In a significant strategic maneuver, KYUNGBANG LTD (000050), one of Korea’s pioneering modern enterprises, has announced a major decision regarding the disposal of its treasury stock. This move, valued at approximately 7.5 billion KRW, is far more than a simple financial transaction; it represents a calculated step to fortify its core spinning division and foster long-term growth. For investors, understanding the nuances of this KYUNGBANG treasury stock disposal is crucial.

This comprehensive analysis will delve into the specifics of the announcement, explore the underlying strategic objectives, examine the latest KYUNGBANG financials, and outline the potential impacts on the company’s stock performance. We’ll equip you with the insights needed to make an informed decision about this historic company’s future.

The Announcement: A ₩7.5 Billion Strategic Disposal

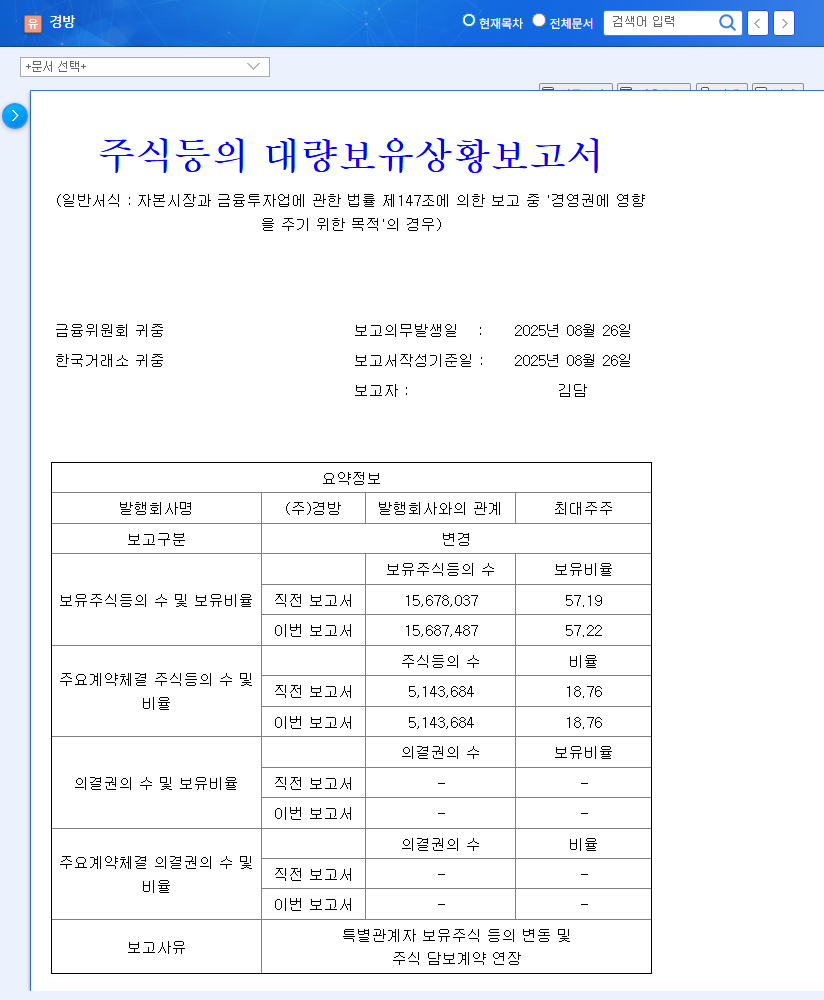

On October 28, 2025, KYUNGBANG LTD formally disclosed its plan to dispose of 1,071,581 common shares held in its treasury. The transaction is set to generate approximately 7.5 billion KRW. The stated purpose is not merely to enhance liquidity but to serve a clear, strategic goal: to strengthen business cooperation within its foundational spinning division. You can view the Official Disclosure (Source: DART) for complete details.

This treasury stock disposal is a deliberate strategy to reinvest in the company’s core operations, signaling a long-term commitment to enhancing competitiveness and securing new avenues for growth in the global textile market.

KYUNGBANG Stock Analysis: Unpacking the Financial Health

A deep dive into the company’s 141st semi-annual report for the first half of 2025 provides essential context. The KYUNGBANG financials paint a picture of a company on solid footing, making this strategic investment a well-supported initiative rather than a move of desperation.

Key Financial Highlights (H1 2025)

- •Revenue Growth: Revenue reached 197.37 billion KRW, a 2.3% increase year-on-year, largely propelled by the consistent performance of its complex shopping mall division, including the flagship Times Square property.

- •Profitability Surge: Operating profit climbed an impressive 21.7% to 16.32 billion KRW. This was achieved through disciplined cost control and better non-operating income streams.

- •Net Income Boom: Net income saw a remarkable 57.1% jump to 13.34 billion KRW, showcasing strong bottom-line performance.

- •Improved Financial Soundness: The debt-to-equity ratio improved, decreasing from 60.01% to 56.76%. Furthermore, inventory turnover rose to 5.2 times, indicating highly efficient operational management.

Future Outlook: Opportunities and Risks for Investors

The treasury stock disposal creates a mix of potential upsides and necessary considerations for investors. A balanced view is essential for navigating the path ahead.

Potential Positive Catalysts

The primary benefit lies in the ‘strengthening of business cooperation.’ This could manifest as joint ventures, technology sharing agreements, or even strategic acquisitions that generate powerful synergies, boost productivity, and open new markets. The influx of 7.5 billion KRW also enhances cash liquidity, providing a war chest for operations and future investments. For more information on how companies leverage cash flow, you can read this guide on corporate financial strategy.

Risks and Headwinds to Monitor

In the short term, such a significant treasury stock disposal could lead to stock price volatility. The market’s reaction will depend heavily on the final disposal price and method. Moreover, the tangible benefits of the ‘business cooperation’ are not yet realized and will take time to materialize. Investors must also remain aware of broader macroeconomic risks, including the global slowdown in textile demand and volatility in raw material prices, as noted by industry analysts at authoritative sources like Bloomberg.

Investor Action Plan and Final Verdict

Given the strong fundamentals and clear strategic intent, the long-term outlook for KYUNGBANG appears positive. This move to strengthen its core business is a proactive step toward sustainable growth. However, the existing market uncertainties and the time required to see concrete results from the new partnership warrant a cautious stance.

Investment Opinion: HOLD. We recommend that current investors hold their positions while closely monitoring developments. Potential investors should wait for more clarity on the business partnership’s specifics and observe the market’s absorption of the new shares.

Key monitoring points include upcoming quarterly reports for sustained financial performance and any official announcements detailing the nature and progress of the business cooperation in the spinning division.