Polar Capital Reduces Stake in Eugene Tech: What Happened?

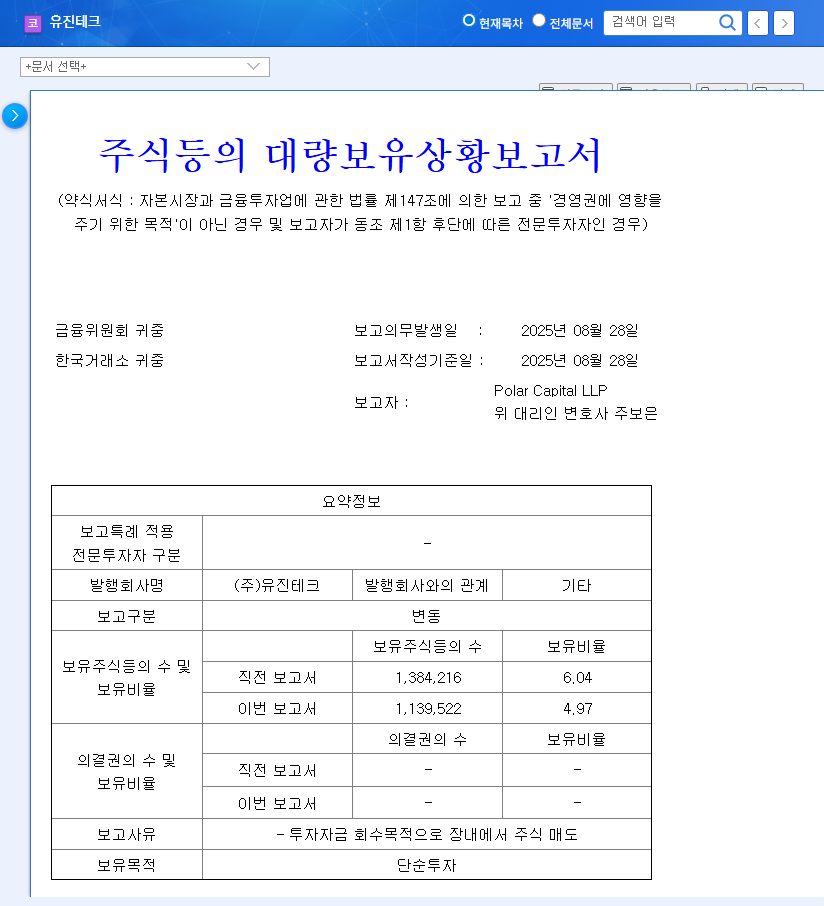

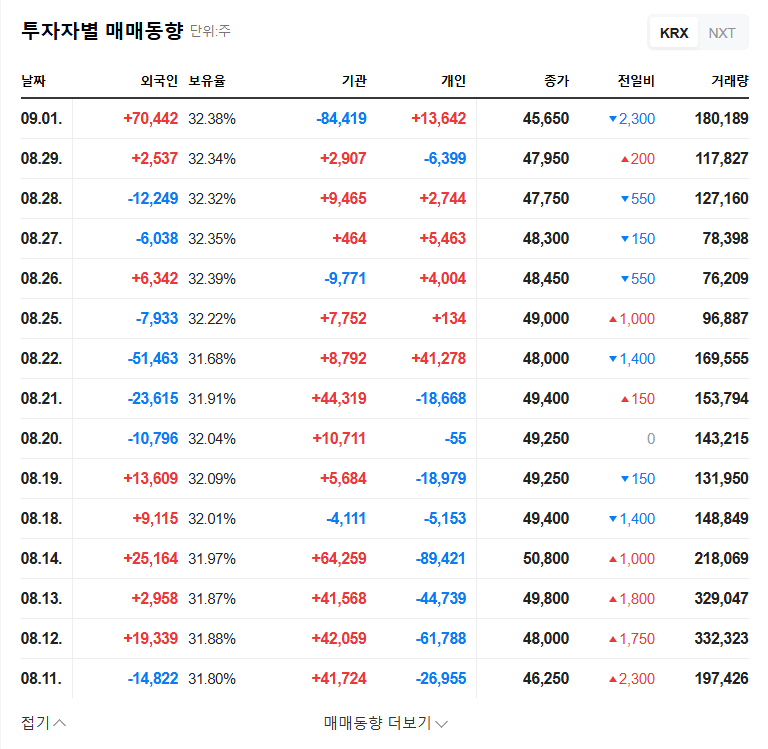

On September 2, 2025, Polar Capital LLP, a major shareholder of Eugene Tech, reduced its stake from 6.04% to 4.97%. This was done for investment recovery purposes and is not considered a negative signal regarding the company’s fundamentals.

Is Eugene Tech’s Financial Foundation Solid?

- Strong H1 2025 Performance: Revenue up 28.7%, operating profit up 108.6%

- Robust Financials: Healthy order backlog (KRW 68.833 billion) ensures revenue visibility

- Continuous R&D Investment: 24.1% of revenue invested in R&D to strengthen technological competitiveness

- Limited FX Impact: Low sensitivity to USD fluctuations

Market Impact of the Divestiture?

Short-term downward pressure on stock price and potential supply-demand imbalance are possible. However, considering Polar Capital’s rationale for selling, the long-term impact is expected to be limited. This temporary dip could present a buying opportunity.

What Should Investors Do?

- Short-term Investors: Monitor the absorption of the divested shares and look for buying opportunities (be mindful of increased volatility)

- Long-term Investors: Continuously monitor the company’s fundamentals, growth strategy, new orders, and R&D achievements

This analysis is based on currently available information, and the results may vary depending on changes in the market.

Frequently Asked Questions

Is Polar Capital’s divestiture a negative signal for Eugene Tech’s future?

No. This sale was for investment recovery purposes and is not a negative reflection of the company’s fundamentals.

What is Eugene Tech’s current financial status?

Eugene Tech recorded strong performance in the first half of 2025 and maintains a healthy backlog of orders, ensuring stable revenue visibility. They also continue to invest in R&D to strengthen their technological competitiveness.

Is it a good time to invest in Eugene Tech?

While there may be short-term stock price volatility, considering the company’s solid fundamentals and the positive outlook for the semiconductor market, it may be worth considering an investment from a long-term perspective. However, investment decisions should be made carefully and based on your own judgment.

Leave a Reply