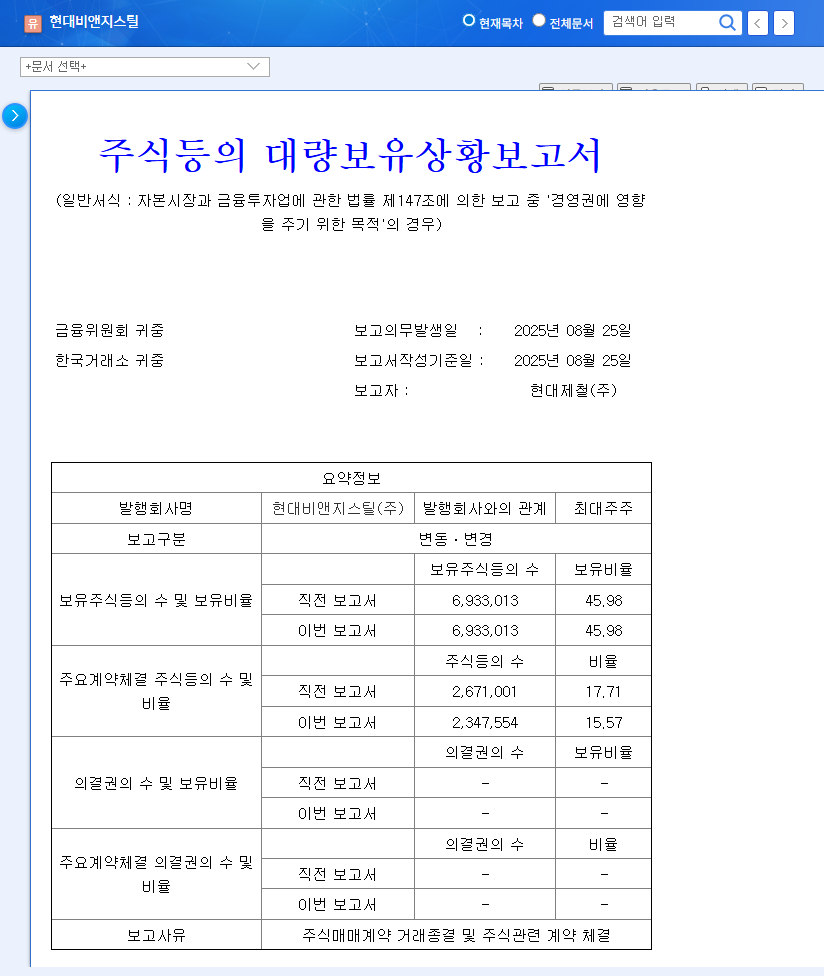

1. What Happened?: CEO Jeong Il-seon Increases Stake in Hyundai BNG Steel

With the transfer of 1,507,881 shares from Hyundai Steel to CEO Jeong Il-seon, his stake has increased to 12.5%, while Hyundai Steel’s stake has decreased to 31.1%. This signals a potential shift in management control and decision-making structure.

2. Why It Matters: Governance Changes and Potential Impact

The change in majority shareholder stake suggests a potential shift in management strategy. Jeong Il-seon’s increased stake implies his management philosophy will have a stronger influence, potentially increasing short-term stock volatility and impacting the company’s long-term growth trajectory.

3. Hyundai BNG Steel’s Current Status: Fundamental Analysis

- Positive Factors: Strengthened financial soundness, improved profitability, maintained competitiveness in core business

- Negative Factors: Decline in sales, insufficient R&D investment, deteriorating market environment, ESG risks

While the financial structure has improved, declining sales and lack of R&D investment raise concerns about growth stagnation. The structural weakness of the auto parts business, in particular, requires urgent action.

4. What’s Next?: Future Outlook and Investment Strategy

Key variables include CEO Jeong Il-seon’s future management moves, whether R&D investment will increase, and plans to restructure the auto parts business. Investors should continuously monitor these factors and be mindful of risk management due to changes in the macroeconomic environment.

5. Investor Action Plan

Rather than being swayed by short-term stock volatility, it’s important to analyze the company’s fundamentals and growth potential from a long-term perspective. It’s advisable to closely monitor changes in management strategy, new investment plans, etc., following the change in majority shareholder stake before making investment decisions.

Frequently Asked Questions

How will CEO Jeong Il-seon’s increased stake affect Hyundai BNG Steel’s stock price?

In the short term, it may increase stock volatility by drawing market attention. The long-term impact will depend on CEO Jeong’s management capabilities and new strategies.

How do you assess Hyundai BNG Steel’s future growth potential?

While financial soundness is positive, declining sales and insufficient R&D investment raise concerns about growth. Improvement in the structural weaknesses of the auto parts business and efforts to secure new growth engines will be crucial.

What should investors consider when investing in Hyundai BNG Steel?

Monitor changes in management strategy, investment plans, and R&D investment following the change in majority shareholder stake. Also, consider risk management related to macroeconomic changes.

Leave a Reply