1. Shinhan Financial Group H1 2025 Earnings Analysis: 10.6% Net Profit Growth!

Shinhan Financial Group achieved a consolidated net profit of KRW 3.0374 trillion (YoY +10.6%) in the first half of 2025, maintaining robust growth. Balanced growth in both interest and non-interest income, along with the disappearance of one-off costs, contributed to this strong performance. Key business segment results are as follows:

- Shinhan Bank: Net profit KRW 2.2668 trillion (YoY +10.4%)

- Shinhan Card: Net profit KRW 0.2466 trillion (YoY -35.0%, impacted by rising procurement costs and increased provisions)

- Shinhan Investment Corp: Net profit KRW 0.2589 trillion (YoY +25%)

- Shinhan Life: Net profit KRW 0.3443 trillion (YoY +10.0%)

- Shinhan Capital: Net profit KRW 0.0639 trillion (YoY -44.1%, affected by provisions related to PF/bridge loans)

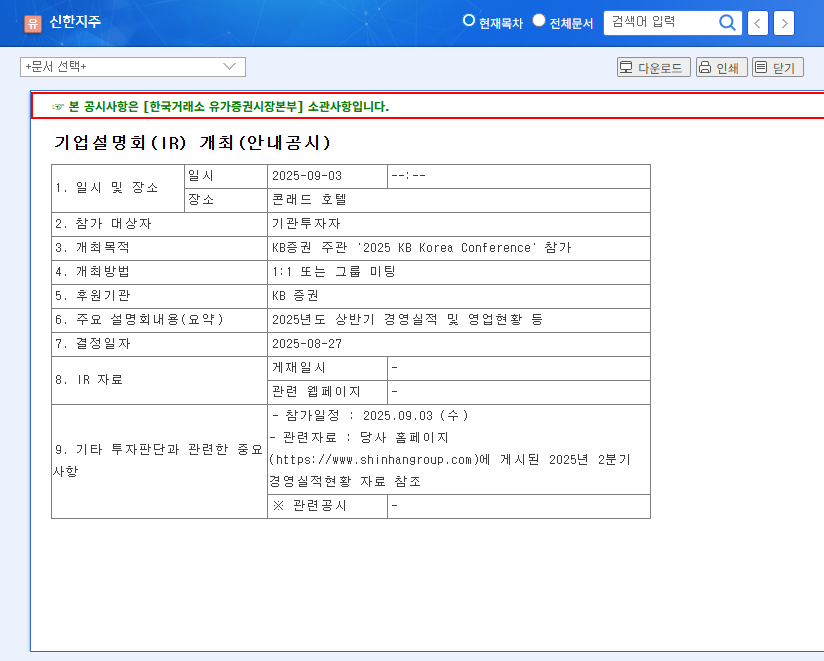

2. KB Korea Conference Participation: What does it mean for investors?

At the KB Korea Conference scheduled for September 3rd, Shinhan Financial Group will share its future business strategies along with its H1 2025 earnings results. This presents a valuable opportunity for investors to assess the company’s vision and growth potential. Announcements regarding their proactive shareholder return policy (treasury stock acquisition/cancellation) and strengthened ESG management efforts are expected to positively influence investor sentiment.

3. Investment Strategy: Considering both opportunities and risks

Shinhan Financial Group’s solid fundamentals and shareholder return policy enhance its investment appeal. However, factors such as Shinhan Capital’s weak performance, real estate PF risks, and intensifying competition should be considered before investing. Investors should closely monitor the conference proceedings and market conditions to make informed investment decisions.

Frequently Asked Questions

What caused Shinhan Capital’s decline in earnings?

Provisions for bad debts related to PF/bridge loans and increased volatility in the investment market were the primary causes.

What is Shinhan Financial Group’s shareholder return policy?

They have resolved to pay a dividend of KRW 570 per share for Q2 and to acquire/cancel treasury stock worth KRW 800 billion.

What will be announced at the KB Korea Conference?

H1 2025 business performance and operating results, along with future business strategies, are expected to be announced.

Leave a Reply