What Happened?

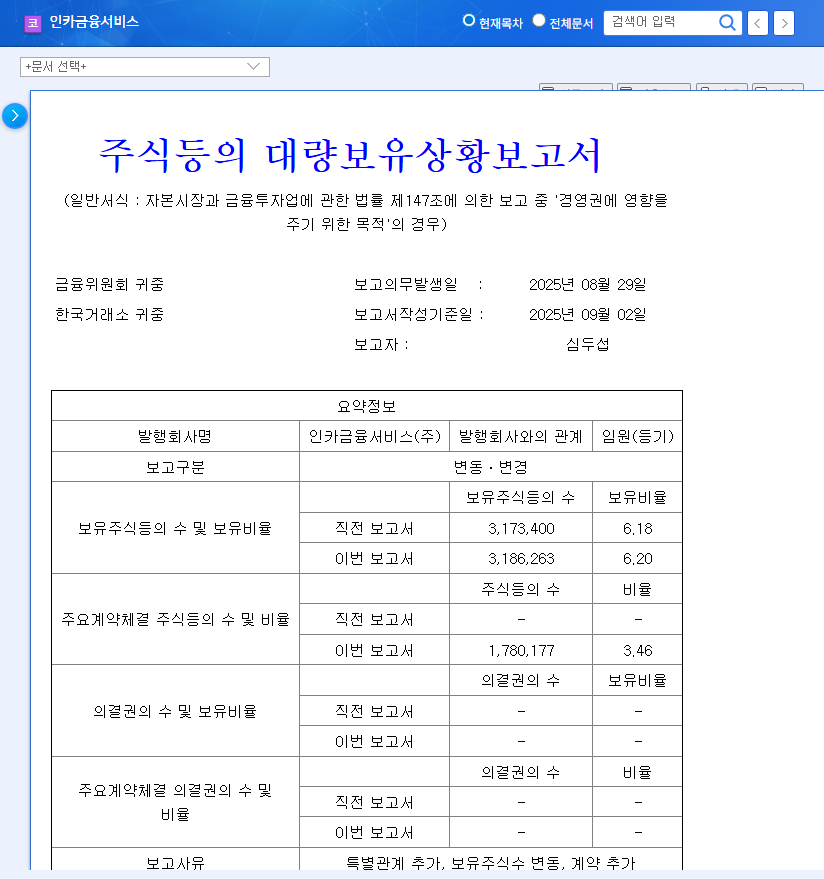

On September 5, 2025, Shim Doo-seop, a major shareholder of Inca Financial Services, and related parties (Glory Consulting Co., Ltd.) increased their stake from 6.18% to 6.20%. Glory Consulting purchased 5,363 shares on the open market between September 1st and 2nd.

Why is the Stake Increase Important?

The key is ‘influence over management’. This is interpreted as showing an intention to participate in management, going beyond the purpose of simple investment. Changes in stake ownership by shareholders holding more than 6% are considered a significant signal in the market, suggesting the possibility of future changes in management strategy. In particular, the direct stake increase through open market purchases demonstrates a stronger will to participate in management.

How are Inca Financial Services’ Fundamentals?

- Solid growth: Revenue in the first half of 2025 reached 468.9 billion won, an 18.3% increase year-on-year.

- Profitability management needed: Operating profit decreased due to external factors, but continuous management is necessary.

- Stable financial structure: The debt ratio has slightly improved, and the increase in total equity is positive.

- Securing future growth engines: The company is pursuing business diversification and digital transformation through financial platform development, AI advisor development, etc.

What Should Investors Do?

The increase in stake by major shareholders can have a positive impact on the stock price in the short term. However, it remains to be seen whether this will lead to actual changes in management or business strategy. Investors should make investment decisions considering both the positive fundamentals and the change in shareholders. They also need to continuously monitor the stake change trend of major shareholders, changes in management strategy, and the progress of new business development.

FAQ

How will Shim Doo-seop’s stake increase affect Inca Financial Services’ stock price?

It is likely to act as a positive momentum in the short term. An increase in stake by major shareholders showing willingness to participate in management can attract market attention and lead to a rise in stock price.

What is the outlook for Inca Financial Services?

Considering the solid revenue growth and business diversification efforts, a positive outlook can be expected. However, operating profit management and the success of new business strategies will be key variables.

What precautions should investors take?

Investors should continuously monitor the stake change trend of major shareholders, changes in management strategy, and the progress of new business development, and consider risk factors related to changes in the external environment.

Leave a Reply