1. What Happened?

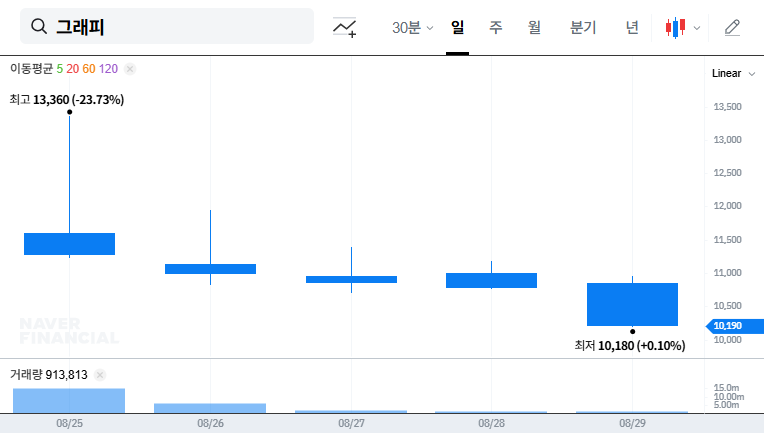

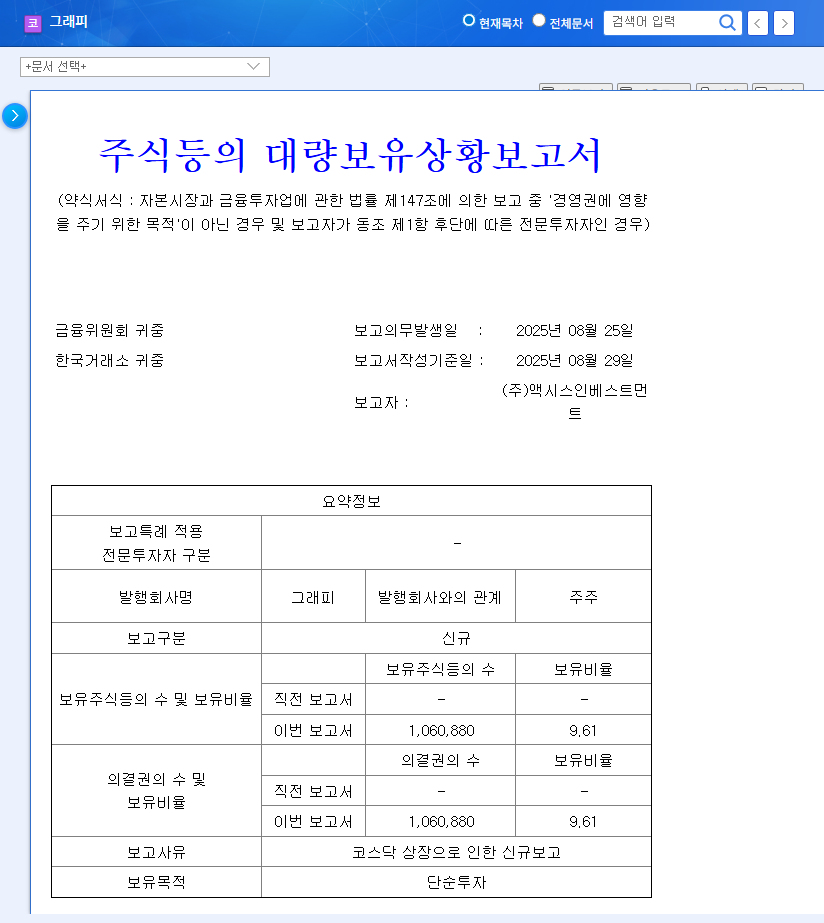

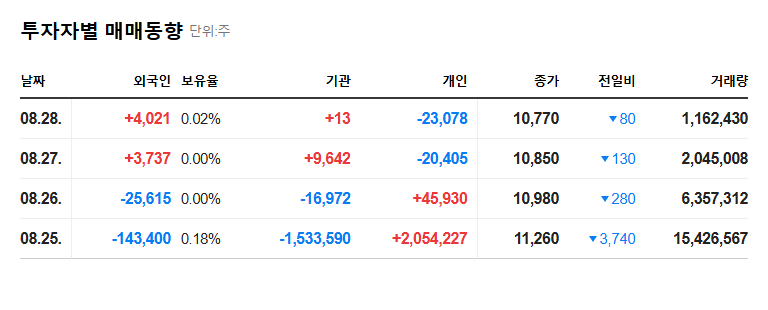

Shortly after Graphi’s KOSDAQ listing, Axis Investment filed a large holding report, disclosing its 9.61% stake in the company. While this can be interpreted as a positive sign, it’s important to note that some over-the-counter selling also occurred.

2. Why Does It Matter?

As the stock price continues to decline after the listing, this report can provide investors with clues about the future direction of the stock price. Axis Investment’s change in stake may reflect market expectations for Graphi’s fundamentals and growth strategy.

3. What Should Investors Do?

Graphi has growth potential through its innovative SMA technology and integrated 3D printing solutions, but it faces challenges in improving its financial soundness and profitability. Investors should closely monitor the IPO proceeds execution plan, financial restructuring efforts, profitability improvement strategy, the role of major investors, and changes in the competitive landscape.

- Key Checkpoints:

- – IPO proceeds utilization strategy

- – Financial soundness improvement roadmap

- – Profitability securing measures

- – Continued support from major investors

- – Market competitiveness of SMA technology

It’s important to analyze the company’s growth potential from a long-term perspective, without being swayed by short-term stock price volatility.

4. Investor Action Plan

Before making investment decisions, carefully analyze Graphi’s financial status, management strategy, and market competitiveness, considering your investment objectives and risk tolerance. It is a wise investment strategy to refer to expert opinions and manage risks through diversified investments.

What is Graphi’s core technology?

Graphi is the first company in the world to develop and commercialize shape memory clear aligners (SMA). Based on its own oligomer development and synthesis capabilities, it has the potential to overcome the limitations of existing clear aligners.

What is Graphi’s financial status?

Graphi is currently in a state of capital impairment and has a high debt ratio. Its operating profit is also in the red, making it urgent to improve its financial soundness.

What is the significance of Axis Investment’s large holding report?

As the report was released amidst a declining stock price following the KOSDAQ listing, it can be interpreted in various ways by the market. Changes in the stakes of major investors can reflect market expectations for a company’s future growth potential, so investors should carefully analyze this.

Leave a Reply