1. DS Danseok’s Stock Buyback: What Happened?

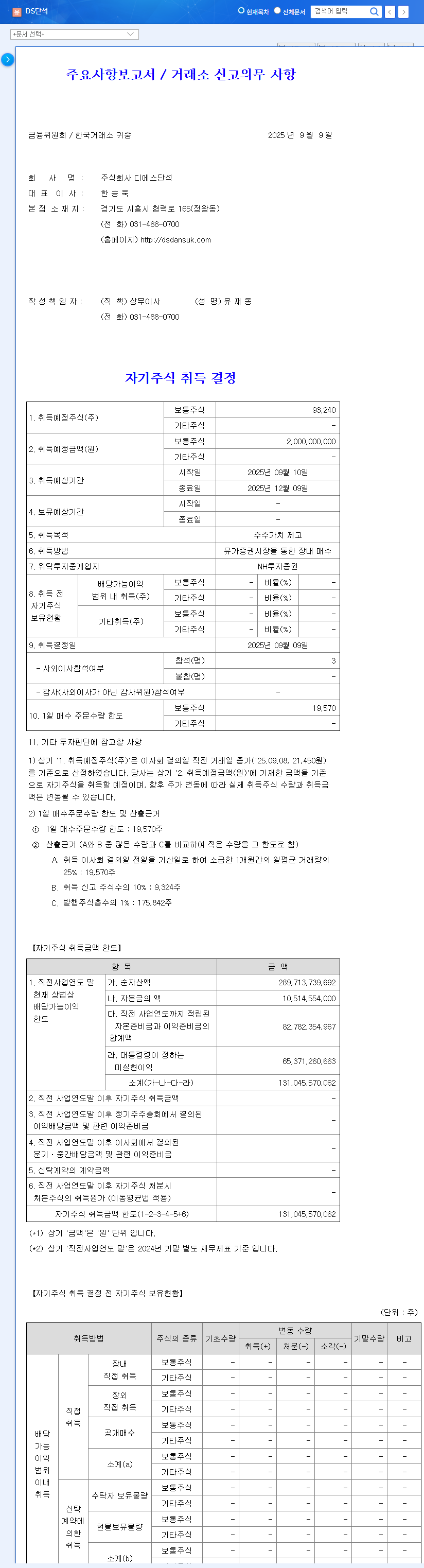

On September 9, 2025, DS Danseok announced a KRW 2 billion stock buyback program. The stated objective is ‘enhancing shareholder value,’ and the company plans to repurchase 93,240 shares through open market purchases on the stock exchange.

2. Why the Buyback?

Stock buybacks are typically conducted to stabilize stock prices and enhance shareholder value. In DS Danseok’s case, recent underperformance in the bioenergy sector has weakened its stock price. This buyback can be interpreted as a strategic move to alleviate investor concerns and create momentum for a rebound.

3. Impact on Stock Price?

- Short-term impact: Buybacks reduce the number of outstanding shares, which can increase earnings per share (EPS). They can also signal the company’s commitment to defending its stock price, potentially improving investor sentiment.

- Long-term impact: If shares are retired after repurchase, it can contribute to long-term shareholder value. However, the effectiveness of the buyback may be limited without improvements in the bioenergy sector’s performance.

4. What Should Investors Do?

DS Danseok has a business portfolio aligned with ESG trends and significant growth potential, including expansion into the SAF market and strengthening its battery recycling business. However, uncertainties remain, including the recovery of the bioenergy sector, raw material prices, and exchange rate fluctuations. Investors should carefully consider these factors before making investment decisions.

Frequently Asked Questions

Do stock prices always go up after a buyback?

While buybacks are generally seen as a positive signal, they don’t guarantee a stock price increase. Various factors like company performance and market conditions influence stock prices.

What is the outlook for DS Danseok?

Both positive factors (ESG management, SAF market growth) and negative factors (weak bioenergy sector performance) exist. A balanced perspective is crucial for investment considerations.

Leave a Reply