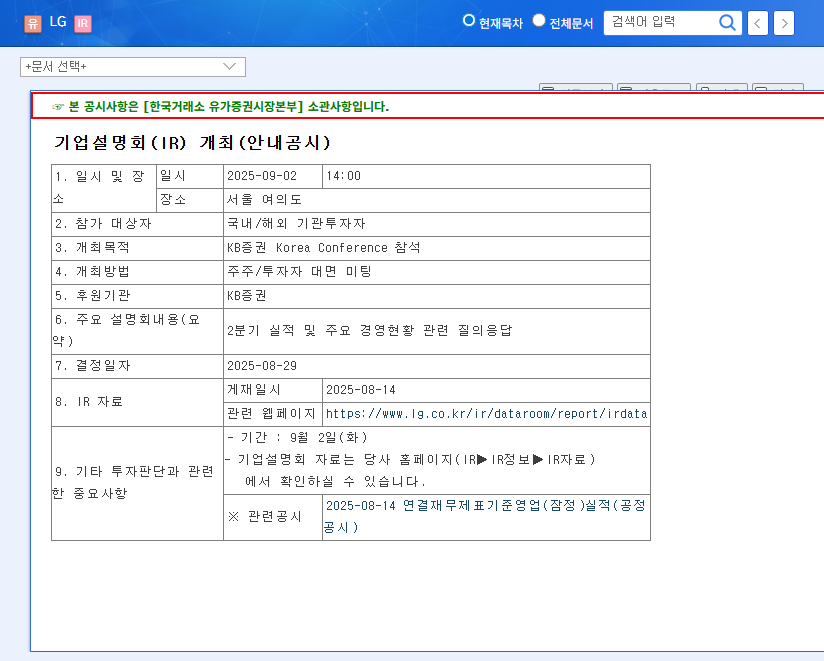

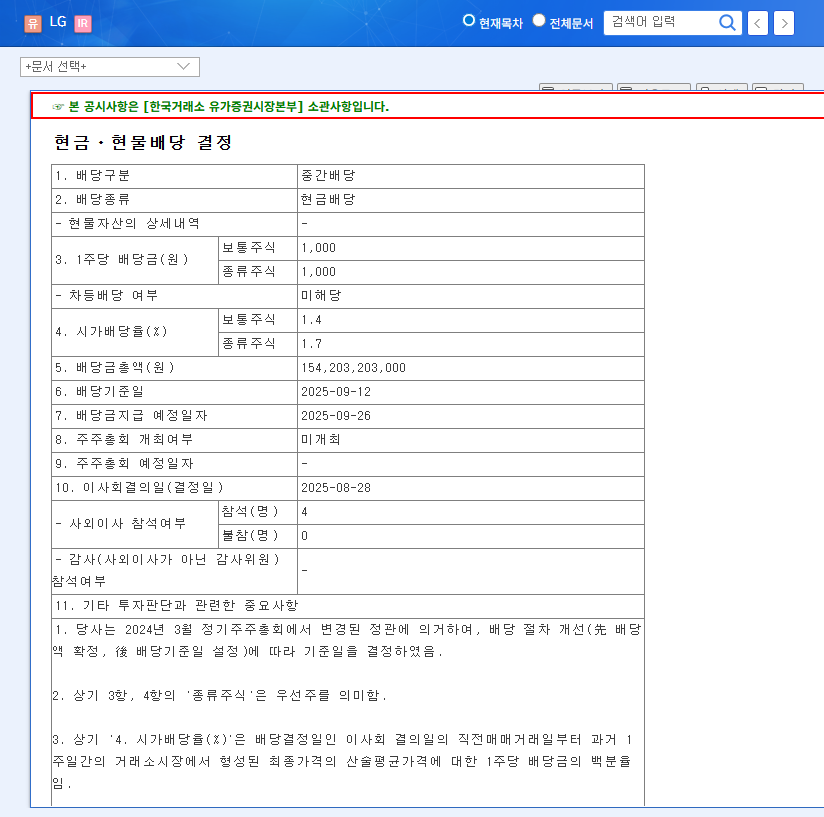

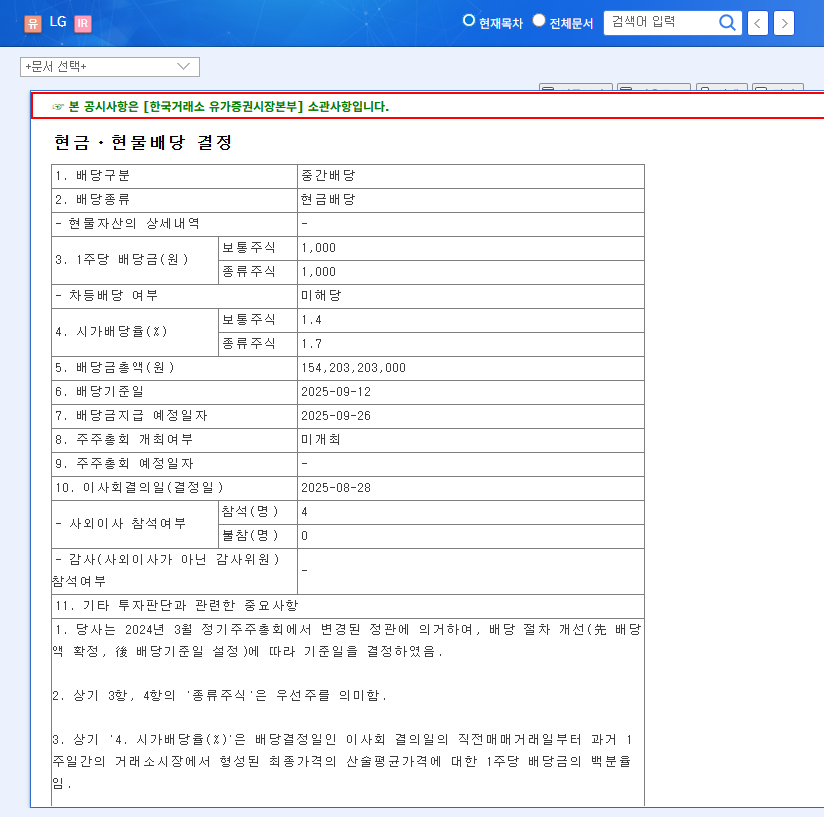

LG Corp. released its preliminary consolidated financial results for the third quarter of 2025, revealing a broad-based miss against consensus market estimates. The data, confirmed by the Official Disclosure on DART, points to challenges in both revenue generation and profitability.

- •Revenue: KRW 1,996.2 billion, which is 2.0% below the market forecast of KRW 2,045.6 billion.

- •Operating Profit: KRW 418.9 billion, a significant 9.0% below the market estimate of KRW 462.8 billion.

- •Net Income: KRW 315.3 billion, marking a substantial 17.0% miss compared to the estimate of KRW 381.1 billion.

The pronounced shortfall in operating profit and net income is particularly concerning, as it suggests that margin compression and operational inefficiencies are compounding the effects of slower sales. This dual pressure is a clear negative signal for investors relying on the company’s profitability.

For investors, the core challenge is distinguishing between short-term market headwinds and a fundamental erosion of LG Corp.’s long-term earning power. A thorough LG stock analysis is more critical now than ever.

Analyzing the Core Reasons for the Earnings Miss

To understand the LG Corp. Q3 2025 earnings performance, we must look at its structure as a pure holding company. Its income is derived primarily from dividends, brand royalties, and rental income. The miss can be traced to both internal performance factors and external macroeconomic pressures.

Negative Factor: Weakness in Subsidiary Payouts

The H1 2025 report already hinted at this vulnerability. On a separate basis, operating revenue had decreased by 13.5% year-over-year, largely driven by a 22.7% drop in dividend income from its subsidiaries. This volatility is a direct risk for a holding company, and Q3’s results suggest this trend continued, impacting the bottom line directly.

Positive Undercurrents: Growth in Key Subsidiaries

Despite the headline miss, it’s not all negative. The consolidated view shows pockets of strength. The growth of LG CNS (up 6.0% in revenue in H1) and a 30.2% increase in equity method gains signal that some core subsidiaries are performing well. Moreover, the strategic importance of LG Energy Solution in the burgeoning EV battery market, alongside innovation at LG Chem and LG Electronics, provides a foundation for future growth. These positive elements are crucial for any long-term investor guide for LG Corp. For more details on subsidiary performance, you can review our previous H1 2025 analysis.

Market Impact and Macroeconomic Headwinds

An earnings miss of this magnitude will almost certainly trigger a negative short-term reaction. We expect increased selling pressure on LG Corp. stock as the market reprices its expectations. Investor sentiment will likely remain weak until the company can provide a clear roadmap for recovery. Several macroeconomic factors are exacerbating the situation:

- •Exchange Rates: A volatile KRW/USD exchange rate directly impacts the profitability of export-heavy subsidiaries like LG Electronics.

- •Interest Rates: Global monetary tightening increases borrowing costs, which can stifle investment and expansion plans. Investors should monitor central bank policies as discussed by sources like the Federal Reserve and Bank of Korea.

- •Raw Material & Logistics Costs: Fluctuations in oil prices affect LG Chem, while shipping costs, measured by indices like the CCFI, can squeeze margins for LG Electronics.

Investor Action Plan: A Prudent Path Forward

Reacting emotionally to short-term price drops is rarely a winning strategy. Instead, a measured and analytical approach is required. Here are four key recommendations for investors evaluating their position on LG Corp.

- •Deep-Dive Analysis: Pinpoint which specific subsidiaries are underperforming and why. Understanding the root cause is essential to forecasting future performance.

- •Assess the Competitive Landscape: Evaluate if the earnings miss is due to market-wide issues or a loss of competitive advantage in key sectors like electronics or chemicals.

- •Model Macro-Impacts: Analyze how different scenarios for interest rates, exchange rates, and commodity prices could affect future LG Corp. financials.

- •Focus on Long-Term Strategy: Base your investment decision on LG Corp.’s long-term vision, its commitment to future growth engines, and its ability to manage its diverse portfolio, rather than on a single quarter’s results.

In conclusion, while the LG Corp. Q3 2025 earnings are disappointing, they also present an opportunity for diligent investors to re-evaluate the company’s fundamentals. By looking beyond the headline numbers and understanding the complex interplay of factors at work, one can make a more informed and rational investment decision.