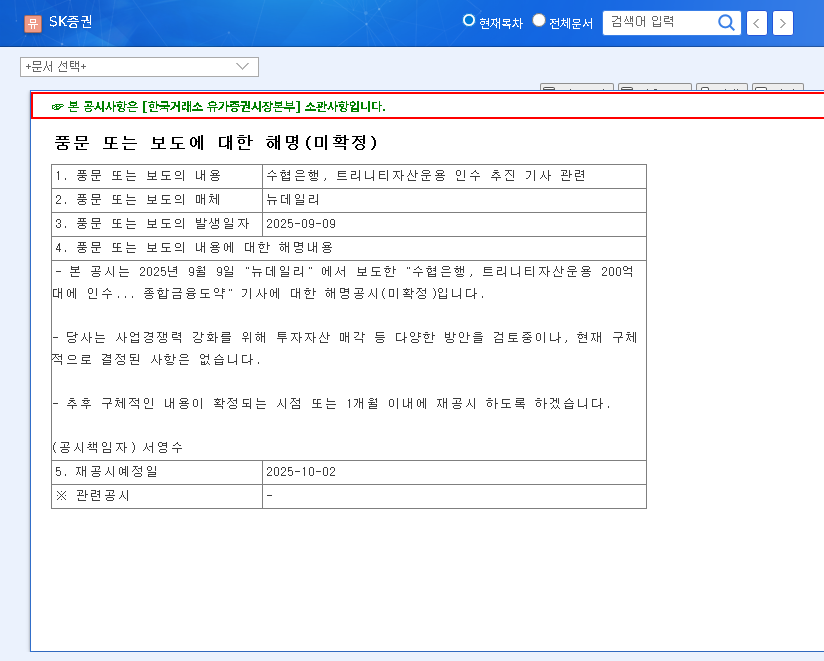

SK Securities Divests Trinity Asset Management: What Happened?

On September 15, 2025, SK Securities announced the sale of its entire stake in Trinity Asset Management for 169 billion won (3.03% of its capital). The disposal is scheduled for September 29th, with the aim of securing resources for strengthening business competitiveness and improving financial structure.

Divestment Background and Fundamental Analysis: Why the Sale?

While SK Securities returned to profitability in the first half of 2025, challenges remain, including sluggish performance in the brokerage division and losses in other segments. Although the Investment Banking (IB) division performed well and proprietary trading saw growth, the company needs to restructure its overall business and strengthen its financial health. The proceeds from the sale are expected to be used for improving financial structure and securing future growth engines.

Impact of the Divestment and Investment Strategy: What’s Next?

In the short term, this divestment is expected to positively impact the financial structure. However, the long-term impact on stock price will depend on how the proceeds are utilized and whether the core business competitiveness is strengthened. Investors should closely monitor SK Securities’ future business strategies and performance changes.

Action Plan for Investors: What to Watch?

- Use of Proceeds: Investors need to check SK Securities’ specific plans for utilizing the funds from the divestment.

- Strengthening Core Business Competitiveness: Pay close attention to the company’s strategies for overcoming weaknesses in the brokerage division and securing new growth drivers.

- Changes in Financial Indicators: Monitor whether the divestment actually leads to improved financial structure.

- Market Environment Changes: Continuously monitor the impact of external factors, such as interest rate fluctuations, on SK Securities.

FAQ

Why did SK Securities divest its stake in Trinity Asset Management?

SK Securities sold its stake in Trinity Asset Management to secure resources for strengthening business competitiveness and improving financial structure.

Will this sale positively impact SK Securities’ stock price?

While it may positively affect the financial structure in the short term, the long-term stock price movement depends on the utilization of the proceeds and the strengthening of core business competitiveness.

What precautions should investors take when considering SK Securities?

Investors should consider potential risk factors, such as the sluggish brokerage performance, losses in other segments, and litigation risks. They should also monitor the company’s future business strategies and performance changes.