The latest HYUNDAI MOTOR SECURITIES Q3 2025 earnings report presents a complex picture for investors. While preliminary results show a noticeable dip from the previous quarter, a year-over-year recovery suggests underlying resilience. Navigating this mixed financial data requires a deeper understanding of the company’s strategic position, recent governance changes driven by shareholder activism, and the broader macroeconomic landscape. Is this a temporary hurdle or the beginning of a sustainable turnaround for Hyundai Motor Securities? This comprehensive analysis will dissect the key figures, explore the catalysts and risks, and provide an actionable outlook for potential investors.

Deep Dive: HYUNDAI MOTOR SECURITIES Q3 2025 Earnings Breakdown

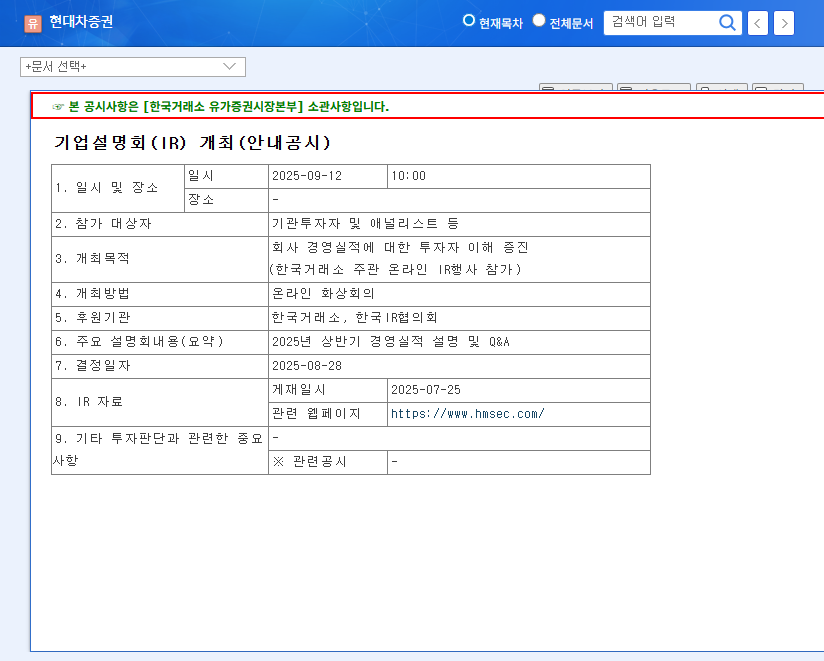

On October 30, 2025, HYUNDAI MOTOR SECURITIES CO.,LTD. released its preliminary consolidated financial statements for the third quarter. The headline numbers, detailed in the Official Disclosure (DART), are as follows:

- •Revenue: 244.0 billion KRW

- •Operating Profit: 14.1 billion KRW

- •Net Income: 12.2 billion KRW

The Story Behind the Numbers: QoQ vs. YoY

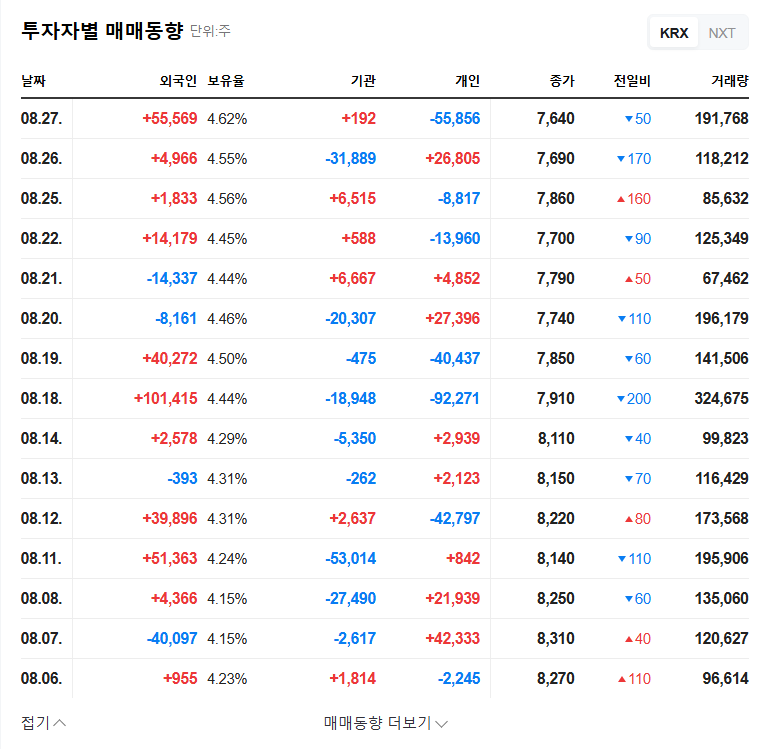

The quarter-over-quarter (QoQ) decline is stark, with revenue falling from 694.6 billion KRW and operating profit from 27.0 billion KRW in Q2 2025. This downturn can be attributed to cyclical market slowdowns and decreased trading volumes typical of the period. However, the year-over-year (YoY) comparison tells a story of recovery. Compared to Q4 2024, where the company posted an operating loss, Q3 2025’s profitable results signal a significant operational improvement and a strengthening of the company’s core business lines against a challenging backdrop.

Shareholder Activism as a Catalyst for Change

A pivotal development for Hyundai Motor Securities has been the recent rise in minority shareholder activism. At the 71st Annual General Meeting, shareholders proposed a cash dividend increase and a reduction in the director compensation limit. While the dividend proposal was rejected in favor of reinvestment, the successful approval of the compensation limit reduction is a landmark win for corporate governance. This signals that management is becoming more responsive to shareholder concerns, a positive indicator for long-term Hyundai Motor Securities shareholder value. For more on this topic, see our guide on evaluating corporate governance in your investments.

The approval to reduce director compensation is a clear sign that shareholder voices are being heard, potentially leading to improved transparency and a stronger alignment between management and investor interests.

Macroeconomic Winds: Headwinds and Tailwinds

No financial firm operates in a vacuum. The performance of Hyundai Motor Securities is intrinsically linked to global and domestic economic trends. Investors must monitor these key factors:

- •Interest Rate Environment: A potential shift towards lower benchmark interest rates by central banks in the US and Korea is a major tailwind. Lower rates typically stimulate loan demand, boost asset valuations, and improve investor sentiment, creating a favorable environment for securities firms.

- •Currency Volatility: High volatility in the Won/Dollar exchange rate poses a risk, particularly for the company’s overseas asset management and Investment Banking (IB) divisions. A stable currency is crucial for predictable returns on foreign investments.

- •Commodity and Freight Markets: As reported by high-authority sources like Reuters, instability in oil prices and shipping freight indices are barometers of global economic health and can directly impact the profitability of IB deals tied to these sectors.

Future Outlook and Investor Action Plan

Looking ahead, the investment thesis for the Hyundai Motor Securities stock hinges on balancing short-term challenges with long-term opportunities. The YoY recovery and governance improvements are positive signals. However, macroeconomic uncertainty remains a persistent risk.

Key Points for Investors to Monitor:

- •Sustained Profitability: Scrutinize upcoming earnings reports for consistent profitability and margin improvement to confirm a genuine turnaround.

- •Shareholder Return Policies: Watch for any future announcements regarding dividend policies or share buyback programs as a sign of management’s commitment to shareholder value.

- •Macroeconomic Response: Analyze how effectively the company hedges against currency risks and adapts its IB strategy to the changing global economic climate.

Frequently Asked Questions (FAQ)

Q1: What were the key takeaways from HYUNDAI MOTOR SECURITIES’ Q3 2025 performance?

The key takeaway is the dual narrative: a short-term, quarter-over-quarter decline in revenue and profit, contrasted with a positive year-over-year turnaround to profitability. This suggests the company is recovering from previous lows but is still susceptible to market volatility.

Q2: How is shareholder activism impacting the company?

Shareholder activism is acting as a positive force for governance. The approval of a reduced director compensation limit demonstrates that management is beginning to respond to shareholder demands for greater accountability and transparency, which can boost investor confidence.

Q3: What is the most significant economic factor for Hyundai Motor Securities’ future?

The direction of global interest rates is arguably the most significant factor. A trend towards lower rates would create a highly favorable operating environment by stimulating investment activity and increasing the value of assets under management.