1. What Happened?

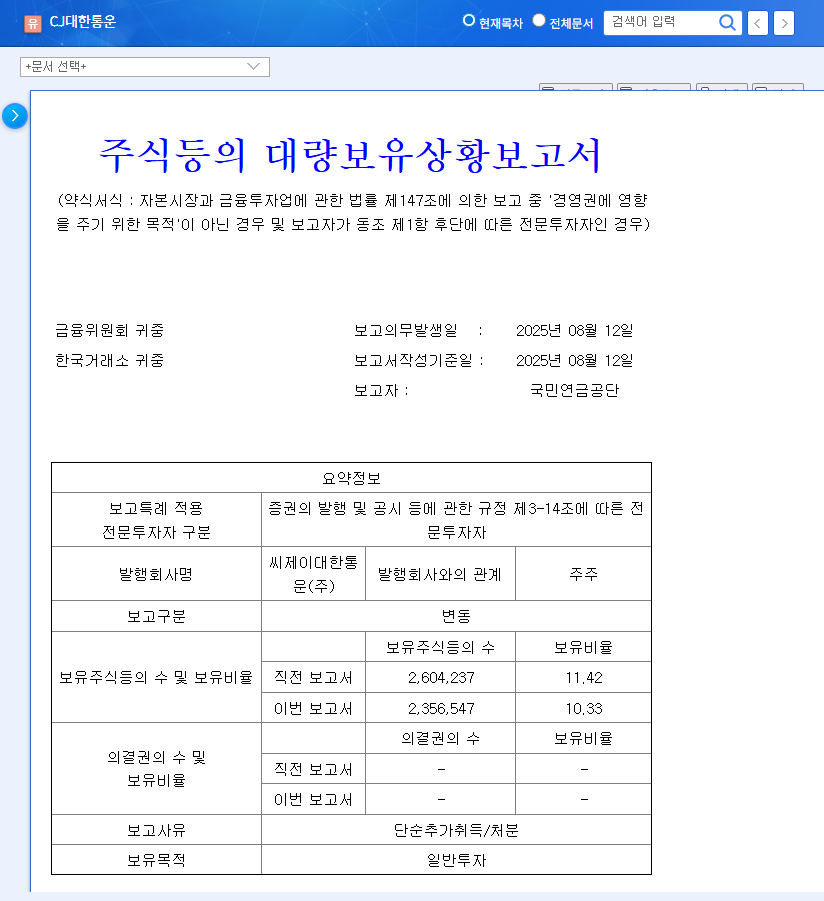

The NPS reduced its stake in CJ Logistics from 11.42% to 10.33%. While stating it was a ‘simple acquisition/disposal’, investors are closely watching the underlying reasons.

2. Why Did This Happen?

CJ Logistics saw a slight increase in revenue but a decline in operating profit in the first half of 2025. All business segments, including CL, parcel delivery, global, and construction, reported sluggish performance, with an increase in debt-to-equity ratio. The macroeconomic environment is also unstable, with rising exchange rates and interest rates, and increasing oil price volatility adding to the challenges.

- Sluggish CL and Construction Business: Facing difficulties due to slowing growth in industrial materials and rising logistics costs.

- Slowing Parcel Delivery Business Growth: Market share decline due to slowing domestic volume growth and intensifying competition.

- Increasing Uncertainty in Global Business: Increased volatility due to global economic downturn and geopolitical risks.

3. What Should Investors Do?

While the NPS’s selling may put downward pressure on the stock price in the short term, it doesn’t directly impact the fundamentals. The key is whether CJ Logistics can recover its fundamentals.

4. Investor Action Plan

- Monitor Fundamental Recovery: Pay attention to earnings improvement in the second half, business portfolio restructuring, and cost efficiency achievements.

- Watch Institutional Investor Trends: Observe the movements of other institutional investors to understand changes in market sentiment.

- Assess the Impact of Macroeconomic Variables: Continuously evaluate the impact of exchange rate and interest rate fluctuations on CJ Logistics.

- Maintain a Long-Term Perspective: Don’t be swayed by short-term stock price fluctuations and invest based on the company’s long-term growth potential.

What does the NPS’s reduction in CJ Logistics stake mean?

The NPS’s stake reduction could increase short-term stock price volatility, but its impact on fundamentals may be limited. It could be a simple portfolio adjustment, so further information is needed.

What is the current situation of CJ Logistics?

CJ Logistics is facing difficulties due to sluggish performance across its CL, parcel delivery, global, and construction businesses, as well as macroeconomic uncertainties. Intensifying competition in the parcel delivery market and structural sluggishness in the CL/construction sectors are medium to long-term challenges.

What should investors focus on?

Investors should consider CJ Logistics’ fundamental recovery, institutional investor trends, and the impact of macroeconomic variables when developing their investment strategies. It’s crucial to focus on long-term growth potential rather than short-term stock price fluctuations.

Leave a Reply