What’s Happening? Harim Holdings to Dispose of Treasury Stocks

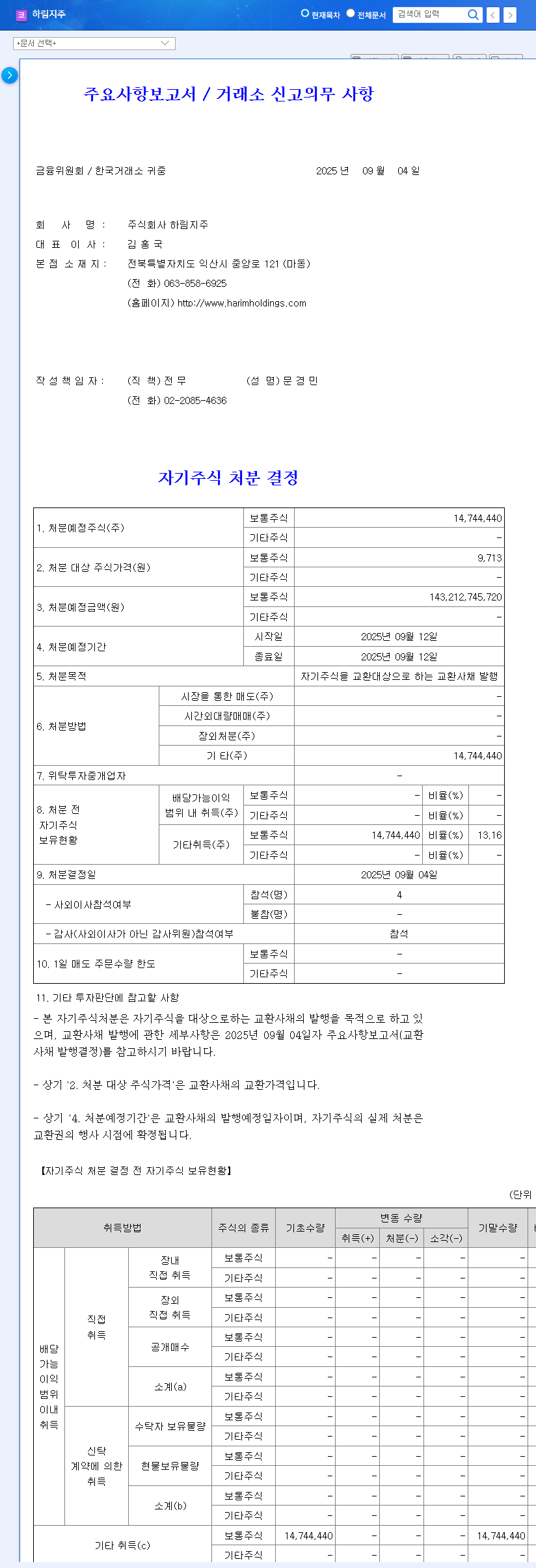

On September 4, 2025, Harim Holdings announced the disposal of 14,744,440 treasury shares, equivalent to ₩143.2 billion. The purpose of this disposal is to raise funds for issuing exchangeable bonds.

Why the Disposal?

Harim Holdings aims to secure funds for investment and operations through the issuance of exchangeable bonds. This is interpreted as a strategy to improve financial structure and invest in new businesses to secure future growth engines.

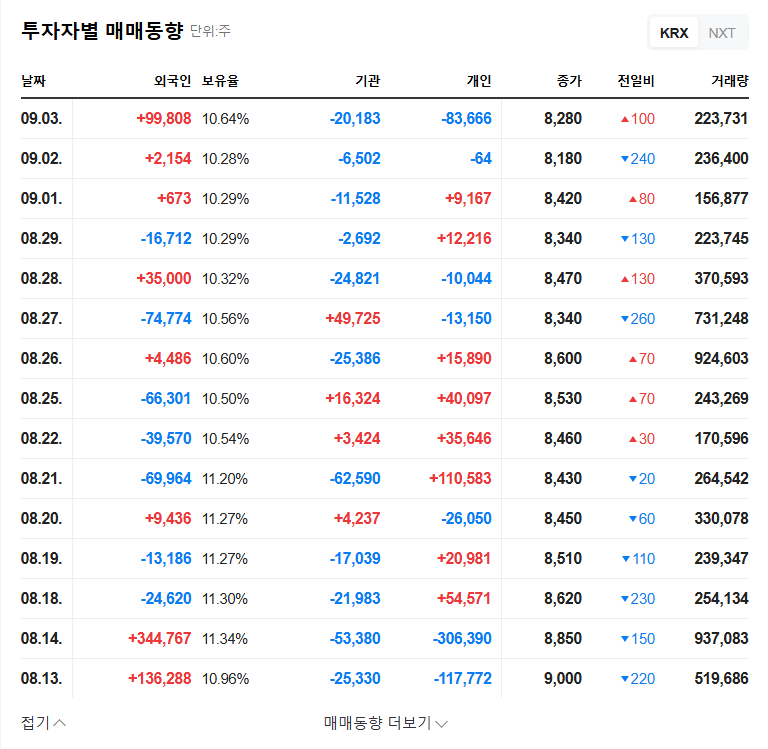

How Will This Impact the Stock Price?

Positive Aspects:

- • Improved financial structure and investment in new businesses through fundraising

- • Potential for increased shareholder value upon conversion of exchangeable bonds (timing and conditions are yet to be determined)

Negative Aspects:

- • Concerns about stock dilution due to new share issuance upon conversion of exchangeable bonds

- • Potential increase in interest expenses and financial risks due to changes in capital structure

- • Possibility of short-term stock price decline following the announcement of treasury stock disposal

What Should Investors Do? Key Checkpoints and Action Plan

Key Considerations:

- • Review the terms of exchangeable bond issuance (conversion price, maturity, interest rate, etc.)

- • Check the company’s specific plans for the use of the raised funds

- • Assess Harim Holdings’ efforts to improve profitability

Investment Strategy:

- • Make investment decisions after reviewing additional information such as the terms of exchangeable bond issuance and the use of funds

- • Continuously monitor the performance of subsidiaries and changes in the market environment

- • Respond cautiously to short-term stock price volatility

In conclusion, before making investment decisions, it is crucial to carefully consider the terms of the exchangeable bond issuance, the company’s plans for using the funds, and Harim Holdings’ efforts to improve its fundamentals.

FAQ

Why can treasury stock disposal negatively affect stock prices?

Treasury stock disposal increases the supply of shares in the market, which can put downward pressure on stock prices in the short term. Additionally, if the disposal is for issuing exchangeable bonds, the potential for stock dilution upon conversion can contribute to long-term price declines.

What is Harim Holdings’ current financial status?

Harim Holdings’ revenue has been increasing, however, operating profit and net income have been declining or recording losses, indicating a need for improved profitability. While the debt-to-equity ratio fluctuates, the current and quick ratios and the retained earnings ratio are relatively healthy.

What are the most important factors to consider when investing?

It’s crucial to comprehensively consider the terms of exchangeable bond issuance (conversion price, maturity, interest rate), the company’s specific plans for using the raised funds, and Harim Holdings’ efforts to improve profitability. It’s also important to make investment decisions based on a long-term perspective, rather than reacting to short-term stock price volatility.