1. What Happened? : Major Shareholder Increases Stake

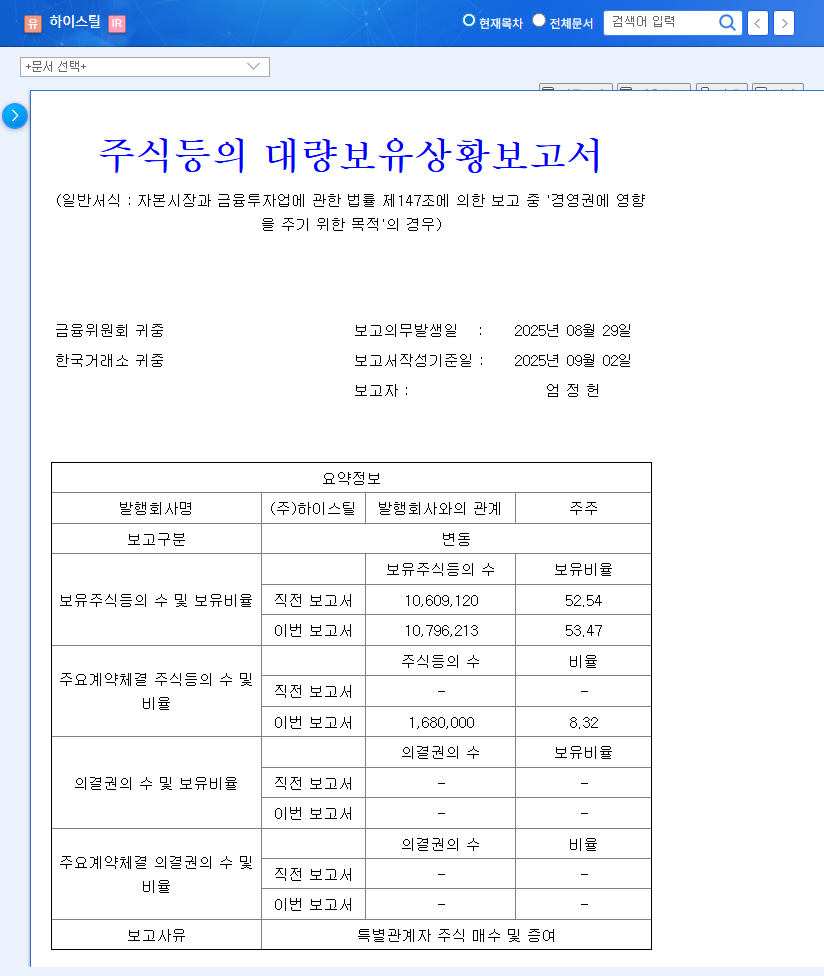

On September 2, 2025, HISCO’s representative reporter, Jeong-Heon Eom, increased his stake from 52.54% to 53.47% through stock transactions involving related parties, solidifying his control over the company.

2. Why Does It Matter? : Enhanced Management Stability and Improved Fundamentals

This stake increase is expected to contribute to management stability and increased decision-making efficiency. HISCO also demonstrated improved fundamentals, recording sales of KRW 129.393 billion (a 2.5% increase year-on-year), operating profit of KRW 2.204 billion (turnaround), and net profit of KRW 0.39 billion (turnaround) in the first half of 2025. Expansion into overseas markets and a high-value-added product strategy are seen as positive factors.

3. So What? : Investment Outlook and Opportunities

While management stability and the turnaround are positive signs, uncertainties remain, including volatility in raw material prices, exchange rates, interest rates, and protectionist trade policies. The future stock price will be influenced by these factors and the company’s ability to execute its strategies.

4. What Should Investors Do? : Key Checkpoints

- Monitor the success of the overseas market diversification strategy.

- Pay attention to the company’s risk management capabilities regarding raw material prices and exchange rate fluctuations.

- Observe improvements in the utilization rate of the Haman plant and profitability enhancements.

- Check the company’s efforts to manage debt ratios and maintain financial soundness.

What were the recent changes in HISCO’s major shareholder’s stake?

On September 2, 2025, representative reporter Jeong-Heon Eom’s stake increased to 53.47%, strengthening management control.

How was HISCO’s financial performance in the first half of 2025?

The company recorded sales of KRW 129.393 billion, operating profit of KRW 2.204 billion (turnaround), and net profit of KRW 0.39 billion (turnaround).

What should investors be aware of when investing in HISCO?

Investors should consider risks related to external environmental changes such as raw material prices, exchange rates, interest rates, and protectionist trade policies. They should also monitor the company’s overseas market strategy, Haman plant utilization rate, and debt ratio management.

Leave a Reply