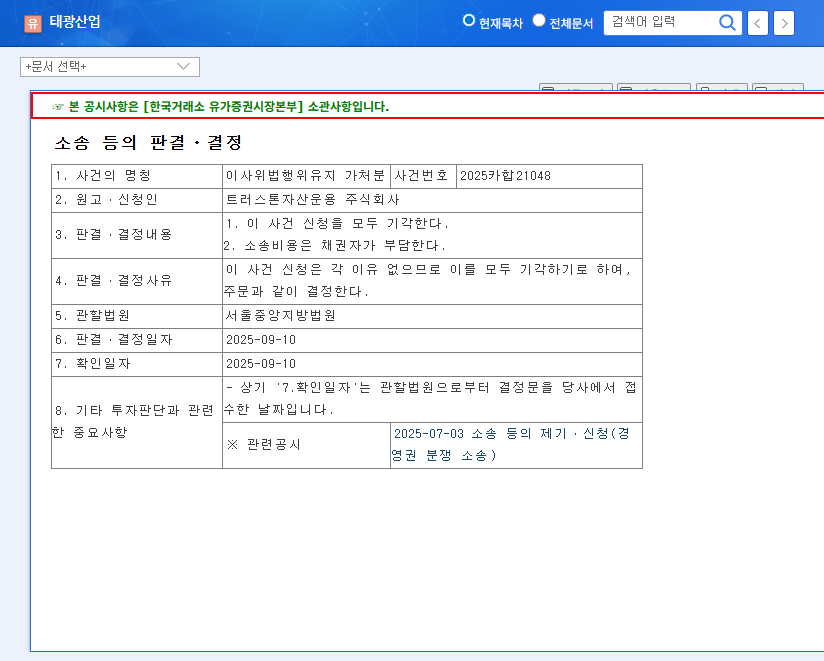

1. What Happened? – Case Overview

Taekwang Industrial amended its December 2024 business report regarding its treasury stock. Key changes include revising the purpose of treasury stock holdings from ‘stock price stabilization’ to ‘securing resources in case of contingencies and shareholder return’. Following this, the company decided to dispose of treasury stock to fund new business investments, but this was halted by an injunction filed by Truston Asset Management. However, on September 10, 2025, the court dismissed Truston’s request, ruling in favor of Taekwang.

2. Why is it Important? – Implications of the Ruling

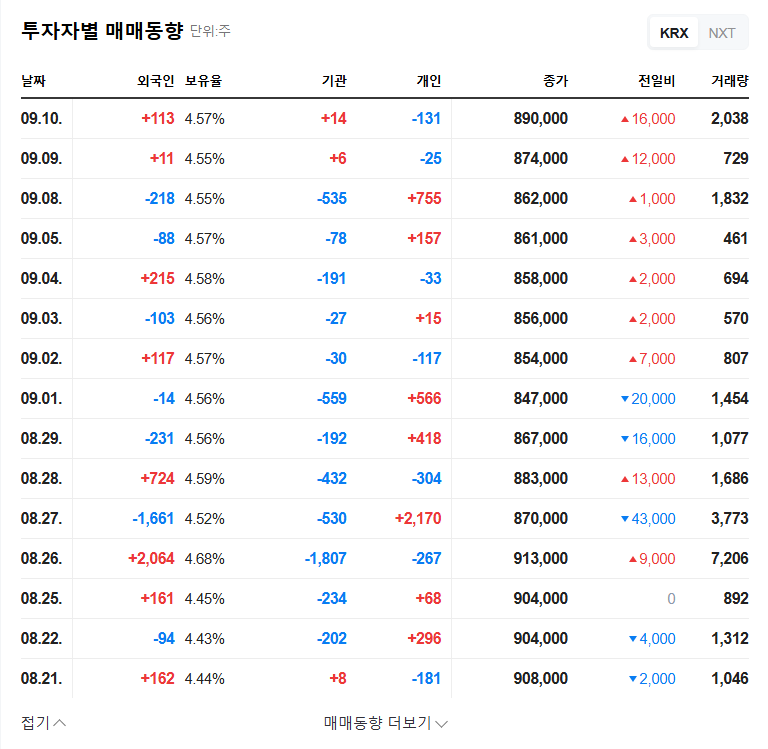

This ruling holds significant implications for Taekwang Industrial. In the short term, it is expected to alleviate investor concerns and contribute to stock price stabilization by removing uncertainty related to treasury stock disposal. In the long term, it is projected to positively impact securing growth momentum by facilitating the pursuit of new business investment plans. However, it’s also crucial to note that this ruling could be a starting point for shareholder activism.

3. Should I Invest in Taekwang Now? – Fundamental Analysis and Future Outlook

- Fundamentals: Taekwang maintains solid fundamentals, including sales and profit growth, and rising ROE/EPS. However, fluctuations in raw material prices and macroeconomic uncertainties remain risk factors.

- Future Outlook: A positive trend is expected due to the removal of uncertainty and rising expectations for new business ventures following the dismissal of the injunction. However, the performance of new businesses needs to be monitored.

4. Action Plan for Investors – Investment Considerations

Before making investment decisions, carefully monitor changes in macroeconomic indicators, the progress of new business projects, and efforts to enhance shareholder value. This analysis is not an investment recommendation, and the final investment responsibility lies with the individual investor.

FAQ

What is the purpose of Taekwang Industrial’s treasury stock disposal?

Taekwang plans to utilize treasury stock for securing resources in case of contingencies (strategic investments and business expansion) and implementing shareholder return policies.

Will the dismissal of the injunction positively impact Taekwang’s stock price?

Yes, in the short term, it’s expected to contribute to stock price stabilization by removing uncertainty, and in the long term, it will likely facilitate new business investments.

What precautions should I take when investing in Taekwang Industrial?

Carefully monitor changes in macroeconomic indicators, the progress of new business projects, and efforts to enhance shareholder value. Make investment decisions cautiously.

Leave a Reply