What Happened? UTI Announces Warrant Exercise

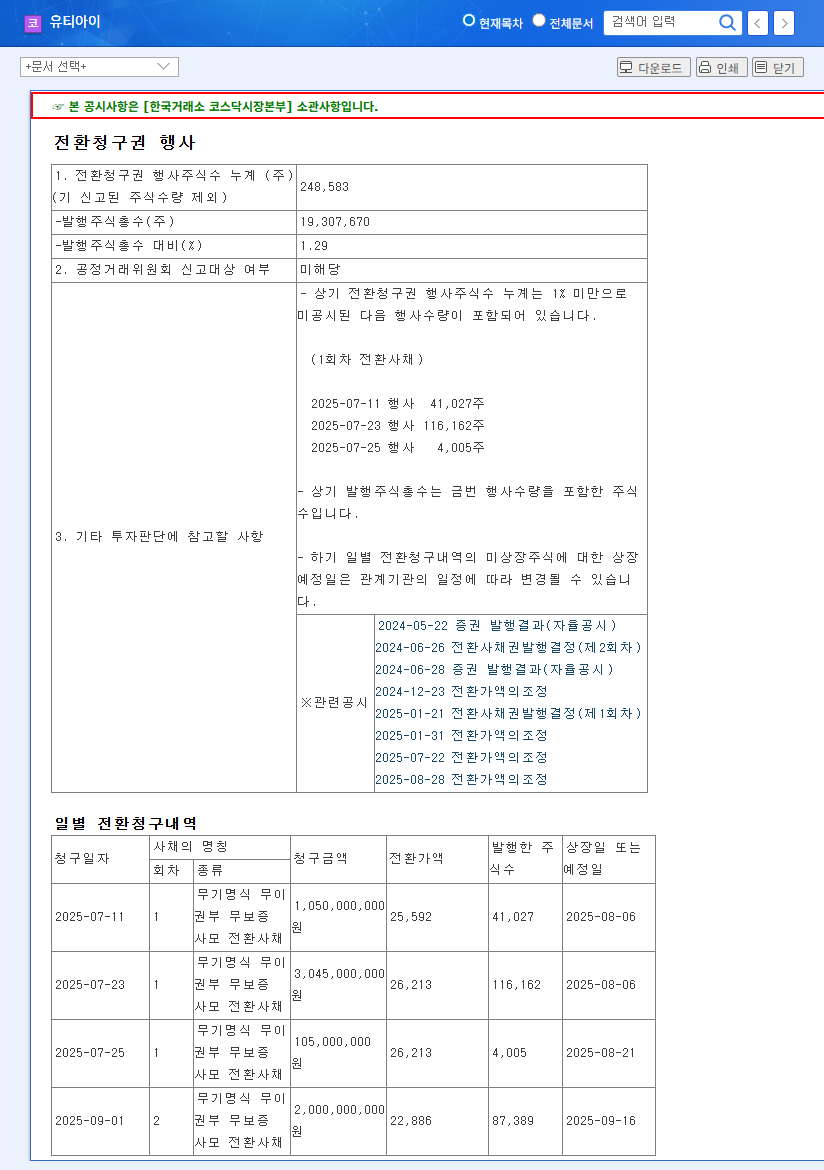

On September 1, 2025, UTI announced the issuance of 248,583 new shares due to a warrant exercise. The conversion price is between ₩22,886 and ₩26,213, significantly higher than the current stock price of ₩364.

Why? The Need for Financial Restructuring

UTI has recently faced challenges due to declining sales and operating losses. The company has relied on issuing convertible bonds and convertible preferred stock for financing. This warrant exercise is interpreted as an attempt to improve its financial structure by converting debt into equity.

What’s Next? Short-Term Pain, Long-Term Gain?

In the short term, concerns about stock dilution and negative investor sentiment are anticipated. However, the long-term trajectory of the stock price hinges on the success of new businesses, such as Flexible Glass.

- Short-term impact: Downward pressure on stock price, negative investor sentiment

- Long-term impact: Potential for new business growth, turnaround expectations

Investor Action Plan

Investors should be aware of potential short-term price volatility. Careful monitoring of the company’s earnings, new business progress, and financial restructuring efforts is crucial for making informed investment decisions.

Frequently Asked Questions

Does the warrant exercise only have negative impacts on the stock price?

While there are concerns about stock dilution in the short term, the warrant exercise could have positive long-term impacts depending on the company’s financial restructuring and new business growth.

What are UTI’s new business ventures?

UTI is focusing on developing next-generation display technologies, including Flexible Glass, Rollable Display Glass Window, and AR/VR Display Wafer Level structures.

What should investors be cautious about?

Investors should be mindful of potential short-term price volatility and continuously monitor the company’s earnings and new business progress.

Leave a Reply