What Happened? Delisting Application Explained

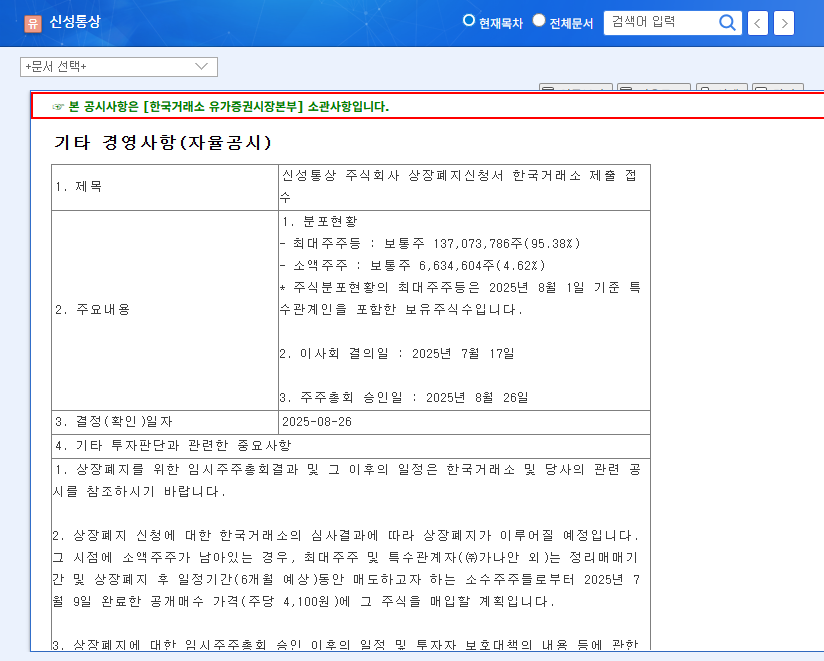

Shinseong Tongsang submitted a delisting application via a voluntary disclosure. The application has been approved by the board of directors and a temporary shareholders’ meeting. The final decision rests with the Korea Exchange.

Why the Delisting? Analyzing the Reasons

While official reasons are yet to be disclosed, the company’s poor performance in Q1 2025 likely played a significant role. Despite a slight increase in revenue, operating profit and net income declined substantially due to increased SG&A and financial expenses. Cost savings from delisting and consolidating management control are also speculated motives.

What’s Next? Investor Impact and Outlook

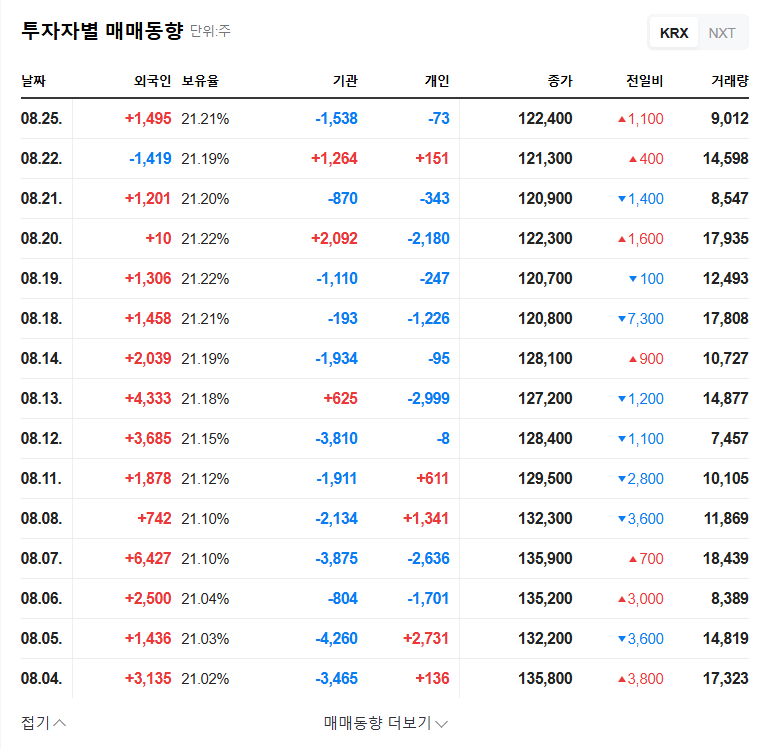

Delisting will halt trading, significantly reduce liquidity, and inevitably lead to a decline in investment value. The tender offer price of 4,100 won per share may result in losses for minority shareholders. Concerns regarding management transparency and further decline in corporate value also exist. Current macroeconomic conditions, such as the weakening Korean Won, high interest rates, and fluctuating raw material prices, further exacerbate the negative outlook.

What Should Investors Do? Action Plan

Current shareholders should consider selling their shares immediately to mitigate potential losses. Closely monitor announcements from the Korea Exchange regarding the review process and minority shareholder protection measures. New investments in Shinseong Tongsang are strongly discouraged.

When will the delisting be finalized?

The Korea Exchange will review the application. The exact date will be announced through official disclosures.

Is the tender offer price of 4,100 won fair?

Compared to historical stock prices, the offer price seems low and may result in losses for minority shareholders.

What happens to my shares after delisting?

Trading will halt, making selling on the exchange impossible. Shareholders can participate in the tender offer or seek over-the-counter transactions.

Leave a Reply