Keeps Pharma Sets Up Shop in Gangnam

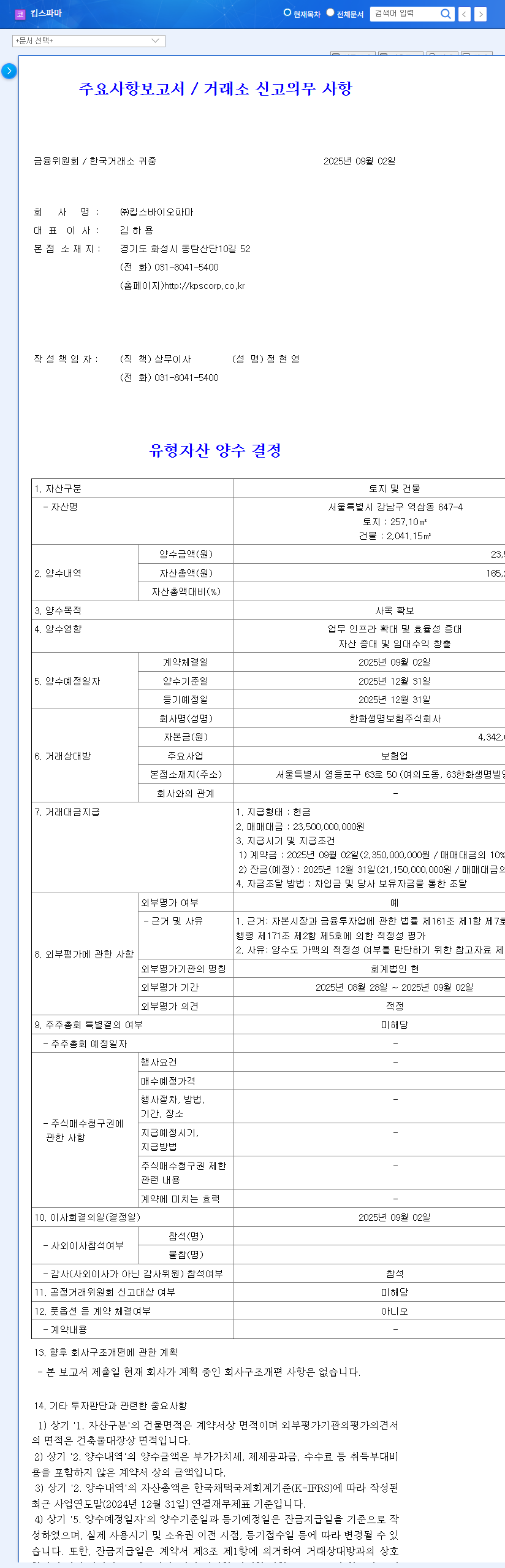

On September 2, 2025, Keeps Pharma finalized the acquisition of land and buildings in Gangnam’s Yeoksam-dong district from Hanwha Life Insurance for ₩23.5 billion. This substantial investment, representing approximately 10% of Keeps Pharma’s market capitalization, aims to enhance operational efficiency and bolster the company’s image.

Weighing the Pros and Cons

- Pros:

- Improved operational efficiency and corporate image

- Increased asset value and potential rental income

- Foundation for long-term growth

- Cons:

- Increased financial burden from the ₩23.5 billion investment (concerning given the current debt-to-equity ratio of 137.51%)

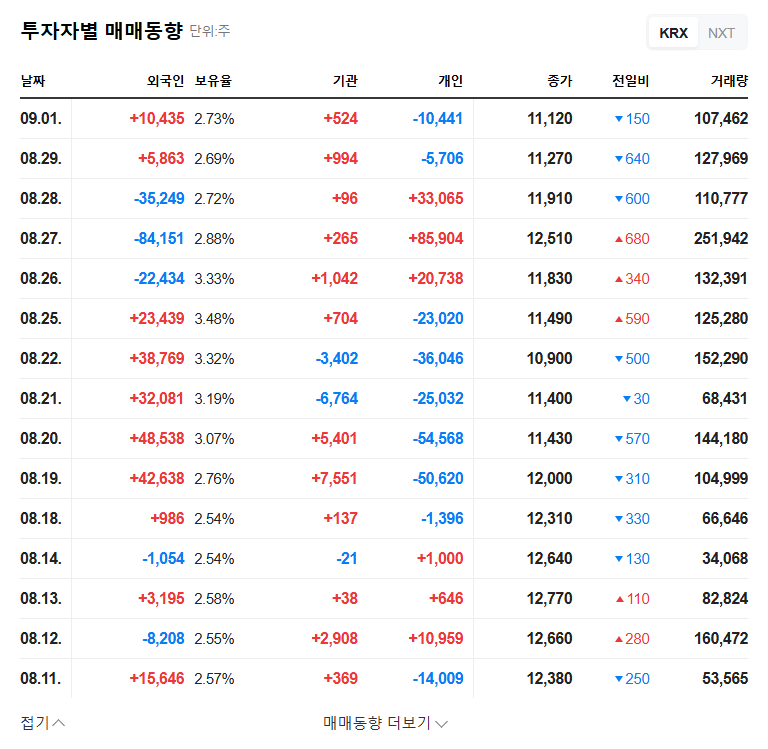

- Potential for short-term stock price volatility

- Existing business risks remain: continued losses in pharmaceuticals/bio, volatile profitability in recycling, and weak OLED sales

Action Plan for Investors

Keeps Pharma’s new headquarters presents both opportunities and risks. Investors should carefully consider the following:

- Keeps Pharma’s financing plans and strategy for improving its financial structure

- The company’s performance in its pharmaceuticals/bio, recycling, and OLED business segments

- Management’s transparency in information disclosure and active communication with investors

A comprehensive evaluation of these factors is crucial for making informed investment decisions.

FAQ

Where is Keeps Pharma’s new headquarters located?

It is located at 647-4, Yeoksam-dong, Gangnam-gu, Seoul, South Korea.

How is Keeps Pharma financing the acquisition?

The company plans to use a combination of debt and existing funds.

What is the primary purpose of the new headquarters?

The main goals are to expand operational infrastructure, improve efficiency, increase asset value, and potentially generate rental income.

What are the financial risks associated with this acquisition?

The ₩23.5 billion investment increases the company’s financial burden and may lead to short-term stock price volatility.

What should investors pay attention to?

Investors should monitor the company’s financing plans, strategy for improving its financial structure, and performance in its various business segments.

Leave a Reply