Keangnam Enterprises Secures Daejeon Subway Line 2 Contract

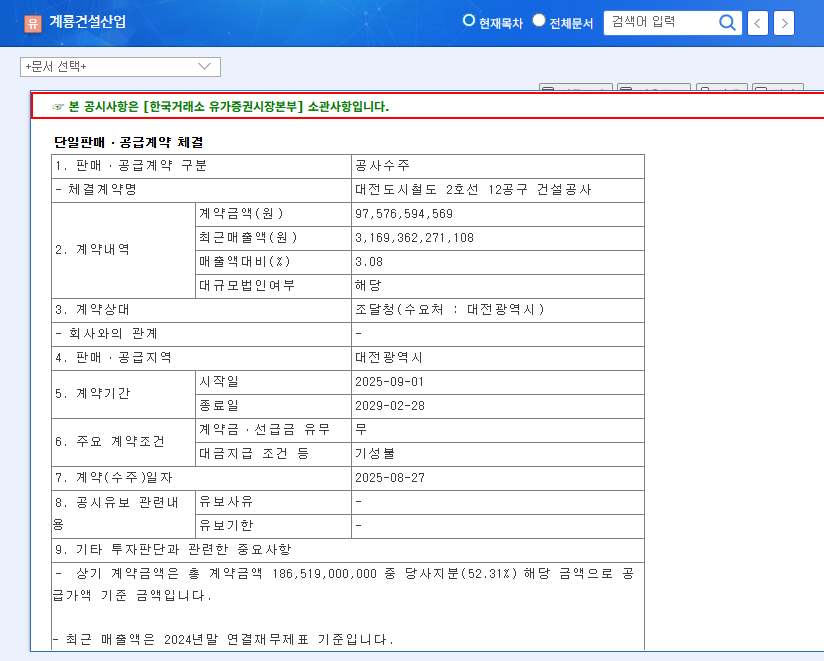

On August 27, 2025, Keangnam Enterprises signed a contract for the construction of Section 12 of Daejeon Subway Line 2, worth $720 million. This represents 3.08% of Keangnam’s revenue and is expected to contribute to stable revenue growth over the next 3 years and 6 months.

Contract Background and Positive Impacts

This large-scale public infrastructure project win amidst a construction industry downturn demonstrates Keangnam’s competitiveness in securing contracts. This contract offers several potential benefits:

- Revenue and Profitability Growth: Expected stable revenue and potential profit improvement.

- Strengthened Project Pipeline: Increased likelihood of winning similar projects and enhanced business stability.

- Improved Corporate Image: Enhanced credibility through winning a major public project.

Investment Considerations

Despite the positive aspects, investors should consider the following risk factors:

- Recent Poor Performance: 2023 operating loss necessitates profit improvement. The impact of this contract on profitability remains to be seen.

- Macroeconomic Environment: Potential impact of interest rate and raw material price volatility on financial soundness.

- Project Execution Capabilities: Efficient project execution and profit management are crucial.

Investor Action Plan

While this contract provides positive momentum, investors should carefully monitor the company’s actual performance improvement. Ongoing monitoring of the project’s progress, profitability, and potential for further large-scale contracts is essential.

Frequently Asked Questions

How much will this contract contribute to Keangnam’s financial recovery?

The $720 million contract represents a significant portion of Keangnam’s revenue and is expected to contribute to stable revenue growth over the next 3 years and 6 months. However, the extent to which it can offset recent losses depends on project execution and profit management.

What are the key investment risks to consider?

Investors should consider the recent poor performance, uncertainties stemming from interest rate and raw material price volatility, and the company’s ability to execute the project successfully and profitably.

What is the outlook for Keangnam Enterprises?

While this contract is a positive sign, continued growth and recovery will depend on securing additional contracts, efficient project management, and adapting to changes in the macroeconomic environment.

Leave a Reply