What Happened?

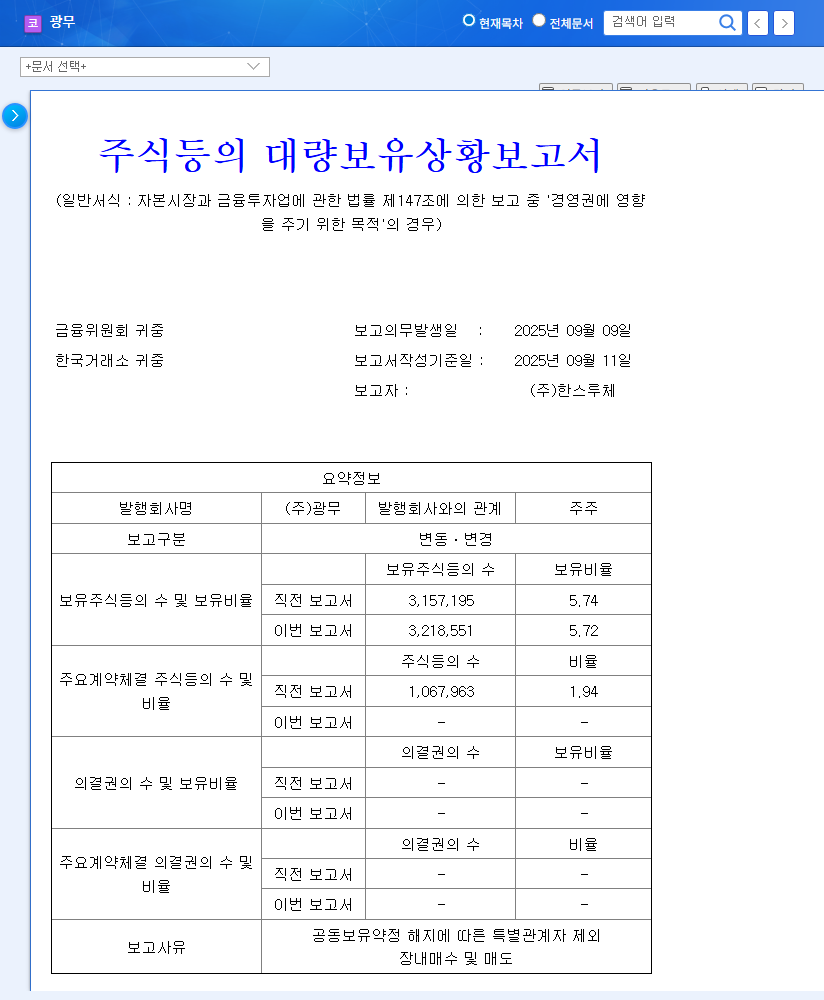

Hans Ruce disclosed a change in KWANGMU’s stake from 5.74% to 5.72% on September 11, 2025, due to the termination of a joint holding agreement and subsequent market transactions. Notably, the stated objective of the holding is ‘management influence’.

About KWANGMU

KWANGMU operates in network/system integration, equipment leasing, semiconductor distribution, and secondary battery materials, which is its current focus. HYUPJIN became the largest shareholder in April 2025, increasing the potential for strategic shifts.

Why is this Disclosure Important?

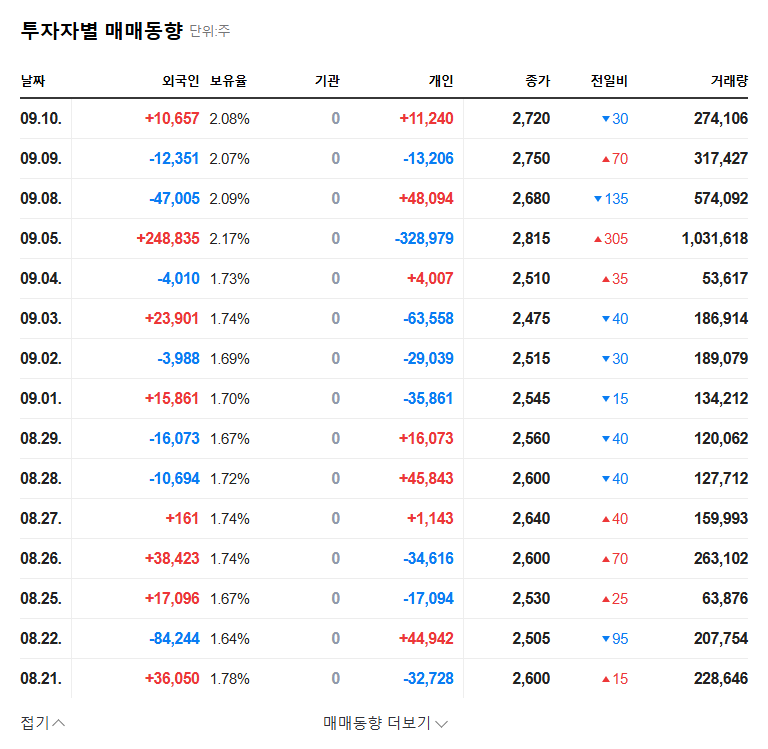

The ‘management influence’ objective suggests potential management disputes, signaling possible changes in governance, business restructuring, and significant impacts on the company’s future. This disclosure is particularly noteworthy given the unstable management situation following the change in the largest shareholder.

Stock Outlook: What to Expect?

- Positive Factors: Growth potential of the secondary battery materials business and the new major shareholder’s management capabilities.

- Negative Factors: Continuous operating losses, unstable cash flow, and volatility related to financial assets and derivatives.

Investor Action Plan

Investors should focus on a long-term perspective, considering KWANGMU’s fundamentals, the performance of its secondary battery business, and the major shareholder’s management strategy. Risk management related to financial risks and market volatility is crucial.

Frequently Asked Questions (FAQ)

What are KWANGMU’s main businesses?

KWANGMU operates in network/system integration, equipment leasing, semiconductor distribution, and secondary battery materials.

How will this change in shareholding affect the stock price?

The short-term impact may be limited, but continuous monitoring is needed as it signals potential long-term management changes.

What should investors be aware of when investing in KWANGMU?

Investors should consider financial risks, market volatility, and uncertainties surrounding the secondary battery business.

Leave a Reply