In a significant development for the construction sector, CHINHUNG INTERNATIONAL INC (002780) has announced a substantial new contract with its primary shareholder, Hyosung Heavy Industries. This news raises a critical question for investors: Is this the catalyst that will invigorate CHINHUNG INTERNATIONAL INC’s stock price and reshape its corporate value amidst a challenging market? This comprehensive analysis dissects the contract, examines the company’s fundamentals, and outlines a strategic investment outlook.

We will explore the short-term stock implications, the potential for long-term business stability, and key factors investors should monitor. Our goal is to provide actionable insights for making informed decisions regarding your CHINHUNG INTERNATIONAL INC investment portfolio.

The Landmark Deal: Contract Details & Significance

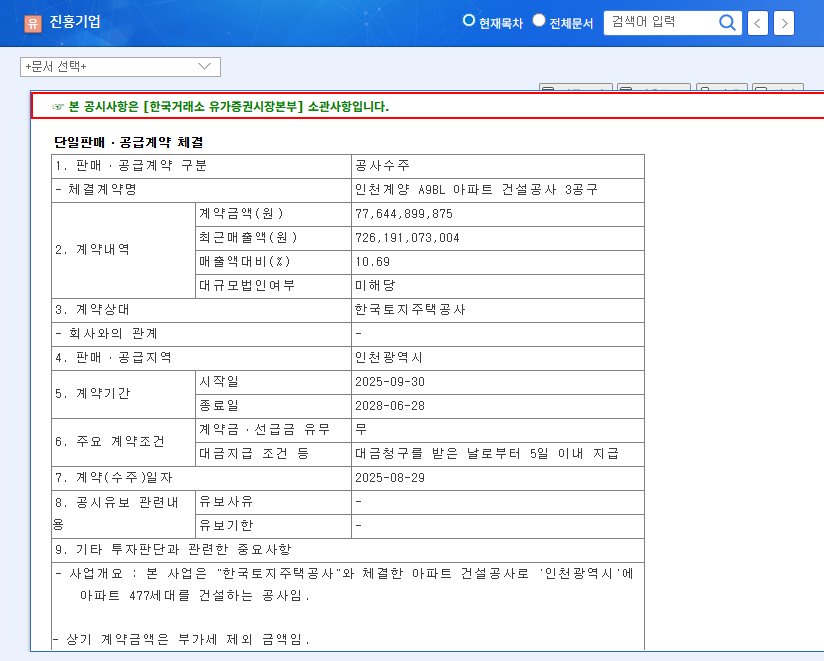

On October 28, 2025, CHINHUNG INTERNATIONAL INC formally disclosed the signing of a major single sales and supply contract. The project involves the construction of a dedicated factory for circuit breaker extractors and an insulator factory for Hyosung Heavy Industries Co., Ltd. According to the Official Disclosure, the contract’s value is equivalent to 6.8% of the company’s H1 2025 revenue of 232.1 billion KRW. The project is scheduled to run from October 15, 2025, to May 31, 2026.

While not a colossal deal in isolation, its strategic importance comes from the stable workflow it provides from a major shareholder, acting as a potential buffer against broader market volatility.

Diagnosing the Fundamentals: CHINHUNG INTERNATIONAL INC’s Current State

To understand the contract’s true impact, we must first assess the current financial health of CHINHUNG INTERNATIONAL INC. The first half of 2025 painted a mixed picture:

- •Revenue Decline: Revenue stood at 232.1 billion KRW, a sharp 37% decrease year-on-year, primarily due to a slowdown in the private construction sector.

- •Operating Profit Turnaround: The company posted an operating profit of 1.4 billion KRW, a welcome return to black. However, this was largely driven by non-recurring factors like cost reductions and financial income, not core operational strength.

- •Persistent Net Loss: A net loss of 5.6 billion KRW highlights the ongoing challenging business environment.

The company is actively working to improve its financial structure by reducing debt. However, it faces macroeconomic headwinds common in the construction industry, such as volatile raw material costs and fluctuating interest rates, which can impact project profitability. For a broader view, industry reports from sources like global construction market analyses can provide additional context.

This contract with Hyosung Heavy Industries is less about a massive immediate profit injection and more about securing a stable foundation for future growth and business diversification.

Impact Analysis: Short-Term vs. Long-Term Outlook

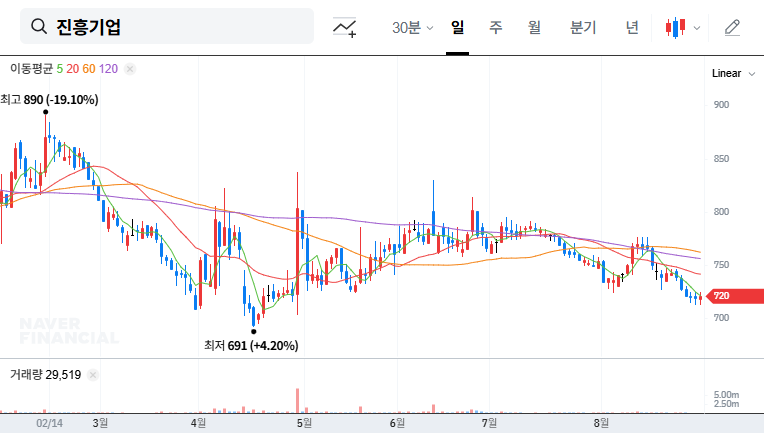

Short-Term Impact: Muted Stock Momentum

The immediate impact on the 002780 stock price is likely to be limited. Because the contract is an internal transaction with a major shareholder, the market may not view it as a sign of new, competitive market penetration. While it provides a welcome revenue boost, the modest size relative to total annual revenue and the company’s recent performance suggest it won’t be a powerful catalyst for a sharp price surge. The key will be demonstrating strong profitability from this project in upcoming quarterly reports.

Long-Term Impact: Building Stability and Diversifying

The long-term implications are far more promising. Securing a steady stream of projects from Hyosung Heavy Industries strengthens CHINHUNG INTERNATIONAL INC’s order pipeline, enhancing revenue predictability. Furthermore, this project allows the company to build expertise in constructing specialized industrial facilities, which diversifies its business portfolio beyond traditional civil and architectural work. This strategic move could reduce its reliance on the volatile private construction market and open doors to more profitable, niche projects in the future.

Investment Strategy for CHINHUNG INTERNATIONAL INC

Investors should adopt a cautious but optimistic long-term perspective. This Hyosung Heavy Industries contract is a positive step, but not a magic bullet. True corporate value appreciation will depend on several factors.

Key Indicators to Monitor:

- •Project Profitability: Track the gross profit margins specifically related to this project in upcoming financial statements.

- •Future Order Flow: Look for signs of new, high-quality orders from third-party clients, which would signal a genuine turnaround.

- •Financial Health: Continue to monitor debt levels and cash flow. For more details, you can read our guide on Analyzing Financial Ratios for Construction Companies.

In conclusion, this contract is a foundational piece, not the entire puzzle. It enhances the business stability of CHINHUNG INTERNATIONAL INC. However, investors should base their final decisions on demonstrated improvements in core profitability and the company’s ability to secure a diverse and profitable project pipeline moving forward. Continuous monitoring of the key indicators listed above is essential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on the investor’s own judgment and responsibility.