1. What Happened?: The Share Buyback Announcement

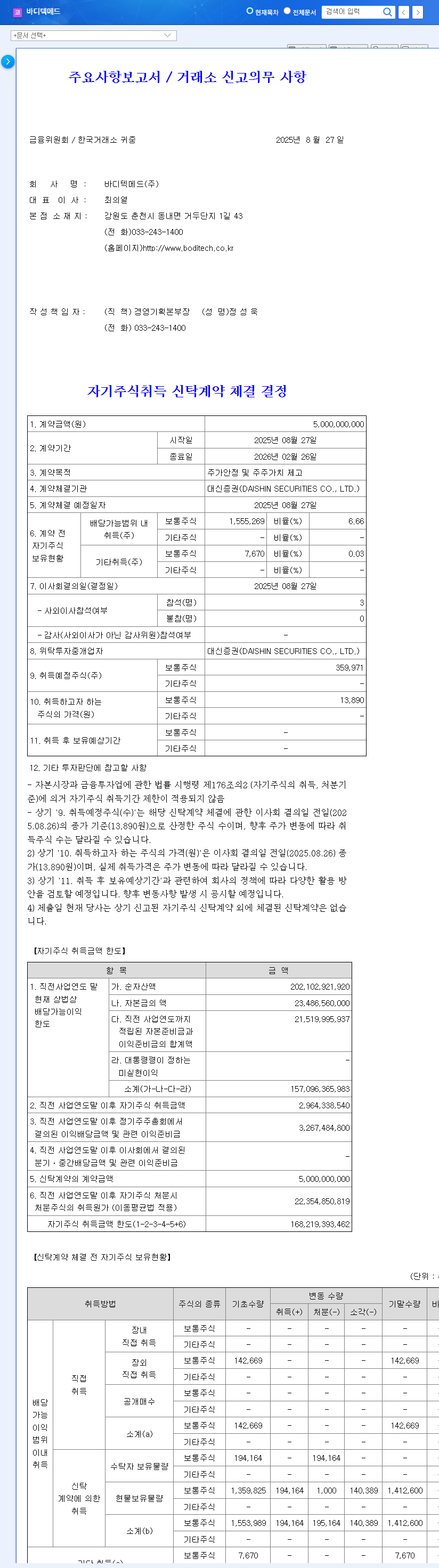

Bodytech Med plans to repurchase ₩5 billion worth of its own shares through Daishin Securities from August 27, 2025, to February 26, 2026. The primary objectives are stock price stabilization and shareholder value enhancement.

2. Why the Buyback?: Background and Implications

Share buybacks typically indicate a company’s belief that its stock is undervalued and demonstrate confidence in its growth potential to shareholders. In Bodytech Med’s case, the decision appears to be a shareholder return initiative in response to recent stock volatility despite robust earnings growth.

3. About Bodytech Med: Fundamental Analysis

Bodytech Med specializes in in vitro diagnostics, particularly point-of-care testing (POCT). The company reported revenue of ₩80.582 billion in the first half of 2025, a 16.41% year-on-year increase, and boasts a strong global presence with exports accounting for 92.63% of its sales. Its high R&D investment ratio (11.7% of sales) underscores its commitment to securing future growth drivers.

4. The Market Landscape: Macroeconomic and Industry Analysis

The POCT market is expected to grow steadily due to aging populations and the increasing prevalence of chronic diseases. However, macroeconomic factors such as exchange rate and interest rate fluctuations can impact Bodytech Med’s performance.

5. Buyback Impact and Investment Strategy

While the share buyback may positively impact the stock price in the short term, the medium to long-term trend hinges on fundamental improvements. Investors should closely monitor the progress of the buyback, the company’s earnings performance, and macroeconomic changes.

Do share buybacks always have a positive impact on stock prices?

Not necessarily. While they can improve supply and demand dynamics in the short term, sustained stock price appreciation requires strong underlying fundamentals.

What is the outlook for Bodytech Med’s stock price?

The positive fundamentals and share buyback announcement are encouraging signs, but macroeconomic changes should be considered. Experts currently maintain a ‘Neutral’ outlook.

What should investors watch out for when investing in Bodytech Med?

Investors should monitor the buyback progress, new product development, overseas market expansion, and fluctuations in exchange rates and interest rates.

Leave a Reply