What Happened? Okins Electronics Announces Warrant Exercise

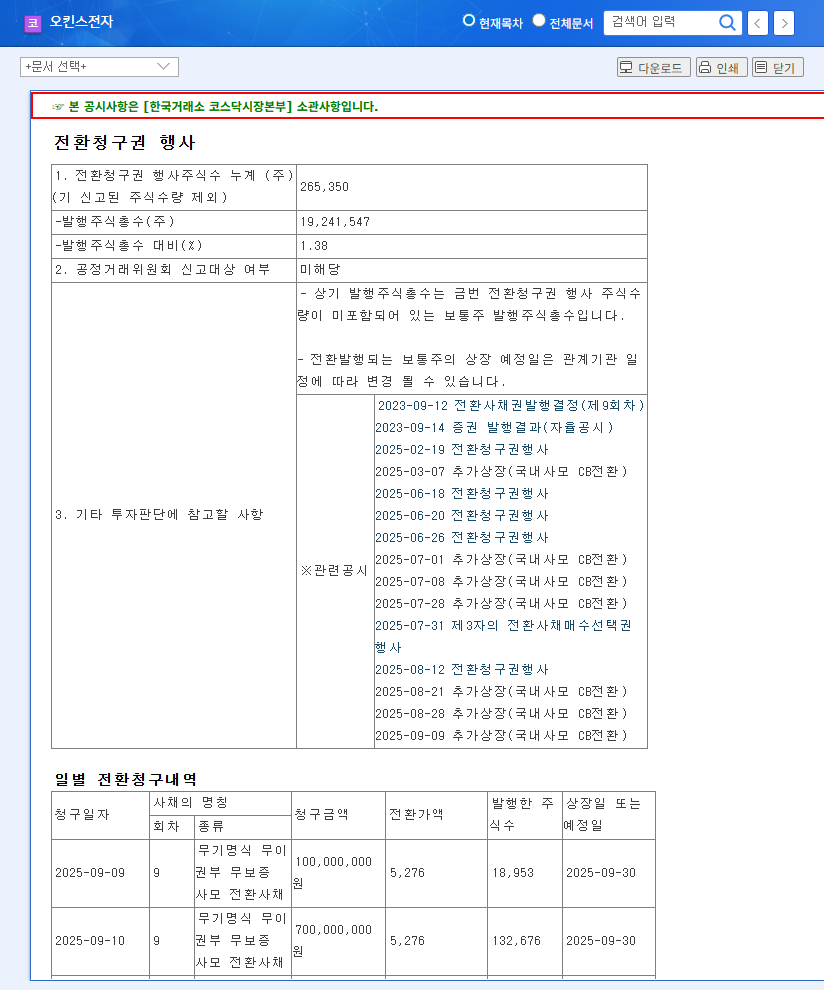

On September 11, 2025, Okins Electronics announced the exercise of warrants for 265,350 shares. This represents 1.38% of the market capitalization and will be listed on September 30th at a conversion price of KRW 5,276.

Why Does It Matter? Potential for Increased Stock Price Volatility

- Dilution Effect: Potential decrease in Earnings Per Share (EPS) due to an increase in the number of outstanding shares.

- Possibility of Sell-off: Concerns about increased selling pressure due to profit-taking, given the low conversion price compared to the current stock price.

- Negative Market Sentiment: A large-scale warrant exercise can negatively impact investor sentiment.

So What Happens Next? Short-term Volatility vs. Long-term Growth Potential

In the short term, downward pressure on the stock price is expected, but a sharp drop is less likely than range-bound movement or a gradual decline. In the medium to long term, the outlook remains positive due to semiconductor industry growth and new business ventures.

What Should Investors Do? Key Monitoring Points

- Actual scale and timing of stock sales

- Sales and operating profit margin trends

- Performance of new businesses

- Impact of exchange rate and interest rate fluctuations

Disclaimer: This report is not investment advice, and investment decisions are the responsibility of the investor.

FAQ

What are warrants?

Warrants are rights to buy a company’s stock at a predetermined price within a specific period.

Why does warrant exercise affect stock prices?

New shares are issued, diluting the value of existing shareholders’ stakes, and increased selling pressure can cause downward pressure on the stock price.

What is the investment outlook for Okins Electronics?

Volatility is expected in the short term, but the long-term growth potential remains valid.

Leave a Reply