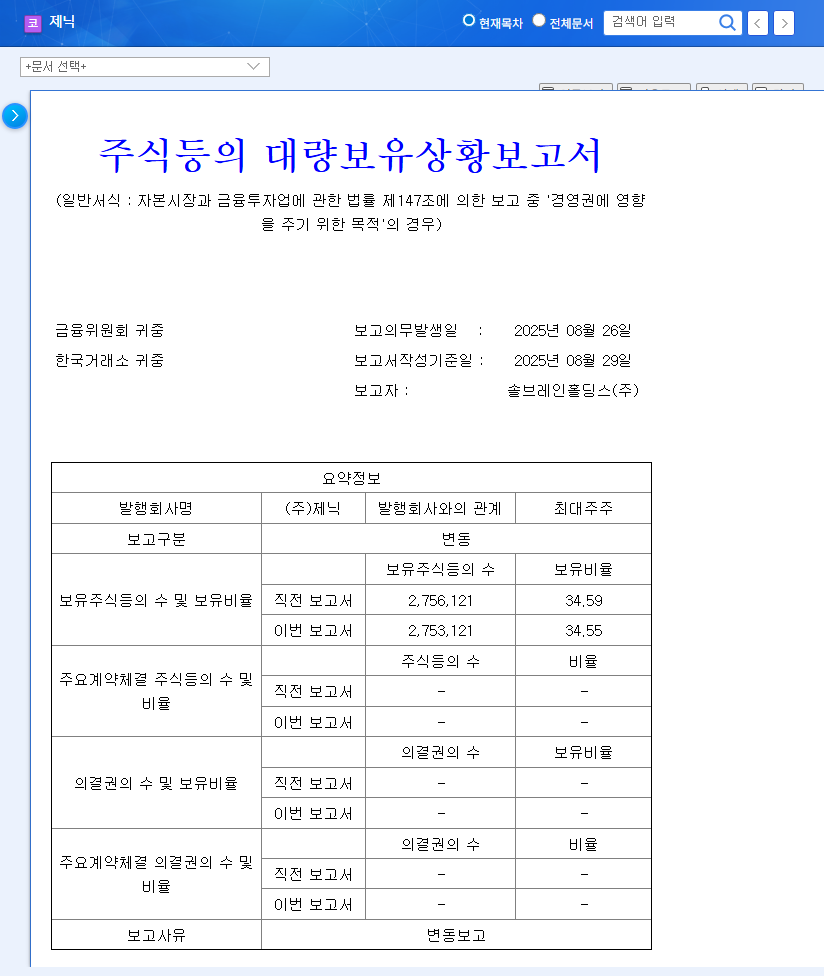

1. What Happened? Solbrain Holdings Sells a Small Portion of Genic Stock

On August 29, 2025, Solbrain Holdings sold 3,000 shares of Genic, slightly decreasing its stake from 34.59% to 34.55%. However, they maintain their stake with the purpose of “influencing management.”

2. Why? Solid Fundamentals! Genic Continues its Growth Trajectory

Genic recorded strong performance in the first half of 2025. Sales have been steadily growing year-over-year, and profitability has improved since turning to profit in 2024. The strong performance of the OEM/ODM business and the steady growth of the hydrogel mask pack business are particularly noteworthy. Financial soundness is also being maintained stably.

3. So, What’s Next? Market Impact and Future Outlook Analysis

- Positive Aspects: Solbrain Holdings’ continued interest is a positive signal for long-term growth. This could create synergy with the strong fundamentals and strengthen the momentum for stock price increase.

- Potential Risks: It is necessary to be aware of the possibility of short-term stock price volatility. Market reactions may vary depending on the specific actions of Solbrain Holdings in the future.

4. Investor Action Plan: Maintain a Long-Term Perspective and Monitor Continuously

Genic has high growth potential based on its solid fundamentals. It is worth considering investment from a long-term perspective, and it’s crucial to continuously monitor Solbrain Holdings’ stake changes and management participation, as well as macroeconomic variables. Additionally, it’s advisable to refer to analyst reports to refine your investment strategy.

Frequently Asked Questions

Is Solbrain Holdings’ stake sale a negative signal for Genic’s future?

It’s difficult to conclude based solely on a small stake sale. Since they maintain their stake for the purpose of “influencing management,” it’s important to observe the situation from a long-term perspective.

What is the expected future stock outlook for Genic?

Considering the solid fundamentals and Solbrain Holdings’ continued interest, a positive outlook can be expected. However, investment should be approached cautiously, considering market conditions and uncertainties related to management rights.

What precautions should investors take?

Investors should be mindful of short-term stock price volatility and continuously monitor Solbrain Holdings’ future actions, Genic’s performance trends, and macroeconomic variables.

Leave a Reply