1. What Happened? : Background and Current Status of the Divestment

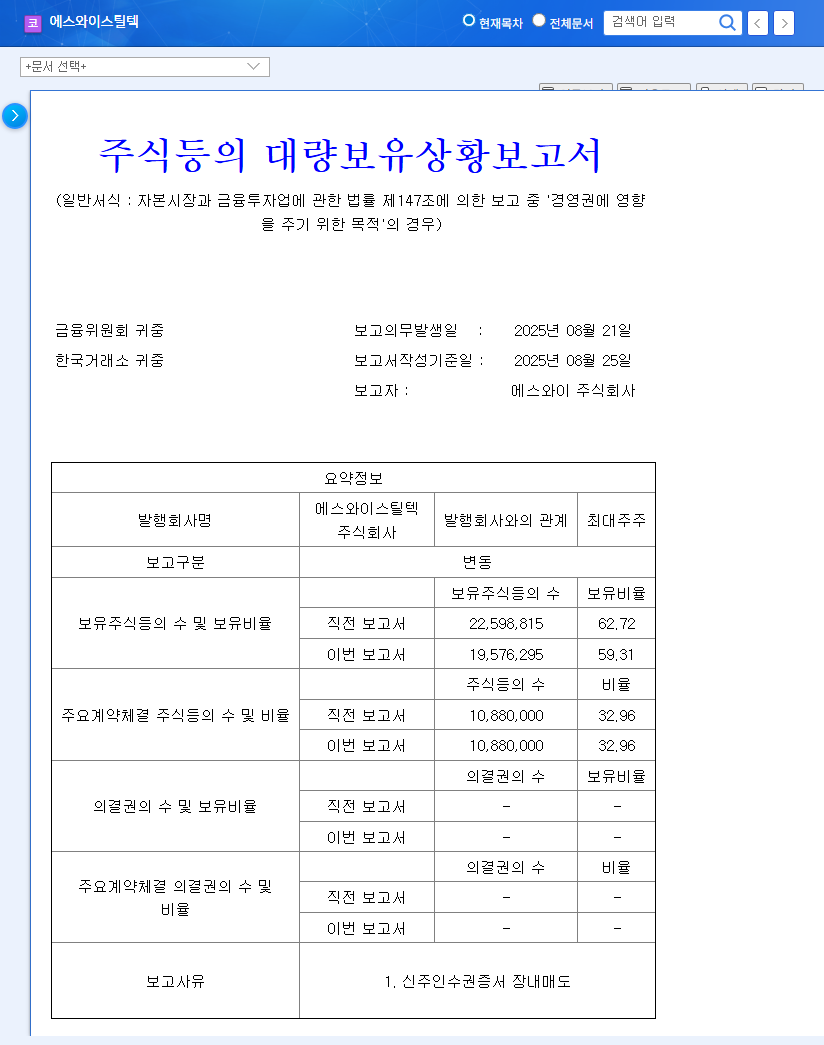

Major shareholders of SW Steel Tech, including SY Co. and related parties, have reduced their stake from 62.72% to 59.31% through the sale of warrants (BW). While not an immediate threat to management control, this decrease suggests a potential weakening of the governance structure. The reason for the sale is presumed to be related to securing funds, but further investigation is needed to determine the exact background.

2. Why Does it Matter? : Implications and Impact of the Divestment

The divestment by major shareholders can negatively impact market sentiment, leading to downward pressure on the stock price. However, this sale doesn’t directly affect the company’s operations or financial status. In fact, a change in ownership without a change in fundamentals may not significantly impact long-term stock trends. Furthermore, growth drivers like the soundproofing material business could contribute to stock price recovery.

3. What Should Investors Do? : Action Plan for Investors

Investors should consider the following:

- Understanding the Sellers’ Intentions: It’s crucial to determine the exact reasons behind the major shareholders’ decision to sell.

- Monitoring Follow-up Actions Related to Warrants: Investors need to monitor whether the sold warrants are exercised and if any new large shareholders emerge.

- Observing Growth Momentum in the Soundproofing Material Business: The performance of the soundproofing material business and its impact on the stock price should be closely watched.

- Analyzing Macroeconomic and Industry Trends: Factors such as construction market conditions and raw material prices should also be considered.

Frequently Asked Questions

Will this divestment affect SW Steel Tech’s management control?

While the decrease in ownership isn’t substantial enough to pose an immediate threat, there is a possibility of a weakened governance structure.

How will this impact the company’s fundamentals?

The sale of warrants does not directly affect the company’s operations or financial standing.

What is the outlook for the stock price?

While downward pressure is expected in the short term, the long-term outlook depends on fundamental improvements, including the growth of the soundproofing material business.

Leave a Reply