NICE Announces ₩10 Billion Stock Buyback: What’s Happening?

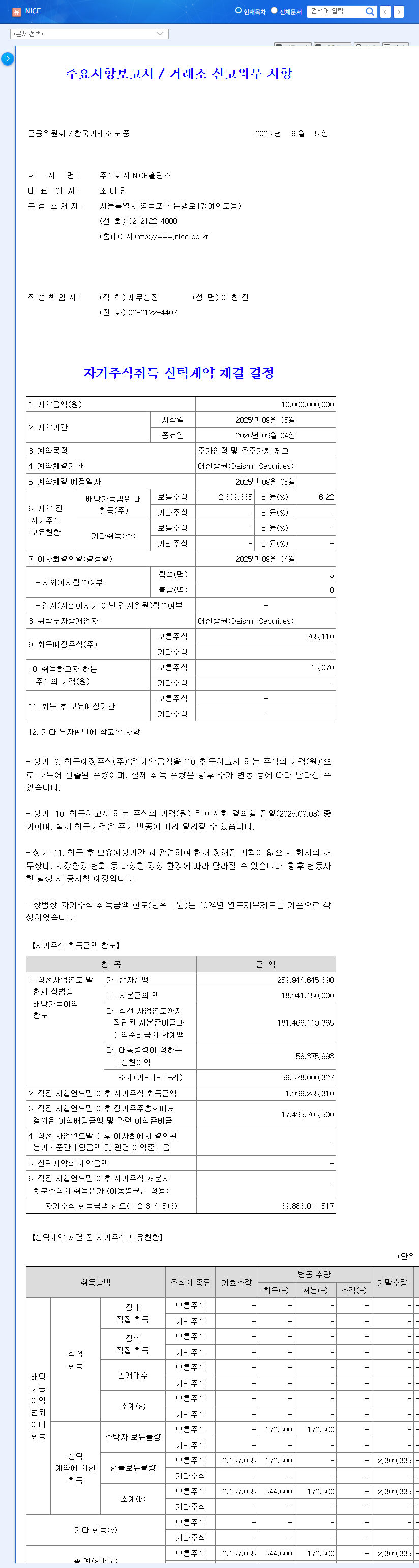

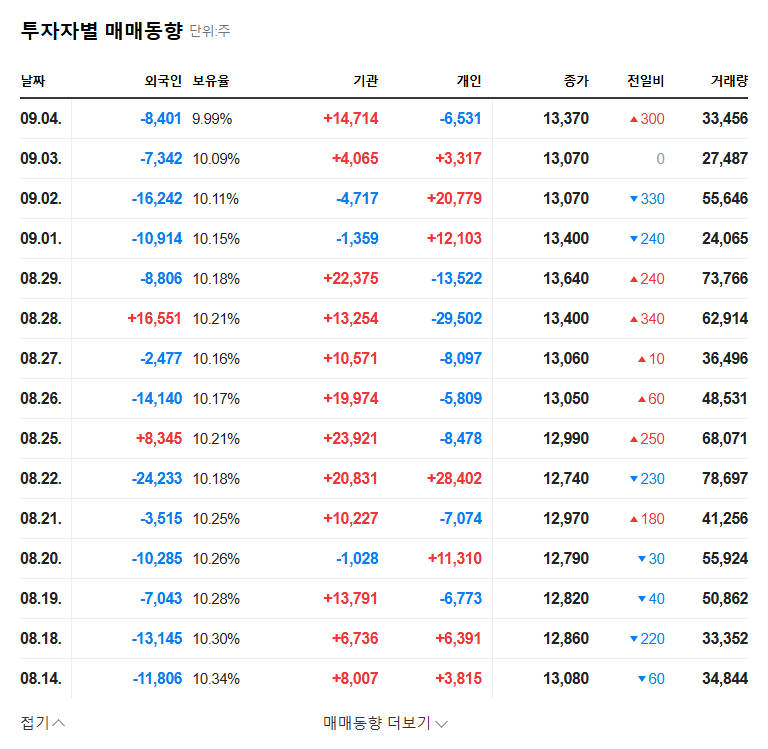

On September 5, 2025, NICE announced a ₩10 billion stock buyback agreement with Daishin Securities. The agreement spans one year and represents approximately 2.01% of the company’s market capitalization. The official purpose is ‘stock price stabilization and shareholder value enhancement.’

Why the Buyback? Analyzing NICE’s Fundamentals and Market Conditions

NICE holds a diverse business portfolio spanning credit information, payment processing, unmanned operations, and manufacturing. However, Q1 2025 results revealed declining net profit and weakened financial stability (decreased equity and increased debt). The current macroeconomic environment, marked by high interest rates, exchange rate fluctuations, and inflation, also poses challenges.

Impact of the Buyback: What’s Next for NICE’s Stock Price?

- Positive Impacts:

- Potential for stock price stabilization and improved investor sentiment

- Demonstration of commitment to enhancing shareholder value

- Negative Impacts and Considerations:

- Increased short-term financial burden

- Not directly linked to fundamental improvement

- Ongoing macroeconomic uncertainties

Investor Action Plan: Should You Invest in NICE Now?

While a short-term stock price boost is possible, NICE’s long-term investment value hinges on fundamental improvements. Investors should look beyond the buyback’s immediate impact and consider factors like future earnings growth, financial stabilization, and macroeconomic shifts before making investment decisions.

Frequently Asked Questions (FAQ)

What is the size of NICE’s stock buyback?

NICE plans to repurchase ₩10 billion worth of its own shares.

What is the purpose of the stock buyback?

The stated purpose is to stabilize the stock price and enhance shareholder value.

Will the buyback positively impact the stock price?

While short-term price stabilization and improved investor sentiment are possible, long-term gains depend on fundamental improvements.

Should I invest in NICE?

While there’s potential for a short-term price increase, a cautious approach is recommended for long-term investors. Continuous monitoring of NICE’s fundamentals is crucial.

Leave a Reply