1. The $185M Contract: What Does it Mean for Orbit Tech?

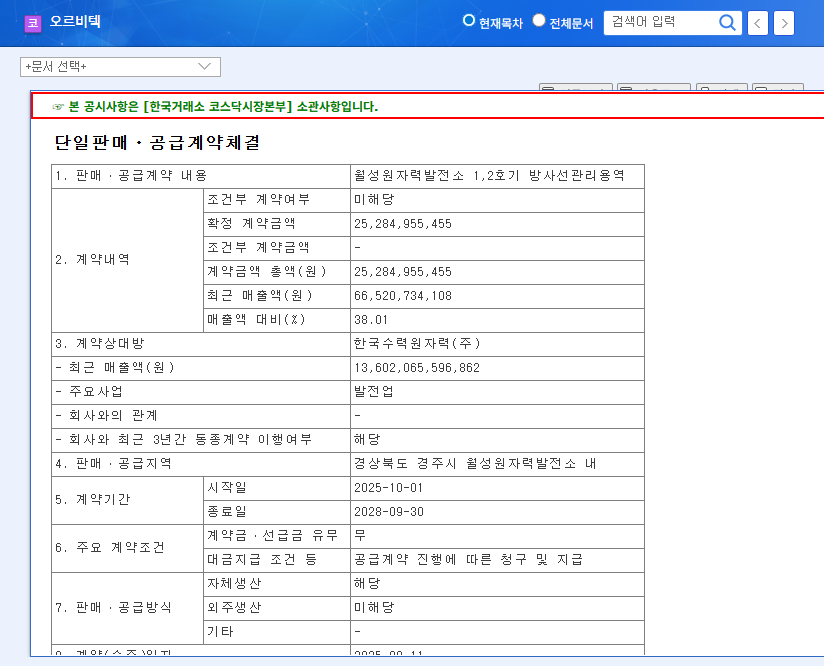

Orbit Tech has secured a $185 million contract with KHNP for radiation management services at the Wolsong Nuclear Power Plant Units 1 & 2. Spanning three years, this contract represents 38.01% of Orbit Tech’s annual revenue and is expected to significantly contribute to the stable growth of its nuclear business. The long-term nature of the contract offers positive prospects for securing stable revenue and increasing the likelihood of further contract wins.

2. Orbit Tech’s Fundamentals: Are They Solid?

Orbit Tech operates in nuclear, ISI, and aviation businesses. While the nuclear business shows stable revenue, its high cost of sales ratio of 84.82% indicates the need for improved profitability. The ISI business, with a critical cost of sales ratio of 132.94%, poses a major challenge to profitability. The aviation business also faces pressure from its high 124.38% cost of sales ratio. Financially, a debt ratio of 73.41% and a negative interest coverage ratio (-5.97x) suggest an urgent need to improve financial soundness. The accumulated deficit of $159 million also presents a long-term challenge.

3. Market Conditions: Favorable for Orbit Tech?

The recent rise in the USD/KRW exchange rate could be positive for the aviation business’s export sales but might increase the cost burden due to rising import material prices. While the interest rate freeze is favorable for borrowing costs, managing interest expenses is crucial given the high debt level. The stock price has shown a gradual recovery with increased trading volume after the rights offering.

4. Action Plan for Investors

While this contract is a positive sign for Orbit Tech’s growth potential, the company must also address the challenge of improving profitability. Investors should consider the following:

- Trends in the improvement of cost of sales ratio for the ISI and Aviation businesses.

- Performance of new business investments and securing future growth engines.

- Efforts to strengthen financial soundness and their actual results.

It is crucial to thoroughly analyze the company’s fundamental improvements and profitability potential rather than making investment decisions solely based on the contract signing.

Frequently Asked Questions (FAQ)

Will this contract have a positive impact on Orbit Tech’s stock price?

Generally, large-scale contracts positively influence investor sentiment and can lead to stock price increases. However, the long-term stock price trend depends on the company’s earnings improvement. Therefore, continuous monitoring of profitability trends is necessary.

What is Orbit Tech’s biggest risk?

The high cost of sales ratio in the ISI business segment is the biggest risk. Failure to improve this ratio could offset the positive effects of increased revenue from this contract.

What should investors be cautious of when investing in Orbit Tech?

Investors should carefully examine trends in cost of sales ratio improvement, the performance of new business investments, and efforts to strengthen financial soundness. Investment decisions should be made cautiously.

Leave a Reply