What Happened at Hanwha Ocean?

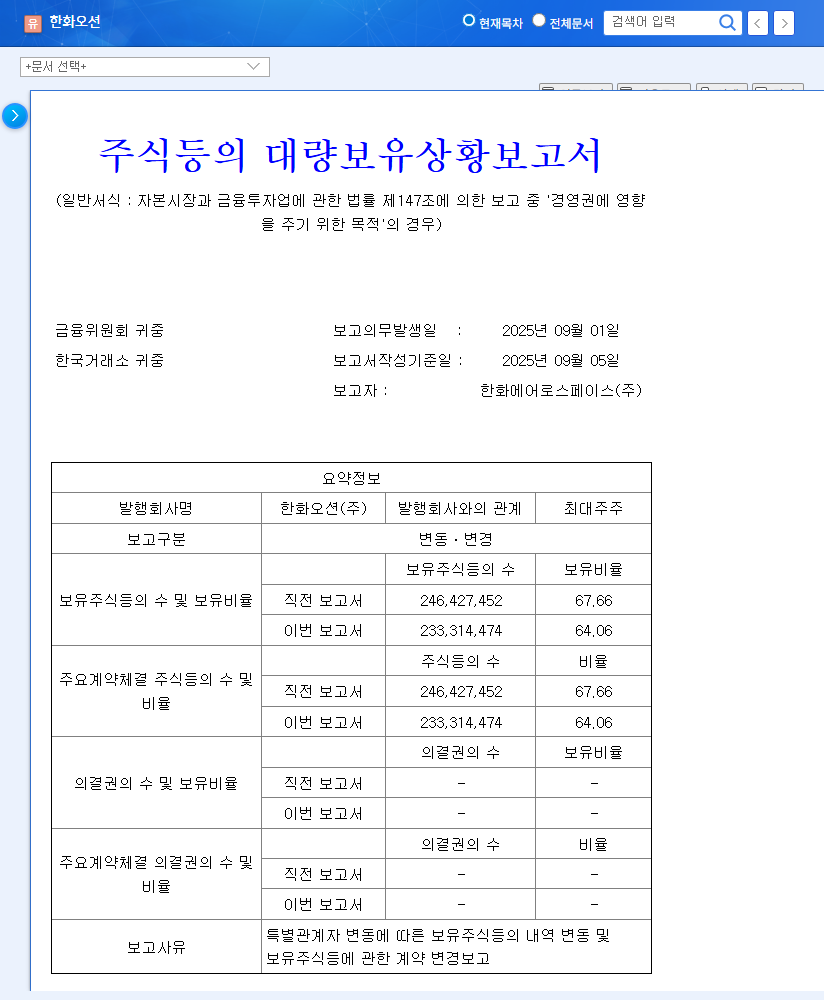

Hanwha Aerospace sold 13,075,691 shares of Hanwha Ocean (approximately 3.6% of the total issued shares) through after-hours trading. This reduced their stake from 67.66% to 64.06%. The official reason for the sale was stated as ‘changes in special relationships,’ indicating no direct connection to a change in management control.

Why Does the Stake Sale Matter?

A major shareholder’s stake sale can be interpreted as a significant signal in the stock market. The release of a large volume of shares for sale can lead to downward pressure on the stock price in the short term. Especially when conducted through after-hours trading like this case, it can amplify market anxiety.

What’s the Stock Forecast?

Short-term Impact: There is a possibility of a stock price decline due to supply and demand imbalances caused by the large sale. However, it’s a positive factor that the reason for the sale is unrelated to management changes and there’s no change in the company’s fundamentals.

Mid- to Long-term Impact: The stake dilution effect can lead to increased liquidity and a wider investor base. However, the market is expected to keep an eye on additional information about the background of the sale and the company’s future strategies.

What Should Investors Do?

Rather than reacting emotionally to short-term stock price fluctuations, it is crucial to analyze market conditions and the company’s fundamentals calmly. Hanwha Ocean’s solid order backlog, investment in eco-friendly technology, and entry into the US market remain attractive investment points. The short-term stock price decline could be an opportunity to buy low from a long-term perspective.

FAQ

Why did Hanwha Aerospace sell its stake in Hanwha Ocean?

The official reason for the sale was stated as ‘changes in special relationships,’ related to changes in shareholding structure and related agreements. It indicated no direct connection to a change in management control.

What is the impact of this stake sale on Hanwha Ocean’s stock price?

In the short term, it can put downward pressure on the stock price, but in the long term, it can lead to increased liquidity and a broader investor base.

Should I invest in Hanwha Ocean?

It’s important to make investment decisions based on the company’s fundamentals and growth potential, rather than short-term stock price fluctuations. This stake sale could be seen as an opportunity from a long-term investment perspective.

Leave a Reply