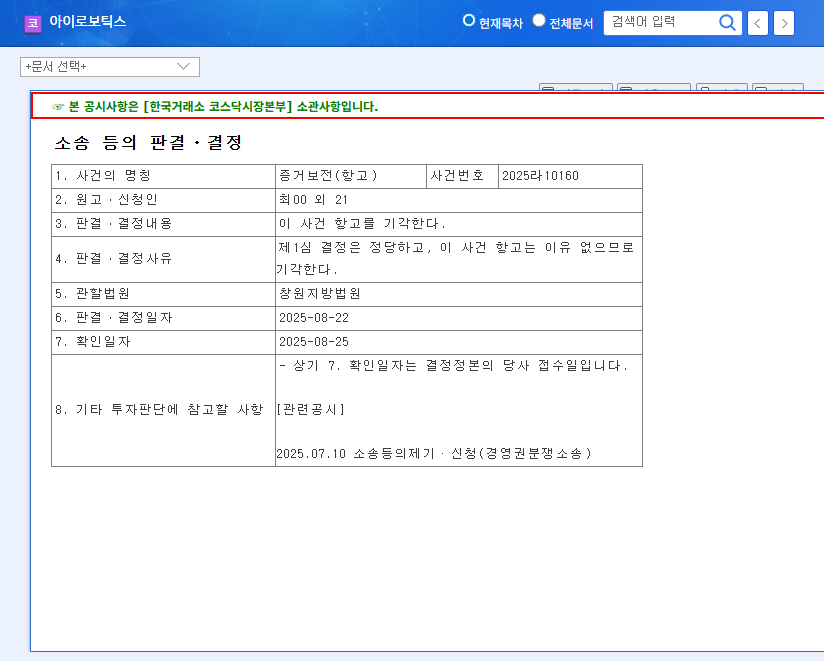

What Happened? : Dismissal of Shareholder Meeting Request

The Changwon District Court dismissed the request by minority shareholders of YOUM to convene a shareholder meeting, citing procedural flaws. This can be interpreted as a positive sign for the management, but it doesn’t necessarily mean that minority shareholders’ desire for management participation has completely disappeared.

Why Does It Matter? : Management Disputes and Corporate Value

The dismissal of the shareholder meeting request mitigates the risk of management disputes in the short term. A stable management environment allows the company to focus on its core business. However, the possibility of continued pressure from minority shareholders still exists, which could impact the company’s long-term growth. Especially if the minority shareholders’ demands are justified and can contribute to enhancing shareholder value, the management needs to actively accommodate and communicate with them.

What’s Next? : Future Outlook and Investment Strategy

This ruling may positively impact YOUM’s stock price in the short term. However, the medium to long-term stock trend will depend on the future actions of minority shareholders and the management’s response. If the management strengthens shareholder-friendly policies and rebuilds trust through communication, an increase in corporate value can be expected. Conversely, if the conflict with minority shareholders intensifies, stock volatility may increase. Investors should also consider external factors, such as the recent sensitivity of the PE industry to economic conditions and fluctuations in raw material prices.

Investor Action Plan

- Continuously monitor YOUM-related news and disclosures.

- Analyze the future movements of minority shareholders and the management’s response.

- Consider PE industry outlook and macroeconomic variables.

- Comprehensively assess risk factors and potential returns when making investment decisions.

Frequently Asked Questions

What does the dismissal of the shareholder meeting request mean?

The court ruled that the minority shareholders’ request to convene a shareholder meeting did not meet the legal requirements. This means that the requested shareholder meeting will not be held.

How will this ruling affect YOUM’s stock price?

In the short term, it could have a positive impact by reducing management uncertainty. However, the medium to long-term stock trend may vary depending on the actions of minority shareholders and the management’s response.

What should investors pay attention to?

Investors should consider YOUM-related news, future actions of minority shareholders, management response, PE industry outlook, and macroeconomic variables when making investment decisions.

Leave a Reply