1. Wireble’s KRW 9.5 Billion Buyback: What’s Happening?

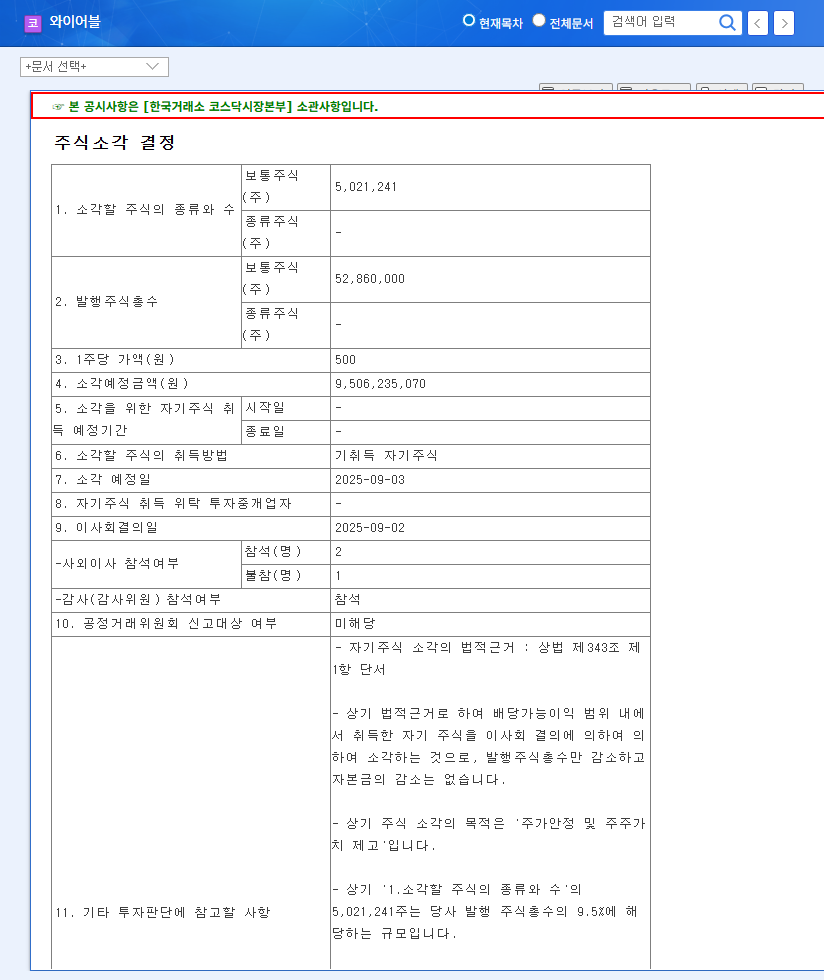

On September 2, 2025, Wireble announced its plan to repurchase and retire KRW 9.5 billion worth of its own shares. This equates to 5,021,241 common shares, a substantial 13.84% of its market cap. The buyback is scheduled for September 3rd.

2. Why the Buyback? Analyzing the Current Situation

Wireble’s first-half 2025 results revealed declining sales and profitability. The underperformance of its ‘Telecommunications Infrastructure Construction’ segment is a key factor, while the success of its new ventures remains uncertain. With a PER of -49.49 and a PBR of 0.96 (as of August 14, 2025), the stock shows signs of undervaluation. In this context, the share buyback can be interpreted as a strategic move to enhance shareholder value and improve investor sentiment.

3. How Will the Buyback Impact the Stock Price?

- Positive Impacts:

- Increased Shareholder Value: Reducing outstanding shares increases the value per share.

- Improved Investor Sentiment: Positive reaction to the shareholder-friendly policy.

- Potential Stock Price Boost: The buyback could create short-term upward momentum.

- Potential Negative Impacts:

- Cash Outflow: The KRW 9.5 billion outflow could put a strain on short-term liquidity.

- Lack of Fundamental Improvement: The buyback itself doesn’t guarantee improved financial performance.

4. What Should Investors Do? Action Plan

While short-term upward price movement is possible, long-term investment requires caution. Investors should carefully examine upcoming earnings releases to assess whether the company can reverse the sales decline trend and demonstrate success in its new ventures. A short-term buy consideration is valid, but continuous monitoring of fundamental improvement is crucial.

FAQ

What is a share buyback?

A share buyback is when a company repurchases its own outstanding shares. This reduces the number of shares available on the market, potentially increasing the value of each remaining share.

Does a share buyback guarantee a stock price increase?

Not necessarily. While a buyback can create positive short-term momentum, sustained price increases depend on improvements in the company’s underlying fundamentals.

What is the outlook for Wireble’s stock price?

Positive sentiment surrounding the buyback might boost the stock price in the short term. However, the long-term outlook depends on the company’s ability to improve its financial performance. Caution is advised.

Leave a Reply