1. What Happened?

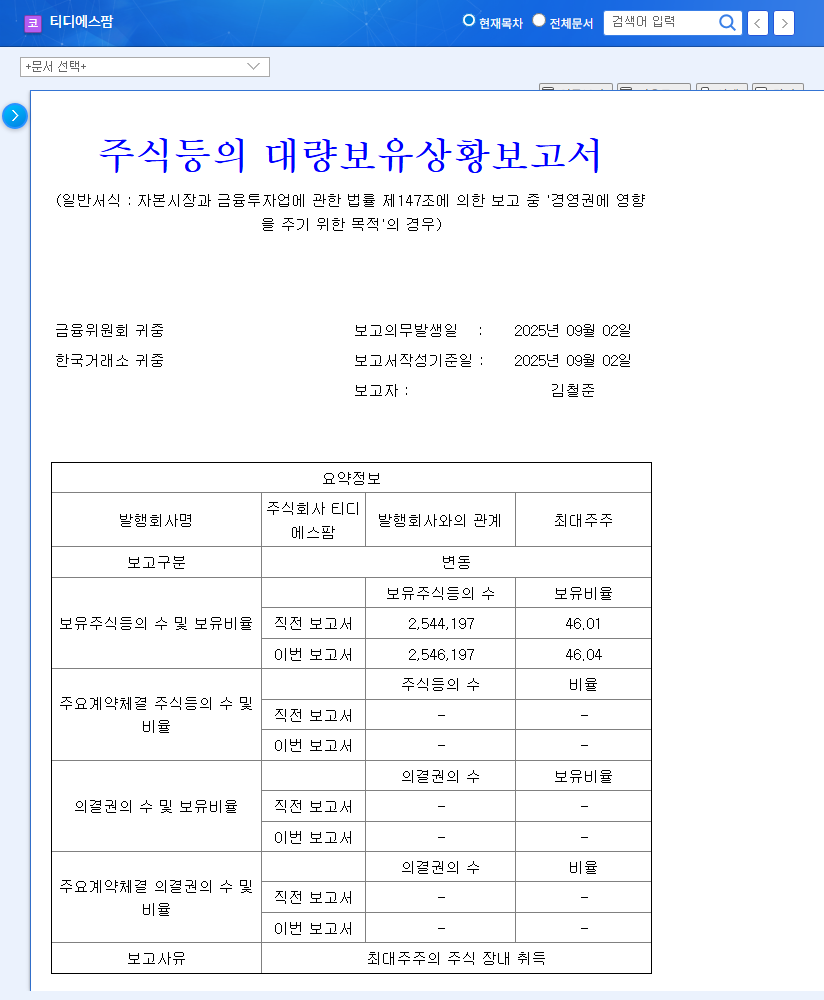

On September 2, 2025, TDS Pharm’s largest shareholder, Kim Chul-jun, acquired an additional 2,000 shares, increasing his stake to 46.04%. This is interpreted as a response to the recent sharp decline in stock price and could send a positive signal to the market.

2. Why Does It Matter?

The increase in stake by the largest shareholder suggests stabilization of management rights and confidence in the company. This is particularly noteworthy given the significant drop in TDS Pharm’s stock price following poor half-year results in 2025 (29.6% decrease in sales, 80.3% decrease in operating profit). However, sustainable stock price increase is unlikely without fundamental improvement.

3. What’s Next?

- Short-term Impact: Improved investor sentiment and potential for a short-term rebound. However, concerns about poor performance remain, which could limit significant gains.

- Mid- to Long-term Impact: Enhanced management stability and increased confidence. However, actual stock price appreciation depends on fundamental improvement, new pipeline development, and market conditions.

4. What Should Investors Do?

While this stake increase is a positive sign, investment decisions should be made cautiously. Rather than being swayed by short-term price fluctuations, it’s crucial to closely monitor future earnings announcements, new product development progress, and management’s efforts to enhance shareholder value, focusing on fundamental improvements. Pay close attention to the performance recovery of the cataplasma segment and the success of the new transdermal patch business.

Does an increase in stake by the largest shareholder always have a positive impact on the stock price?

Not always. While it can be interpreted as a positive sign, it doesn’t guarantee long-term stock price appreciation without underlying fundamental improvement.

What is the outlook for TDS Pharm’s stock price?

There is a possibility of a short-term rebound due to the stake increase. However, the mid- to long-term outlook depends on whether the company’s fundamentals improve, especially in the cataplasma segment and new businesses.

What should investors consider when investing in TDS Pharm?

Investors should consider the company’s fundamentals, future earnings prospects, new product development, and management’s commitment to enhancing shareholder value, rather than focusing solely on short-term price movements.

Leave a Reply