What Happened?

Mirae Asset Dream SPAC 1 is required to submit a merger preliminary review application by September 8, 2025. Failure to meet this deadline will result in the company being designated as a 관리종목 (managed stock) on September 9, 2025. If the situation isn’t rectified within one month, the company faces potential delisting from the exchange.

Why is this happening?

As a Special Purpose Acquisition Company (SPAC), Mirae Asset Dream SPAC 1’s sole purpose is to merge with a private company within a specific timeframe. The company has yet to identify a suitable merger target, putting it at risk of delisting. While they are considering targets in renewable energy, biopharmaceuticals, and IT convergence systems, no concrete merger process has begun.

What’s Next?

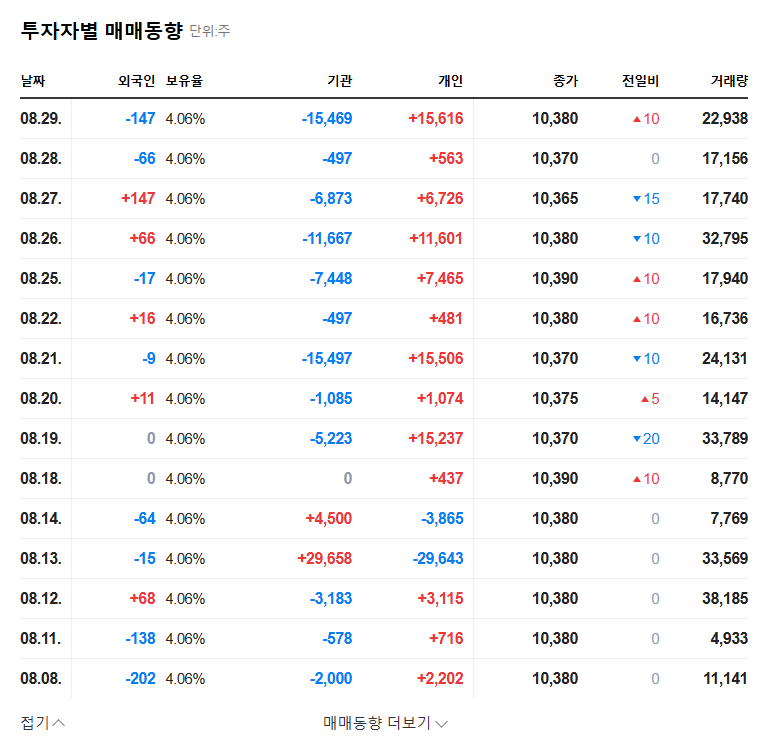

In the short term, the likelihood of being designated a 관리종목 is high, which will likely negatively impact investor sentiment and put downward pressure on the stock price. The medium to long-term outlook hinges on whether the company can submit the preliminary review application and successfully complete a merger. While a successful merger would resolve the crisis, the current uncertainty raises the possibility of delisting.

What Should Investors Do?

- Monitor the Application Submission: Closely monitor whether the company submits the preliminary review application by the September 8th deadline.

- If Submitted: Thoroughly analyze the proposed merger target before making any investment decisions.

- If Not Submitted: Consider strategies to recover your investment or minimize potential losses.

- Invest with Caution: Understand the inherent risks associated with SPAC investments, particularly the uncertainty surrounding mergers.

Frequently Asked Questions

What is a 관리종목 (managed stock)?

A 관리종목 is a designation given by the Korea Exchange to companies facing a high risk of delisting. This designation is intended to protect investors and comes with restrictions such as reduced trading volume and limited access to information.

What is a SPAC?

A SPAC (Special Purpose Acquisition Company) is a shell company created solely for the purpose of merging with or acquiring a private company and taking it public.

Why is Mirae Asset Dream SPAC 1 facing delisting risks?

The company is nearing its deadline to merge with a target company and has yet to identify a suitable candidate. Failure to complete a merger within the timeframe could lead to delisting.

Leave a Reply