1. What Happened?

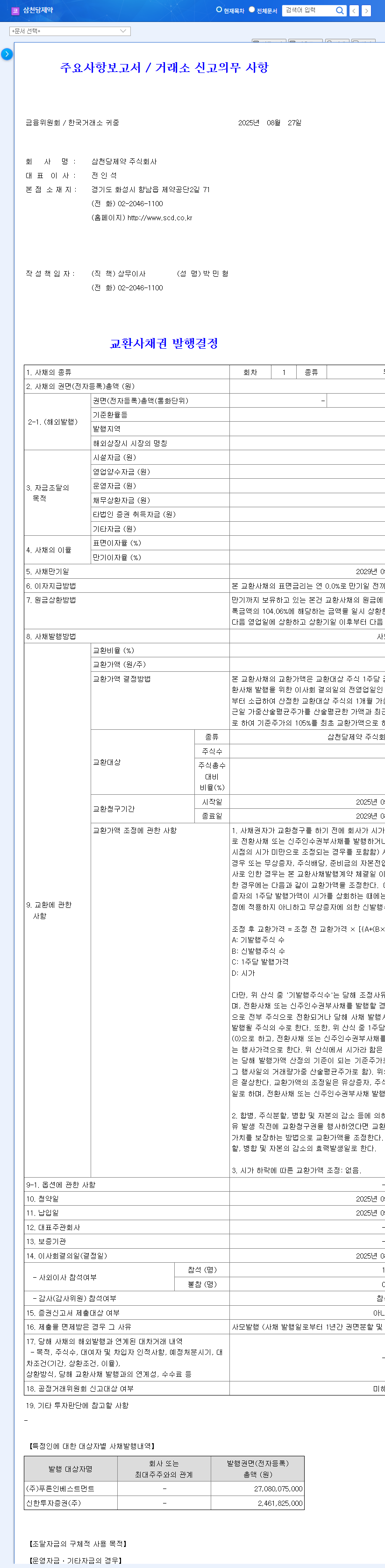

Samchundang Pharm announced on August 27, 2025, that it will dispose of 150,000 treasury shares for 29.5 billion won. The purpose is to secure funds for issuing exchangeable bonds.

2. Why Dispose of Treasury Stock?

Samchundang Pharm is currently accelerating the development of its biosimilar for age-related macular degeneration (SCD411) and is preparing to enter global markets such as Japan, Canada, and Europe. The company needs to secure funds for this business expansion and continued R&D investment.

3. So, What’s the Impact on the Stock Price?

- Positive aspects: Securing funds can enhance financial flexibility and accelerate R&D investment and business expansion.

- Negative aspects: Concerns include the dilution effect on earnings per share (EPS) due to the increase in outstanding shares, the possibility of increased financial burden from issuing exchangeable bonds, and a negative impact on investor sentiment.

In addition, the current high interest rates and exchange rate volatility can negatively affect financing costs and the profitability of overseas businesses. Therefore, the financing strategy needs careful review.

4. What Should Investors Do?

- Keep an eye on the fund utilization plan and the progress of biosimilar development.

- Carefully review the terms of the exchangeable bond issuance (conversion price, maturity, interest rate, etc.) and assess potential risks.

- Analyze the possibility of fundamental improvement, such as whether the trend of slowing sales and deteriorating profitability can be reversed, and the company’s ability to respond to the macroeconomic environment.

Frequently Asked Questions

Is treasury stock disposal always bad news?

Not necessarily. If the funds raised can secure growth drivers, it can have a positive impact in the long run. However, the fund utilization plan and changes in financial soundness should be carefully reviewed.

What are exchangeable bonds?

Exchangeable bonds are bonds that grant the right to exchange them for the issuer’s stock after a certain period.

What is the development status of SCD411?

It is currently preparing to enter major markets such as Japan, Canada, and Europe, and has received approval from Health Canada. Expansion into the US and Latin America is also planned.