1. What Happened? – Buyback Announcement Analysis

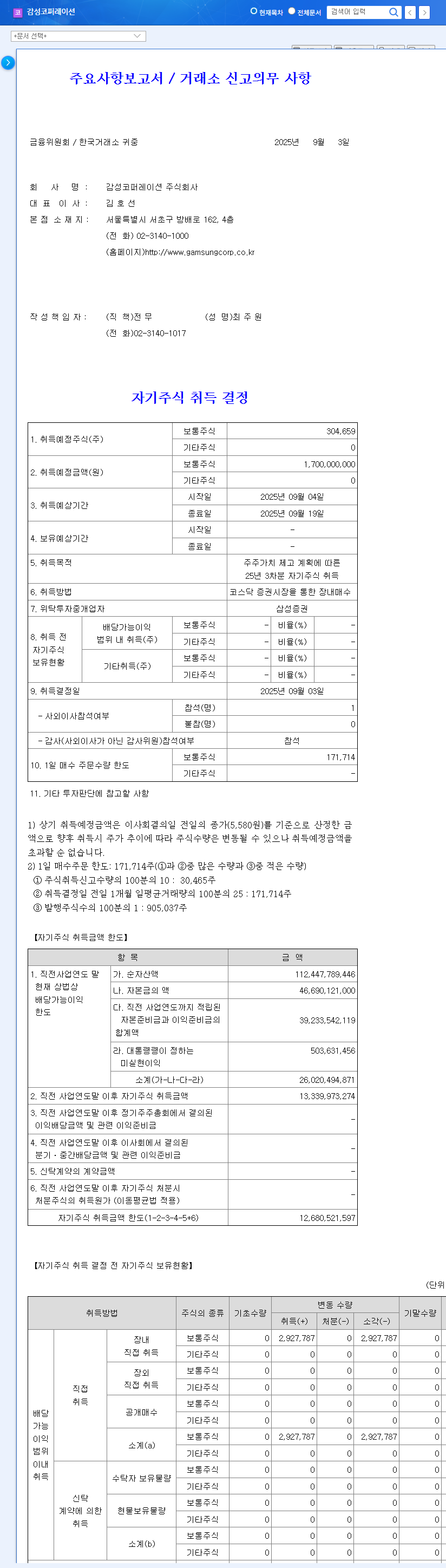

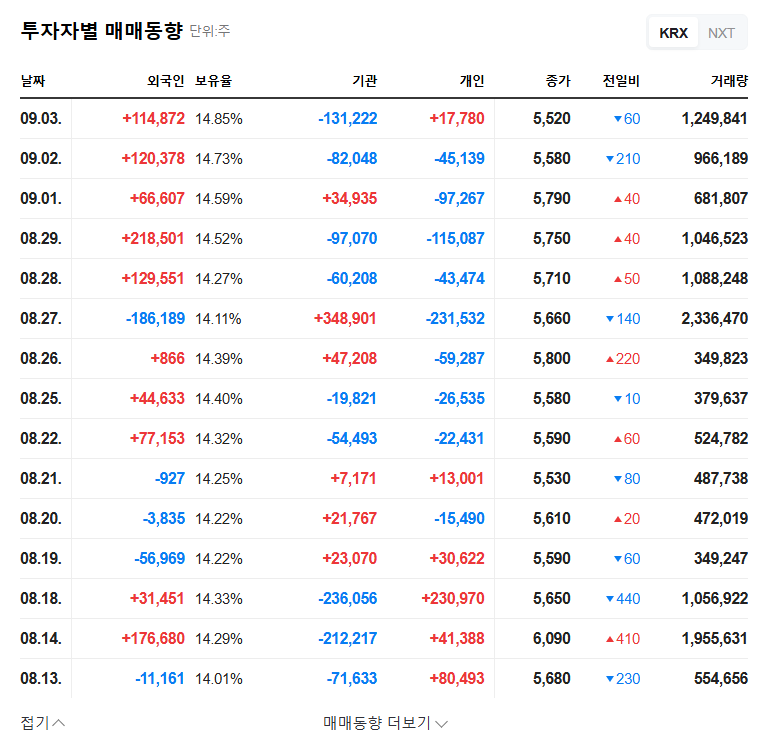

Gamsung Corporation announced a KRW 1.7 billion stock buyback on September 3rd. This equates to 304,659 common shares, representing about 0.34% of the company’s market capitalization. The buyback, aimed at enhancing shareholder value, will be conducted through open market purchases on the KOSDAQ.

2. Why the Buyback? – Background and Objectives

Officially, the company stated “enhancing shareholder value” as the primary objective. This is the third buyback planned for 2025 and can be interpreted as a commitment to stabilizing the stock price and restoring investor confidence. The announcement comes at a time when the stock price has been stagnant despite strong performance in the apparel business, but weighed down by the struggling mobile business.

3. What’s the Impact on Stock Price? – Short-term and Long-term Outlook

In the short term, the buyback is expected to have a positive impact on the stock price. Buybacks reduce the number of outstanding shares, increasing the value per share and raising expectations for shareholder returns. Past instances of stock price increases following buyback announcements support this outlook.

The long-term stock price outlook is closely tied to the company’s fundamentals. Continued growth of Snowpeak Apparel, strengthening the competitiveness of Actimon, and improving cost management efficiency are key tasks. If these factors improve, they can synergize with the buyback effect and drive stock price appreciation.

4. What Should Investors Do? – Action Plan

- Short-term investors: Consider a short-term investment strategy that leverages the upward momentum following the buyback announcement.

- Long-term investors: Carefully analyze whether the company’s fundamentals are improving and make investment decisions from a long-term perspective.

- All investors: Pay constant attention to external factors such as changes in the macroeconomic environment and competitor trends.

FAQ

When will the buyback start?

The exact purchase period has not yet been announced. Please check future announcements.

Are there any plans to cancel the repurchased shares?

Currently, no cancellation plans have been announced. Monitor future company disclosures.

Does a stock buyback always have a positive impact on the stock price?

Not necessarily. While a buyback can act as a short-term positive catalyst, it’s difficult to expect long-term stock price increases without underlying improvements in the company’s fundamentals.

Leave a Reply