1. What Happened?

DB Securities acquired T’way Air’s CB/BW, securing a 17.62% stake. This is expected to provide a short-term cash injection for the airline.

2. Why Does It Matter?

T’way Air is currently in a state of capital impairment and reported weak earnings in the first half of 2025. DB Securities’ investment could play a crucial role in improving the airline’s financial structure. However, due to the nature of convertible bonds and bonds with warrants, there is a possibility of stock dilution upon conversion.

- Positive Factors:

- Short-term funding secured

- Expectation of financial structure improvement

- Negative Factors:

- Potential for stock dilution

- Continued poor performance

- Capital impairment status

3. What Should Investors Do?

Before making an investment decision, carefully consider the following factors:

- Management Strategy: Closely monitor the new management’s business strategies and execution capabilities.

- Financial Indicators: Check the next quarterly earnings announcement for signs of financial improvement.

- External Factors: Continuous monitoring of exchange rate and oil price volatility is necessary.

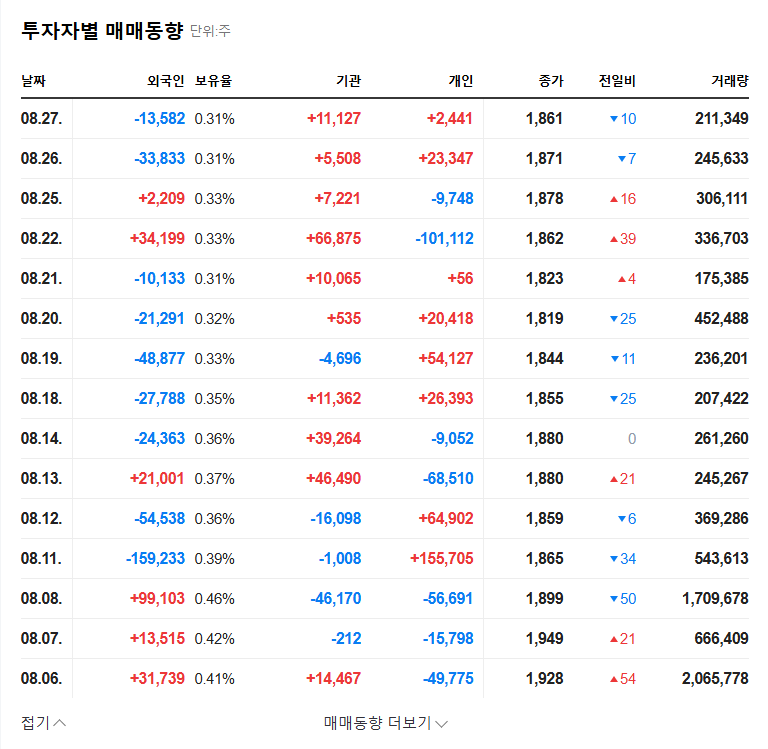

- DB Securities’ Actions: Pay close attention to public announcements regarding DB Securities’ stake changes.

4. Investor Action Plan

The current investment recommendation for T’way Air is ‘caution.’ It is advisable to remain on the sidelines rather than making short-term investments and continuously monitor the factors mentioned above.

Frequently Asked Questions

Will DB Securities’ investment have a positive impact on T’way Air?

It will help with short-term funding, but the long-term impact will depend on management’s strategy and market conditions. A cautious approach is recommended.

Is it a good time to invest in T’way Air stock?

Currently, the airline is in a state of capital impairment and continues to experience poor performance, so caution is advised. It’s best to decide on investment after confirming future management strategies and financial structure improvements.

What is the future outlook for T’way Air?

The recovery in air travel demand is positive, but the airline’s recovery potential will increase only if financial restructuring and management innovation are successful. Continuous monitoring is essential.

Leave a Reply