VIP Asset Management Acquires 5% of Nexen Tire: What Happened?

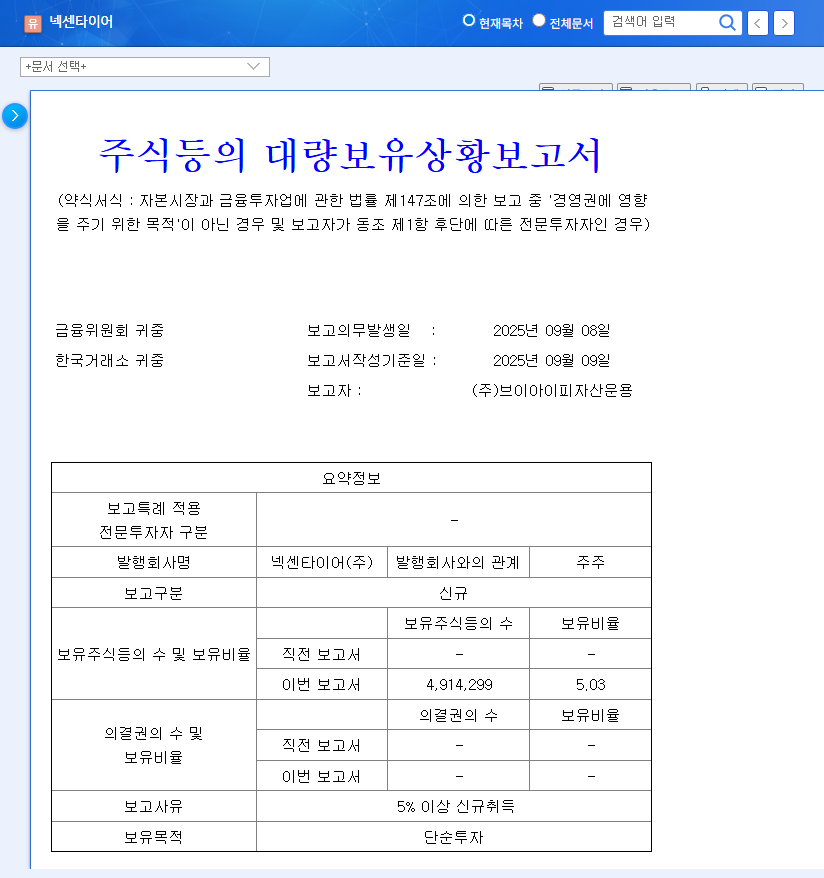

On September 10, 2025, VIP Asset Management disclosed its acquisition of a 5.03% stake in Nexen Tire through a ‘Large Holding Report (Simplified)’. This signifies that VIP Asset Management has secured a stake that allows them to participate in Nexen Tire’s decision-making process as a major shareholder.

Investment Background and Purpose: Why Nexen Tire?

While VIP Asset Management stated the purpose as a simple investment, this suggests a positive assessment of Nexen Tire’s growth potential and future value. Nexen Tire is focusing on global market expansion through the expansion of its European plant and the development of future technologies such as electric vehicle tires, suggesting strong long-term growth potential.

Market Impact and Investment Strategy: What Should Investors Do?

This stake acquisition could have a positive impact on Nexen Tire’s stock price in the short term. However, risk factors such as raw material price volatility, exchange rate fluctuations, and a global economic slowdown should also be considered.

- Fundamental Monitoring: Analyze sales growth, European market performance, and the impact of risk factors.

- Shareholder Action Monitoring: Check the possibility of VIP Asset Management’s future participation in management.

- Macroeconomic Indicator Monitoring: Monitor fluctuations in interest rates, exchange rates, and oil prices.

- R&D Performance Check: Monitor the launch of new products like EV tires and check on technological competitiveness.

Nexen Tire’s Future Growth Potential?

Nexen Tire has both positive and negative aspects. While sales growth, improved profitability, expansion of global production bases, and R&D investment are positive factors, raw material price volatility, exchange rate risks, high debt ratio, and intensifying competition require attention. VIP Asset Management’s stake acquisition can be interpreted as a positive signal, but Nexen Tire’s long-term growth depends on continuous fundamental improvement and risk management efforts.

Frequently Asked Questions

What does VIP Asset Management’s investment in Nexen Tire mean?

VIP Asset Management has decided to invest in Nexen Tire, positively evaluating its growth potential. This can increase market interest in Nexen Tire and have a positive impact on its stock price.

What are the key points to consider when investing in Nexen Tire?

External factors like raw material price fluctuations, exchange rate movements, and a global economic slowdown, as well as financial factors such as a high debt-to-equity ratio should be considered.

What is the outlook for Nexen Tire’s future growth?

Nexen Tire has great growth potential, such as expanding into the global market and developing electric vehicle tires, but managing risk factors and continuous fundamental improvement are crucial.

What investment strategies should investors consider?

It’s crucial to continuously monitor Nexen Tire’s fundamentals, shareholder actions, and macroeconomic indicators and make investment decisions from a long-term perspective.

Leave a Reply