The corporate landscape for KOREA ZINC INC has experienced a significant shift, capturing the attention of investors and market analysts alike. A recent move by Youngpoong to substantially increase its ownership stake signals a potential new era for the company, raising critical questions about management control, strategic direction, and the possibility of a large-scale merger. This detailed analysis unpacks the event, examines the fundamental health of Korea Zinc, and provides a strategic outlook for stakeholders navigating this evolving situation.

A Major Power Shift: Youngpoong Solidifies Control

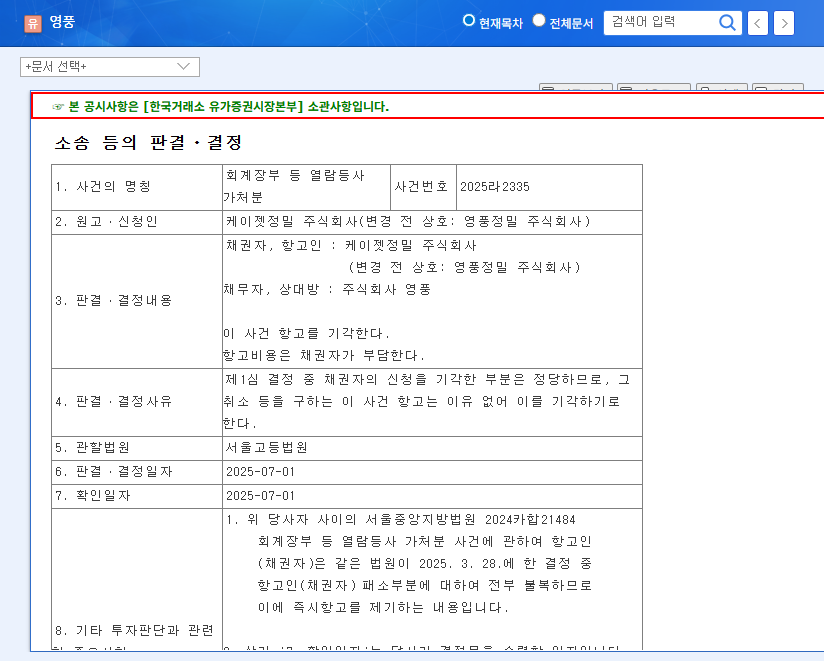

Dissecting the Official Disclosure

On November 12, 2025, a pivotal filing revealed a major change in the ownership structure of KOREA ZINC INC. The reporting entity, Youngpoong, confirmed it had increased its stake from 41.25% to a commanding 44.24%. This increase resulted from a combination of a merger agreement conclusion by a special related party, open market purchases, and the inclusion of new related parties. The company left no room for ambiguity regarding its intentions.

The explicitly stated purpose for this substantial increase in shareholding is to exert ‘management influence,’ signaling a clear intent to steer the future of KOREA ZINC INC. Full details can be reviewed in the Official Disclosure (DART).

This move is more than just a numbers game; it represents a consolidation of power that could dramatically reshape Korea Zinc’s governance and long-term business strategy. The mention of a ‘merger agreement’ in the filing has particularly fueled speculation about a deeper integration between the two entities.

A Deep Dive into KOREA ZINC INC’s Fundamentals

Pioneering New Growth Frontiers

KOREA ZINC INC has been proactively diversifying beyond its core non-ferrous metal smelting business to build a sustainable future. These initiatives are crucial for its long-term valuation.

- •Renewable Energy & Hydrogen: Investments in green energy projects, particularly in Australia, align with global ESG trends and open up new, sustainable revenue streams.

- •Secondary Battery Materials: The company is capitalizing on the EV boom by expanding its nickel sulfate and electrolytic copper foil businesses, securing long-term supply contracts to ensure stability.

- •Resource Recycling: With growing environmental regulations, its steel dust and e-waste recycling operations are becoming increasingly vital and profitable.

Navigating the Volatile Non-Ferrous Metals Market

The company’s core business remains tied to the global commodities cycle. Performance in the first half of 2025 was a mixed bag, with zinc and lead prices facing headwinds from a global economic slowdown. Conversely, precious metals like gold and silver saw price increases due to safe-haven demand. Investors can track these trends on high-authority platforms like the London Metal Exchange for real-time data. Korea Zinc’s reliance on long-term contracts helps mitigate some of this volatility, ensuring more predictable revenue streams.

Financial Health Check: A Mixed But Improving Picture

As of mid-2025, Korea Zinc’s financials showed impressive top-line growth, with sales revenue hitting KRW 7.6582 trillion (a 41.3% increase), driven by strong metal prices and its burgeoning battery materials segment. However, operating profit declined by 27.2% to KRW 530 billion, pressured by lower nickel prices and the high costs of new business investments. On a positive note, the company’s balance sheet is strengthening, with equity rising and liabilities decreasing, indicating an improving overall financial structure.

What Youngpoong’s Move Means for Investors

Balancing Opportunity and Risk

Youngpoong’s strengthened control presents both potential upsides and downsides for investors in KOREA ZINC INC.

- •Positive Aspects: The end of management disputes could lead to greater stability and faster, more decisive strategic execution. If a merger proceeds, it could unlock significant synergies, enhancing competitiveness and efficiency in the non-ferrous metals market.

- •Potential Risks: A dominant controlling shareholder could potentially weaken the representation of minority shareholders. Furthermore, the path to a merger is fraught with regulatory hurdles and requires shareholder approval, introducing significant uncertainty and potential stock price volatility.

Formulating an Investment Strategy for Korea Zinc Stock

For those invested in or considering a position in KOREA ZINC INC, a nuanced approach is required. In the short term, the news is likely to be perceived positively, but volatility is expected as more details about the merger emerge. A prudent strategy may be to observe market reactions rather than engaging in speculative short-term trades.

From a long-term perspective, the focus should be on the fundamental value created by Korea Zinc’s diversification efforts and the potential synergies of a merger. It is crucial to monitor key external risks, including foreign exchange fluctuations (especially USD and AUD), interest rate changes, and ongoing management-related legal matters. For more on this topic, consider reading our guide on analyzing corporate governance in emerging markets. Continuous monitoring of Youngpoong’s disclosures and Korea Zinc’s segmental performance will be paramount for making informed investment decisions.