1. Gisson’s Capital Reduction Decision: What’s Happening?

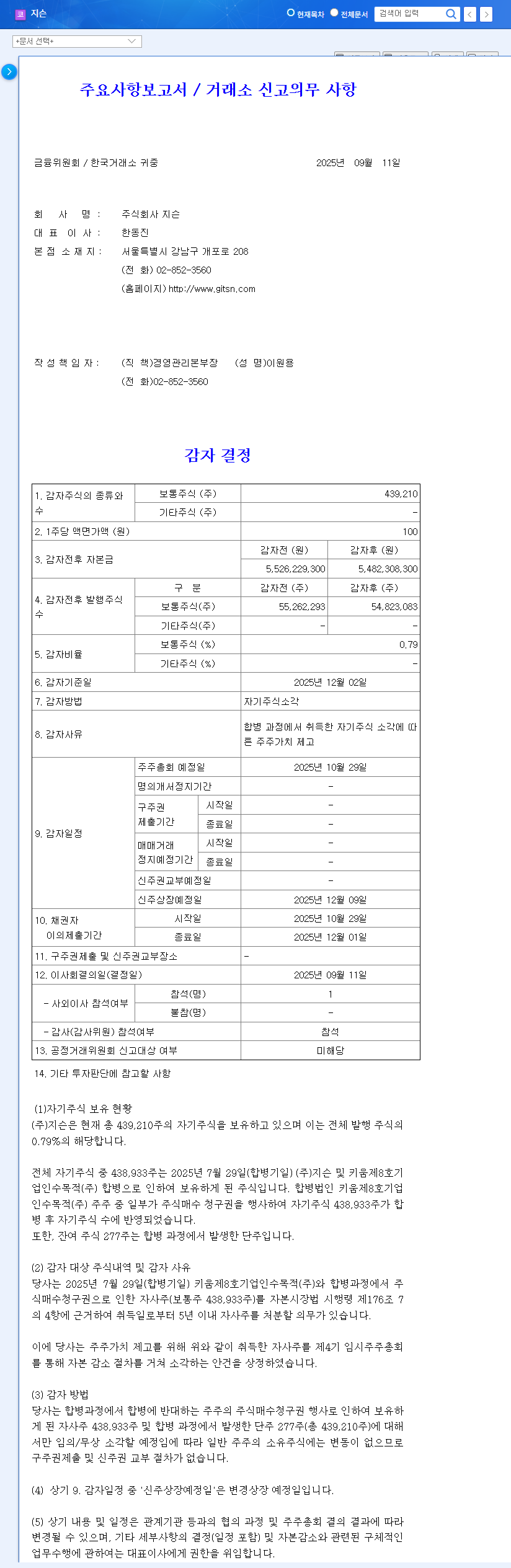

Gisson (formerly Kiwoom SPAC No. 8) announced on September 11, 2025, a capital reduction to cancel 439,210 treasury shares (0.8% of total outstanding shares) to enhance shareholder value. The record date is December 2, 2025, and the shareholders’ meeting is scheduled for October 29.

2. Why Cancel Treasury Stock?

This treasury stock cancellation aims to increase shareholder value per share by utilizing treasury stock acquired during the merger process. Reducing the number of outstanding shares increases earnings per share (EPS), which can lead to a rise in stock prices. It can also positively impact the company’s image by demonstrating shareholder-friendly management practices.

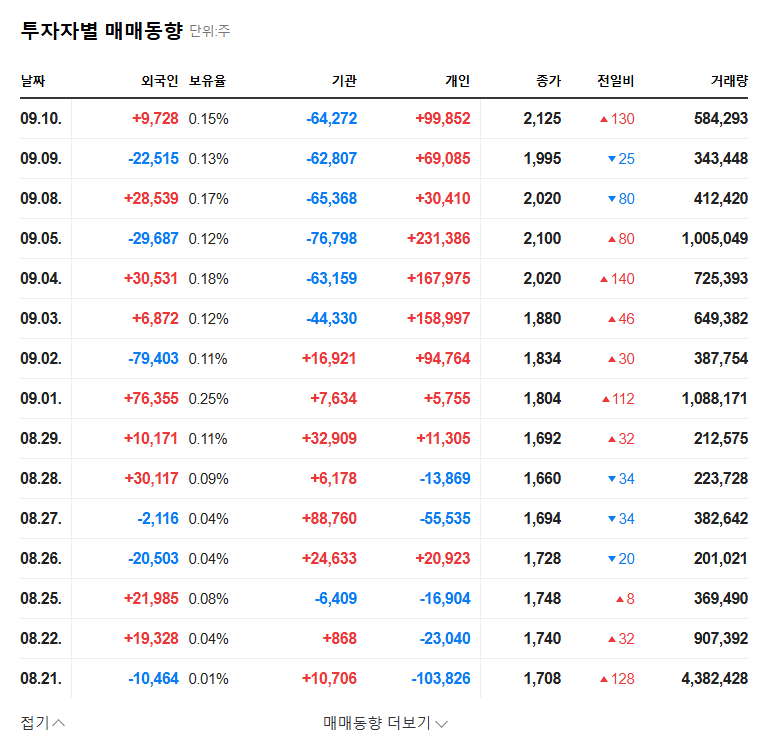

3. Impact of the Capital Reduction on Stock Prices

- Positive Impacts: Increase in per-share value, prevention of shareholder value dilution, improvement of corporate image

- Potential Considerations: Needs to be linked with actual business growth, possible changes in short-term trading volume and liquidity, need for continuous efforts to enhance shareholder value

As the capital reduction ratio is not substantial at 0.8%, short-term stock price fluctuations may be limited, but positive effects can be expected in the long term.

4. Investment Strategies for Investors

Gisson’s treasury stock cancellation can be interpreted as a positive signal for enhancing shareholder value. However, the capital reduction decision itself does not change the company’s fundamentals. Therefore, investors should make investment decisions by comprehensively considering Gisson’s business growth strategies, financial soundness, and market conditions. The current stable macroeconomic environment, including interest rates, exchange rates, and raw material prices, could be positive factors for Gisson.

Will Gisson’s treasury stock cancellation positively affect its stock price?

Yes, generally, canceling treasury stock positively affects the stock price by increasing the per-share value. However, the capital reduction ratio of 0.8% is not significant, so the short-term impact might be limited. Positive effects can be expected in the long run, along with the company’s growth.

How will stock trading proceed after the treasury stock cancellation?

There is no scheduled trading suspension. Trading will resume on December 9, 2025, the effective date of the capital reduction.

What are the investment prospects for Gisson?

This capital reduction decision is a positive signal as a shareholder-friendly policy. However, investments should always be made with caution, and factors such as the company’s business performance and market conditions should be considered comprehensively.

Leave a Reply