This comprehensive Hyundai E&C earnings analysis provides a detailed look at the Q3 2025 financial results for HYUNDAI ENGINEERING & CONSTRUCTION CO.,LTD (KRX: 000720). Following the company’s recent earnings announcement, the market saw a mixed picture: impressive top-line growth that beat expectations, but a concerning shortfall in net income. This report dissects these figures, explores the company’s move towards greater financial transparency, and evaluates the macroeconomic factors influencing the Hyundai E&C stock investment case.

Investors are questioning the path forward. Is the revenue strength a sign of fundamental recovery, or does the profitability weakness signal deeper issues? We’ll provide a clear-eyed view and a strategic action plan for potential and current investors.

Dissecting the Q3 2025 Hyundai E&C Earnings Report

The provisional Q3 2025 earnings show a company on the path to recovery, yet still facing significant hurdles. The results mark a crucial turnaround from the substantial loss recorded in Q4 2024, but the details reveal a dual narrative of success and challenge.

Key Financial Highlights (vs. Market Consensus)

- •Revenue: KRW 7.83 trillion, a strong beat of +4.4% against estimates. This suggests robust activity in both domestic housing projects and key overseas contracts.

- •Operating Profit: KRW 103.5 billion, an impressive +43.1% surprise. This indicates effective cost management at the project level and operational efficiency gains are taking hold.

- •Net Income: KRW 43.6 billion, a significant miss of -38.0% below expectations. This discrepancy is the primary concern for investors, pointing to non-operating expenses or profitability issues at consolidated subsidiaries.

While top-line growth is impressive, the pressure on net income reveals underlying profitability challenges, particularly within consolidated entities like Hyundai Engineering, that investors must monitor closely.

Strategic Moves: Enhancing Transparency and Trust

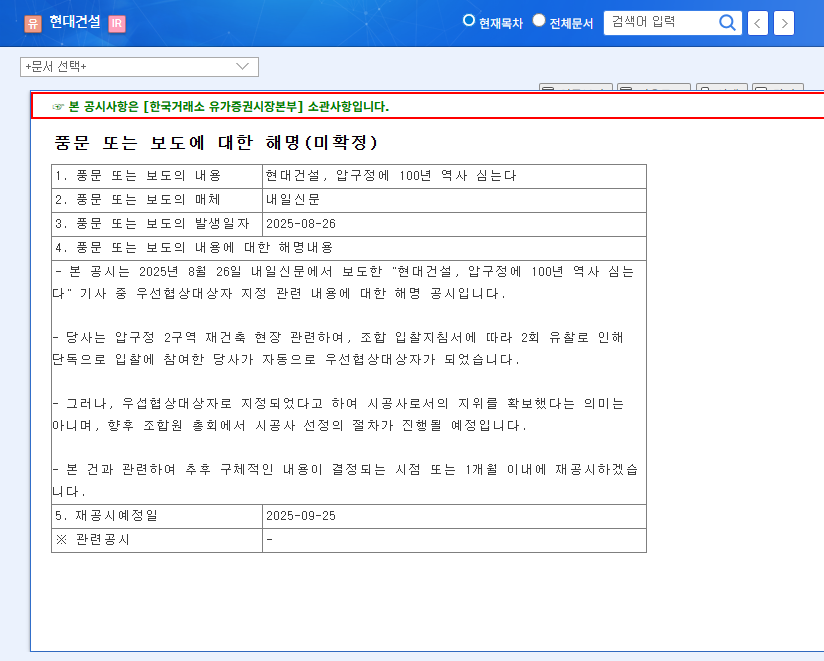

Beyond the numbers, Hyundai E&C took a crucial step to bolster investor confidence. The company amended its December 2024 business report, specifically to enhance the transparency and accuracy of revenue recognition from its construction contracts. This move, detailed in the Official Disclosure, is not about changing fundamentals but about improving clarity.

By aligning more closely with accounting standards, Hyundai E&C reaffirms its massive order backlog (KRW 95.82 trillion on a consolidated basis) and provides a clearer picture of its financial health. In the long term, this improved accounting reliability can reduce perceived risk and make the Hyundai E&C stock more attractive to institutional investors.

Macroeconomic Headwinds and Tailwinds

No company operates in a vacuum. A complete 000720 stock analysis requires looking at the broader economic environment, which presents both opportunities and threats.

Domestic Market Factors

- •Interest Rates: With the Bank of Korea’s base rate holding at 2.50% and expectations of future easing, borrowing costs could decrease, potentially stimulating domestic construction and real estate investment.

- •Exchange Rate: The high KRW/USD rate (1,431.30) is a double-edged sword. It can inflate the value of overseas earnings when converted to won, but it also increases the cost of imported raw materials and equipment, squeezing margins.

Global Economic Landscape

- •Oil Prices & Freight Costs: Falling international oil prices (around $60.34) and declining freight indices are significant positives, reducing direct operational costs for energy and logistics. For more on global economic trends, investors often consult sources like Reuters.

- •Future Growth Drivers: Despite a challenging market, Hyundai E&C is well-positioned in high-growth sectors. Its focus on nuclear power (including Small Modular Reactors or SMRs) and renewable energy aligns with global energy transition goals, providing a long-term growth catalyst. For more on this sector, see our analysis of the South Korean construction sector.

Investment Strategy: A Prudent ‘Hold’ Recommendation

Considering all factors, our Hyundai Engineering & Construction investment thesis leads to a ‘Hold’ recommendation. The strong operational performance and clear recovery momentum are undeniable positives. The massive order backlog provides revenue visibility, and strategic positioning in future-proof industries is compelling.

However, the significant net income miss cannot be ignored. It highlights a critical need to improve bottom-line profitability and effectively manage the performance of its consolidated subsidiaries. The external risks from exchange rate volatility and broader market uncertainty also warrant caution.

What to Watch For:

Investors should monitor the following key indicators in upcoming quarters before considering a ‘Buy’ stance:

- •Net Profit Margin Improvement: A clear, sustained trend of closing the gap between operating profit and net income.

- •Subsidiary Performance: Specific commentary from management on the profitability of Hyundai Engineering and the steps being taken to improve it.

- •Major Project Wins: Securing new, high-margin contracts in their target growth sectors like nuclear or renewables.

In conclusion, while Hyundai E&C’s Q3 2025 results provide reasons for optimism, a patient and watchful approach is the most prudent investment strategy at this time.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. All investment decisions should be made with the consultation of a qualified financial professional.