What is Mirae Asset’s Investment?

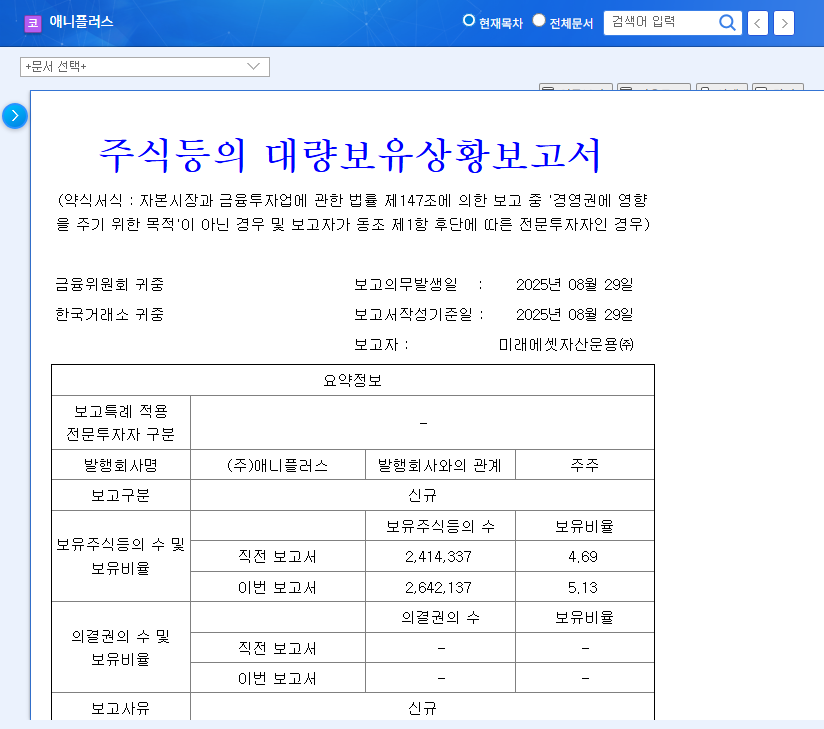

Mirae Asset Global Investments announced that it now holds a 5.13% stake in Aniplus. Although the purpose is simple investment, the market is perceiving the investment from a large asset management company as a positive signal.

Why is Aniplus Struggling?

Aniplus experienced a significant decline in performance in the first half of 2025, with sales falling 55.7% year-on-year. The global economic slowdown, intensifying competition, and exchange rate fluctuations are cited as the main causes. High debt-to-equity ratio is also acting as a financial burden.

What Does Mirae Asset’s Investment Mean?

Mirae Asset’s investment could have a positive impact on the stock price in the short term. However, without fundamental improvement, it is difficult to expect a sustained rise. In the medium to long term, the success of Aniplus’s new businesses and the strengthening of its IP competitiveness are important variables.

- Positive Aspects: Increased market interest, expectations for potential growth

- Negative Aspects: Simple investment purpose, uncertainty of fundamental improvement

What Should Investors Do?

Short-term investors may consider the possibility of a short-term rebound due to Mirae Asset’s investment, but a cautious approach is necessary. Long-term investors should continuously monitor whether Aniplus’s fundamentals are improving. It is advisable to make investment decisions after confirming sales recovery, profitability improvement, and new business performance.

What is the purpose of Mirae Asset’s investment in Aniplus?

It is known to be for simple investment purposes. It is interpreted as part of portfolio diversification rather than management participation.

What are the reasons for Aniplus’s poor performance?

It is the result of a combination of factors, including the global economic slowdown, intensifying competition in the content market, and exchange rate fluctuations.

Should I invest in Aniplus stock now?

Short-term stock price volatility is expected, so careful investment decisions are needed. It is recommended to invest after confirming fundamental improvements.

Leave a Reply