1. What Happened?

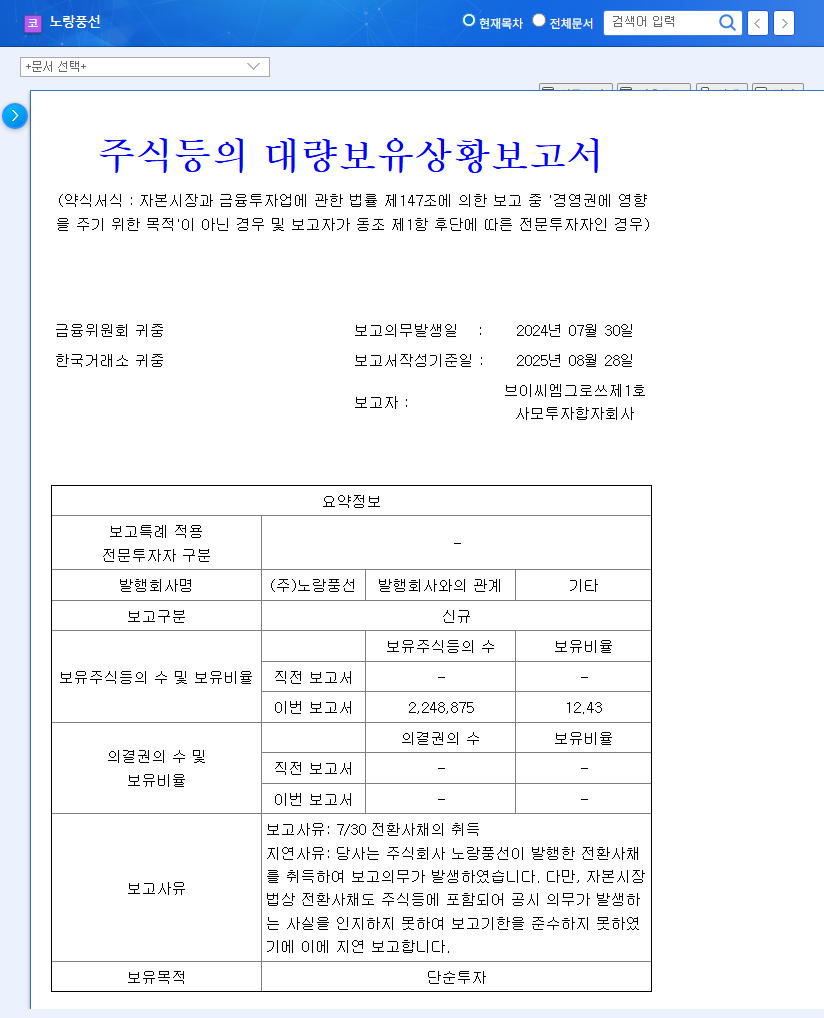

VCM Growth acquired a 12.43% stake in Yellow Balloon through convertible bonds. However, they filed a late report due to delayed recognition of the reporting obligation.

2. Why the Investment?

The official reason is ‘simple investment.’ However, they likely see growth potential in Yellow Balloon’s diversification efforts (location-based services, international logistics, event planning), digital transformation (AI recommendations, smart booking system), and overseas expansion.

3. Yellow Balloon’s Current State

While Yellow Balloon is seeing gradual improvement with the travel recovery, they are still operating at a loss. Debt-to-equity ratio has decreased, but operating cash flow remains weak. The issuance of convertible bonds could add to financial burdens.

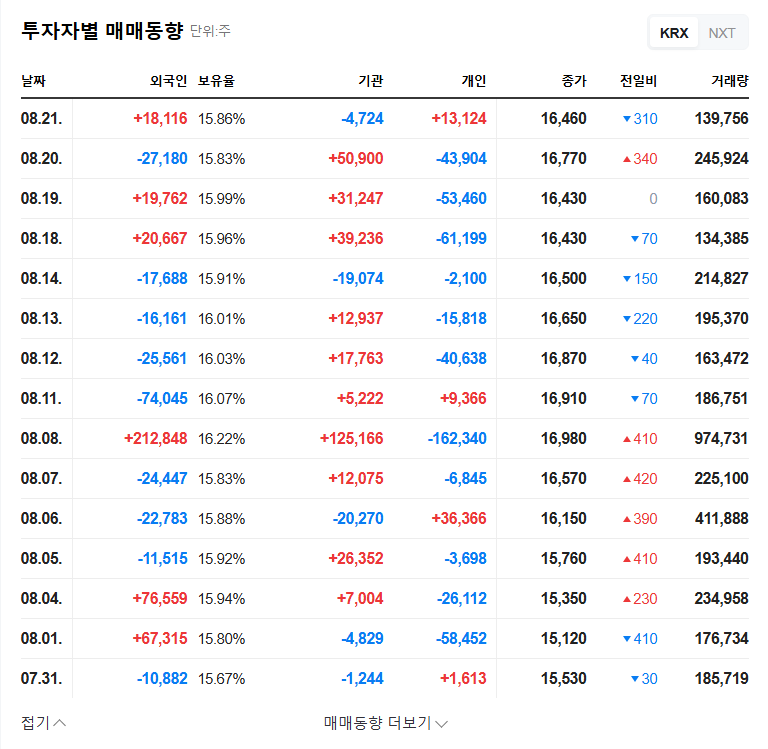

- Positive: Increased institutional investor interest

- Negative: Late report filing, potential stock dilution

- Key Challenges: Profitability, securing cash flow

4. Investor Action Plan

Monitor VCM Growth’s future actions and Yellow Balloon’s fundamental improvements. Be mindful of short-term volatility and develop a long-term investment strategy. Flexibility is key, adapting to market conditions and company performance.

Is VCM Growth’s investment a positive sign for Yellow Balloon?

It indicates institutional interest, but the late reporting and Yellow Balloon’s fundamental instability should be considered.

What is the outlook for Yellow Balloon?

Diversification and digital transformation efforts are positive, but profitability and securing cash flow are key challenges.

Should I invest in Yellow Balloon stock now?

The investment decision is yours. Consider the analysis provided in this article and invest cautiously.

Leave a Reply