Harim Holdings’ ₩143.2B Exchangeable Bond Offering: What’s Happening?

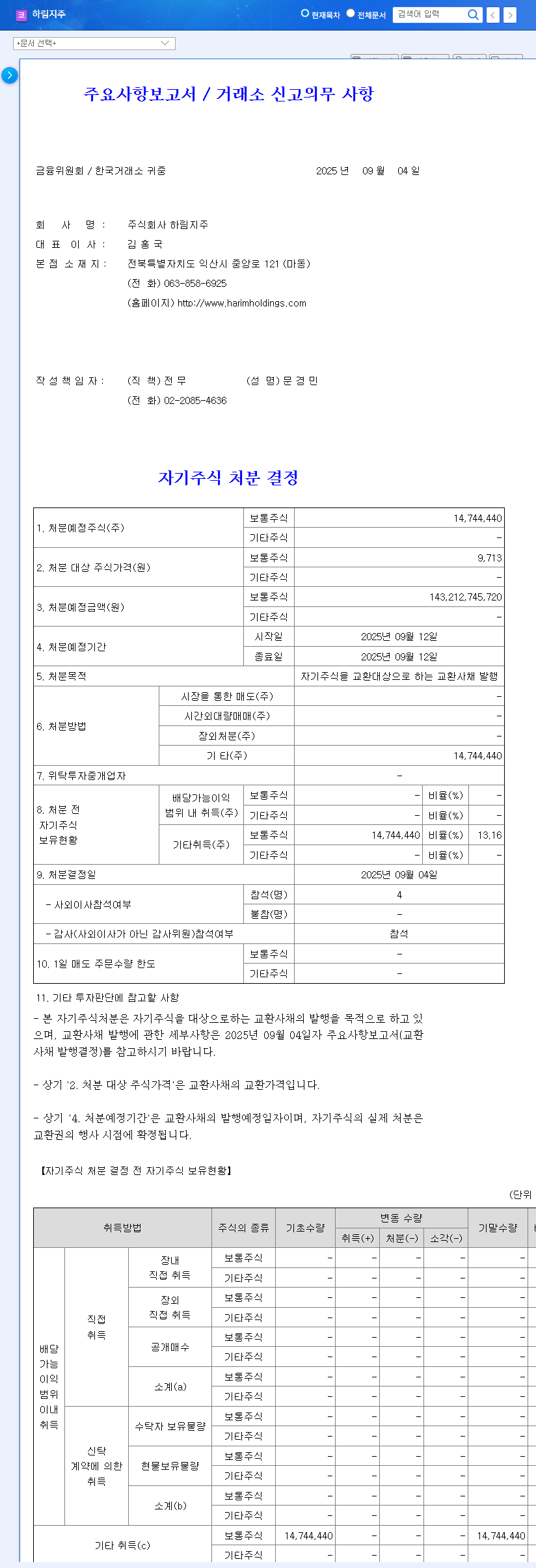

Harim Holdings has decided to issue ₩143.2 billion in exchangeable bonds through a private placement, with a payment date of September 12, 2025. The bonds are exchangeable for Harim Holdings common stock at a conversion price of ₩9,713. The exchange period runs from September 15, 2025, to August 12, 2030. The coupon rate is 0.0%, and the yield to maturity is 1.0%.

Why the Bond Offering?

Harim Holdings plans to use the proceeds from this bond offering to fund the Yangjae advanced logistics complex development project, secure working capital, and improve its financial structure. The low coupon rate minimizes financing costs, and the exchangeable nature of the bonds makes issuance easier compared to conventional corporate bonds.

How Will This Impact the Stock Price?

Positive Aspects: The low coupon rate (0.0%) reduces financial burden, and the funds raised can facilitate business expansion and improve the financial structure. In the short term, there’s no immediate share dilution.

Potential Negative Aspects: The current stock price (₩137,753) is significantly higher than the conversion price (₩9,713), making conversion less likely. This could lead to increased repayment burden if the stock price declines. The increased debt could also negatively impact financial ratios, and there’s a possibility of negative market interpretation.

What Should Investors Do?

- Monitor the Yangjae Logistics Complex Development: Keep a close eye on the project’s progress and viability.

- Track Performance of Key Business Segments: Pay attention to PanOcean’s shipping market conditions and the food division’s strategy in the HMR market.

- Manage Macroeconomic Indicators and Exchange Rate Volatility: Analyze macroeconomic indicators like exchange rates, interest rates, and commodity price fluctuations.

- Consider Bond Maturity and Conversion Terms: Factor in the bond maturity (August 2030) and the conversion price (₩9,713) relative to the current stock price when making investment decisions.

Overall View: We maintain a ‘Neutral’ rating on Harim Holdings. It’s prudent to observe how the company utilizes the funds from the bond offering and whether its business performance improves.

FAQ

What are exchangeable bonds?

Exchangeable bonds are bonds that give the holder the right to exchange them for a predetermined number of shares in a different company than the issuer of the bond.

Will this bond offering positively impact the stock price?

While the short-term impact is expected to be minimal, the long-term effect could be positive or negative depending on how the company utilizes the funds.

What should investors be cautious about?

Investors should consider factors such as bond maturity, conversion price, the difference between the current stock price and the conversion price, changes in business performance, and macroeconomic indicators.

Leave a Reply