1. INVENI’s Treasury Stock Disposal: What Happened?

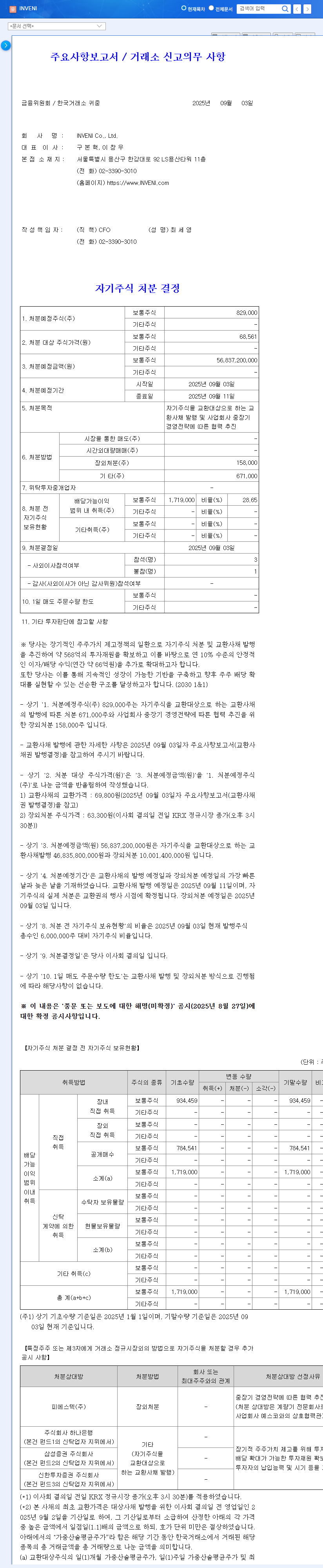

On September 3, 2025, INVENI decided to dispose of 829,000 treasury shares, representing 13.82% of its total outstanding shares (approximately KRW 56.8 billion). This decision aims to raise funds through the issuance of convertible bonds and promote cooperation in line with the company’s mid-to-long-term management strategy.

2. Why the Treasury Stock Disposal?

INVENI plans to utilize the funds secured through this treasury stock disposal for issuing convertible bonds and strengthening strategic collaborations. Issuing convertible bonds can contribute to improving the financial structure and securing investment resources, while strengthening business collaborations can provide opportunities to secure new growth engines.

3. How Will This Impact the Stock Price?

- Positive Aspects: Improved financial structure, new business investments, increased R&D investment, and synergy creation through strategic partnerships.

- Potential Concerns: Potential stock dilution due to treasury stock disposal, negative market reaction.

While there are concerns about potential stock dilution in the short term, from a long-term perspective, business expansion and strengthening collaborations through fundraising could positively impact the stock price.

4. What Should Investors Do?

Investors should continuously monitor INVENI’s financial improvement trends, how the funds secured through the treasury stock disposal are utilized, and the specific details and performance of business collaborations. It’s crucial to evaluate the company’s growth potential from a mid-to-long-term perspective and make investment decisions rather than reacting emotionally to short-term stock price fluctuations.

Frequently Asked Questions (FAQ)

What is the purpose of INVENI’s treasury stock disposal?

To raise funds through the issuance of convertible bonds and to promote cooperation according to the company’s mid-to-long-term management strategy.

What is the impact of the treasury stock disposal on the stock price?

While there is a possibility of stock dilution in the short term, it can have a positive impact in the long term through business expansion and strengthening collaborations.

What should investors pay attention to?

Investors should continuously monitor INVENI’s financial improvement trends, the use of funds, and the performance of business collaborations.

Leave a Reply